Nonresidents WCT Source Inc CT Gov 2019

What is the Nonresidents WCT Source Inc CT gov?

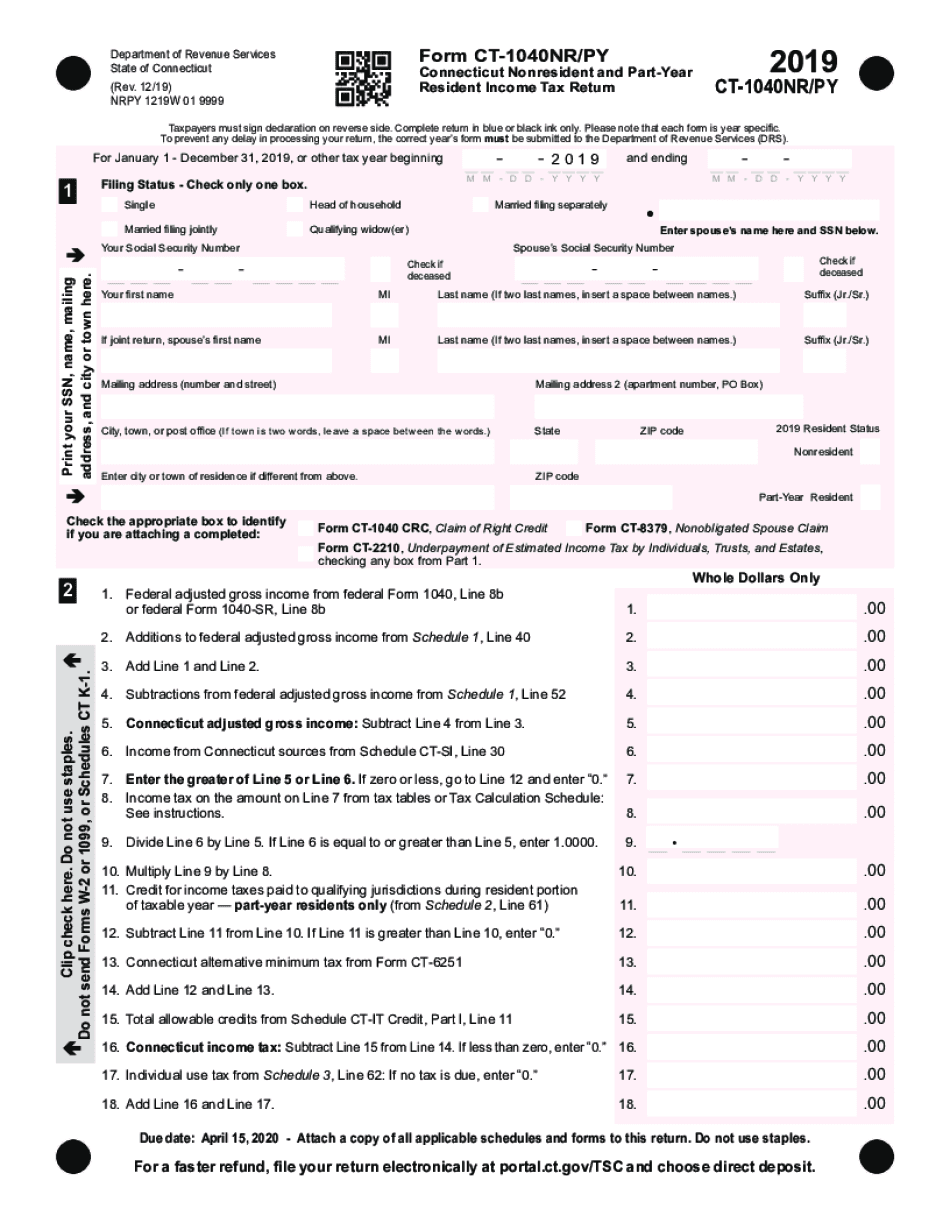

The Nonresidents WCT Source Inc is a form utilized by nonresident individuals and entities who earn income in Connecticut. This form is essential for reporting income that is subject to withholding tax in the state. It ensures that the appropriate taxes are collected from nonresidents who may not have a permanent tax obligation in Connecticut but still earn taxable income within its borders. Understanding this form is crucial for compliance with state tax laws.

Steps to complete the Nonresidents WCT Source Inc CT gov

Completing the Nonresidents WCT Source Inc involves several key steps:

- Gather necessary personal information, including your name, address, and Social Security number or taxpayer identification number.

- Collect documentation of income earned in Connecticut, including pay stubs or contracts.

- Fill out the form accurately, ensuring all income sources are reported.

- Calculate the withholding tax based on the income reported, following the guidelines provided by the Connecticut Department of Revenue Services.

- Review the completed form for any errors or omissions before submission.

Legal use of the Nonresidents WCT Source Inc CT gov

The Nonresidents WCT Source Inc serves a legal purpose by providing a formal avenue for nonresidents to report their income and pay taxes owed to Connecticut. The form must be completed in accordance with state regulations to ensure its validity. Failure to use the form properly may result in penalties or legal repercussions, making it essential for nonresidents to adhere to the guidelines set forth by the state.

Filing Deadlines / Important Dates

Filing deadlines for the Nonresidents WCT Source Inc are critical to avoid penalties. Typically, the form must be filed by the due date of the tax return for the income earned during the tax year. It is advisable to check the Connecticut Department of Revenue Services for specific dates, as they may vary from year to year. Staying informed about these deadlines helps ensure compliance and avoids unnecessary fines.

Required Documents

When completing the Nonresidents WCT Source Inc, several documents are required:

- Proof of income earned in Connecticut, such as pay stubs or contracts.

- Identification documents, including a Social Security number or taxpayer identification number.

- Any previous tax returns or forms that may be relevant to your income reporting.

Who Issues the Form

The Nonresidents WCT Source Inc is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance among residents and nonresidents alike. It is important to refer to their official communications for any updates or changes regarding the form and its requirements.

Quick guide on how to complete nonresidents wct source inc ctgov

Prepare Nonresidents WCT Source Inc CT gov effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the essentials needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Nonresidents WCT Source Inc CT gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to alter and eSign Nonresidents WCT Source Inc CT gov with ease

- Obtain Nonresidents WCT Source Inc CT gov and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Nonresidents WCT Source Inc CT gov, ensuring seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nonresidents wct source inc ctgov

Create this form in 5 minutes!

How to create an eSignature for the nonresidents wct source inc ctgov

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is ct py in the context of airSlate SignNow?

ct py refers to the seamless integration of Contract Management tools with airSlate SignNow, enabling businesses to efficiently prepare, send, and sign contracts electronically. With ct py, you can create workflows that streamline your document signing process, ensuring that your contracts are handled swiftly and securely.

-

How does airSlate SignNow ensure security for documents signed using ct py?

airSlate SignNow employs advanced encryption technologies to safeguard your documents during the signing process through ct py. Each signed document is securely stored, providing an audit trail that ensures compliance and protects sensitive information from unauthorized access.

-

What pricing plans are available for using ct py with airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet diverse business needs when incorporating ct py. From basic plans for small teams to comprehensive solutions for large organizations, you can select a cost-effective option that fits your budget while enjoying all the features of ct py.

-

Can I integrate ct py with other software solutions?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing the ct py functionality. Integrate it easily with CRM systems, cloud storage providers, and project management tools to create a fully automated workflow that's adaptable to your business requirements.

-

What are the key benefits of using ct py in airSlate SignNow?

Using ct py with airSlate SignNow allows you to automate document workflows, reduce turnaround times, and enhance collaboration. This efficient process not only improves productivity but also signNowly reduces the hassle associated with manual signing and document management.

-

Is airSlate SignNow user-friendly for beginners with ct py features?

Absolutely! airSlate SignNow is designed to be intuitive and user-friendly, making the ct py features accessible even for beginners. With step-by-step guides and an easy interface, users can quickly learn how to send and eSign documents without technical expertise.

-

How does ct py improve my team’s productivity?

ct py streamlines the document signing process by eliminating the need for physical signatures and reducing manual errors. This efficiency allows your team to focus on core activities and enhances overall productivity, as documents can be sent, signed, and stored in a matter of minutes.

Get more for Nonresidents WCT Source Inc CT gov

Find out other Nonresidents WCT Source Inc CT gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors