Ct Part Year Resident Return 2018

What is the Ct Part Year Resident Return

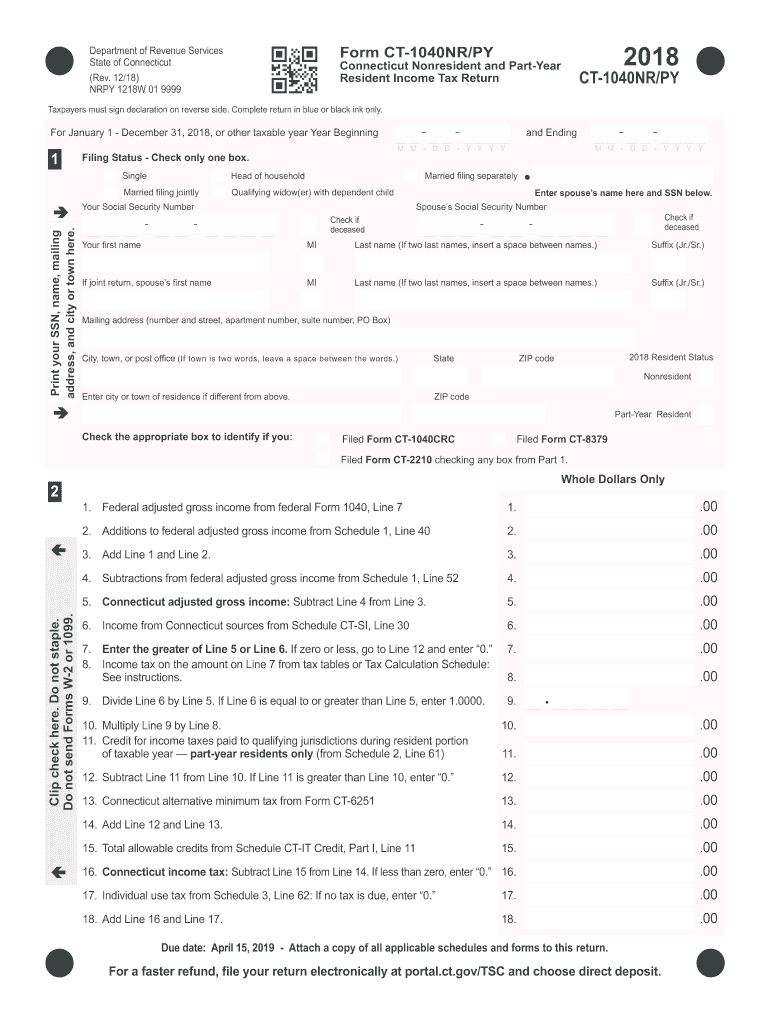

The Ct Part Year Resident Return is a tax form designed for individuals who have lived in Connecticut for part of the tax year. This form allows taxpayers to report their income earned during the period of residency in the state. It is essential for accurately calculating state tax obligations, ensuring compliance with Connecticut tax laws. The form includes sections for reporting various types of income, deductions, and credits applicable to part-year residents.

Steps to complete the Ct Part Year Resident Return

Completing the Ct Part Year Resident Return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency period and the income earned during that time.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate your total income, deductions, and credits specific to your residency status.

- Review the form for accuracy and completeness before submission.

Legal use of the Ct Part Year Resident Return

The Ct Part Year Resident Return is legally recognized by the Connecticut Department of Revenue Services. It must be completed and filed by individuals who meet the residency criteria. Filing this form ensures that taxpayers fulfill their legal obligations regarding state income tax. Non-compliance can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Ct Part Year Resident Return. Typically, the form must be submitted by April 15 for the previous tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any changes that may arise due to state regulations or specific circumstances affecting filing timelines.

Required Documents

To complete the Ct Part Year Resident Return, taxpayers need to gather several key documents:

- W-2 forms from employers for income earned during the residency period.

- 1099 forms for any additional income sources.

- Records of any deductions or credits claimed.

- Proof of residency, if necessary.

Who Issues the Form

The Ct Part Year Resident Return is issued by the Connecticut Department of Revenue Services. This state agency oversees tax collection and compliance, providing the necessary forms and guidelines for taxpayers. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change from year to year.

Quick guide on how to complete ct form resident tax 2018 2019

Your assistance manual on how to prepare your Ct Part Year Resident Return

If you’re interested in understanding how to generate and submit your Ct Part Year Resident Return, here are some concise instructions on how to simplify tax processing.

To begin, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow offers a highly user-friendly and powerful document solution that enables you to modify, create, and finalize your tax documents with ease. With its editor, you can toggle between text, checkboxes, and eSignatures, and revert to adjust any responses as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to finalize your Ct Part Year Resident Return in a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Ct Part Year Resident Return in our editor.

- Complete the necessary fields with your details (text input, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Double-check your document and correct any mistakes.

- Save your changes, print your copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting physical documents can lead to increased return errors and delays in reimbursements. Certainly, prior to e-filing your taxes, review the IRS website for reporting regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct form resident tax 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

I am non-resident alien with F1 OPT married to US citizen in 2018. I want to file tax separately. When I fill tax form, am I dependent on my husband?

No. A spouse is NEVER a dependent. Period.FYI, it's a virtual certainty that you will pay higher taxes filing as a non resident alien and forcing your spouse to file married filing separately. That's your call, but keep it in mind.

-

Can an NRI file a tax return for AY 2018–2019 with an ITR1 form, as there is no column on the ITR1 form to mark residential status?

Yes, there is no column in the ITR 1 For Mark The residential status, therefore, you should furnishred the Form No.2.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the ct form resident tax 2018 2019

How to generate an electronic signature for your Ct Form Resident Tax 2018 2019 in the online mode

How to make an electronic signature for your Ct Form Resident Tax 2018 2019 in Chrome

How to make an eSignature for putting it on the Ct Form Resident Tax 2018 2019 in Gmail

How to make an electronic signature for the Ct Form Resident Tax 2018 2019 right from your smartphone

How to generate an electronic signature for the Ct Form Resident Tax 2018 2019 on iOS devices

How to make an electronic signature for the Ct Form Resident Tax 2018 2019 on Android

People also ask

-

What is ct py in the context of airSlate SignNow?

ct py refers to the integration of the airSlate SignNow platform with other tools to streamline document management and eSignature processes. By utilizing ct py, businesses can enhance their workflow efficiency and ensure secure document transactions.

-

How does airSlate SignNow pricing structure work for ct py users?

airSlate SignNow offers competitive pricing plans tailored for ct py users, allowing businesses to choose packages based on their specific needs. These plans come with various features, including unlimited document signing and access to cloud storage, ensuring cost-effectiveness.

-

What key features does airSlate SignNow offer for ct py users?

For ct py users, airSlate SignNow provides essential features such as customizable templates, advanced security, and automated workflows. These capabilities help businesses manage their documents more effectively while ensuring a seamless signing experience for all parties involved.

-

Can I integrate airSlate SignNow with other applications using ct py?

Yes, airSlate SignNow supports various integrations through ct py to enhance your document management experience. This allows you to connect with popular applications like Google Drive, Salesforce, and more, facilitating smoother operations across platforms.

-

What are the benefits of using airSlate SignNow for ct py?

Using airSlate SignNow for ct py provides numerous benefits, including improved document turnaround time and enhanced security features. The platform’s user-friendly interface also ensures that both signers and senders can navigate the process with ease and confidence.

-

Is airSlate SignNow suitable for small businesses using ct py?

Absolutely! airSlate SignNow is designed with small businesses in mind, providing scalable solutions through ct py. This means small businesses can enjoy the same powerful features as larger companies, all while maintaining budget-friendly options.

-

How can I cancel my airSlate SignNow subscription for ct py?

Canceling your airSlate SignNow subscription for ct py is straightforward. You can manage your subscription through your account settings, and our customer support team is always available to assist you with the process if you need further help.

Get more for Ct Part Year Resident Return

Find out other Ct Part Year Resident Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors