to Prevent Any Delay in Processing Your Return, the Correct Years Form Must Be Submitted to the Department of Revenue Services D 2020

Understanding the Importance of Submitting the Correct Form

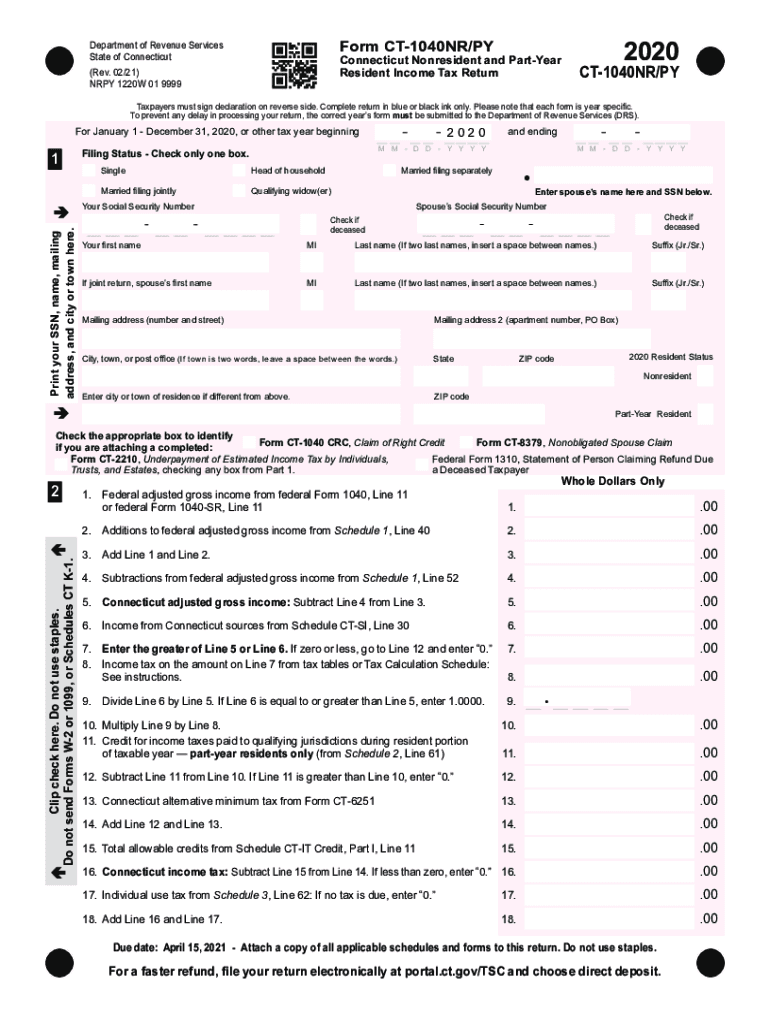

To ensure timely processing of your tax return, it is essential to submit the correct year’s form to the Connecticut Department of Revenue Services (DRS). For non-residents, this typically involves the CT-1040NR PY form. Each tax year has specific requirements and forms that must be adhered to, as using an incorrect form can lead to delays in processing and potential penalties.

Steps to Complete the CT-1040NR PY Form

Completing the CT-1040NR PY form involves several key steps:

- Gather all necessary documents, including income statements and any relevant deductions.

- Ensure you have the correct version of the form for the tax year you are filing.

- Fill out the form accurately, providing all required information such as your name, address, and income details.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, depending on your preference.

Required Documents for Filing

When preparing to file the CT-1040NR PY form, you will need several documents to support your submission:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits you plan to claim.

- Proof of residency status if applicable.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the CT-1040NR PY form to avoid penalties. Typically, the deadline for filing is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended. Always check the DRS website for the most current information regarding deadlines.

Consequences of Non-Compliance

Failing to submit the CT-1040NR PY form or submitting it late can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is important to file your taxes accurately and on time to avoid these issues.

Digital vs. Paper Submission

Filing the CT-1040NR PY form can be done either digitally or via traditional paper methods. Digital submission is often faster and allows for immediate confirmation of receipt. Paper submissions, while still accepted, may take longer to process. Consider your preferences and the resources available to you when deciding on the submission method.

Quick guide on how to complete to prevent any delay in processing your return the correct years form must be submitted to the department of revenue services

Effortlessly Prepare To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to Modify and Electronically Sign To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D with Ease

- Obtain To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost files, tedious form searching, or errors that require new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct to prevent any delay in processing your return the correct years form must be submitted to the department of revenue services

Create this form in 5 minutes!

How to create an eSignature for the to prevent any delay in processing your return the correct years form must be submitted to the department of revenue services

The best way to create an e-signature for your PDF online

The best way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the CT 1040NR PY form?

The CT 1040NR PY form is used by non-resident individuals to report income earned in Connecticut. By filing this form, you can ensure compliance with state tax laws while potentially qualifying for refunds or credits. Understanding the CT 1040NR PY is crucial for accurate tax filings and maximizing benefits.

-

How can airSlate SignNow help with the CT 1040NR PY filing process?

airSlate SignNow streamlines the document management process, making it easy to sign and send your CT 1040NR PY form electronically. Our user-friendly platform ensures that you can complete your tax paperwork quickly and securely. Simplifying this aspect of tax season can help alleviate stress as you handle your non-resident tax responsibilities.

-

What features does airSlate SignNow offer for managing tax forms like the CT 1040NR PY?

airSlate SignNow provides features like document sharing, secure eSigning, and extensive storage options, making it ideal for managing forms like the CT 1040NR PY. The platform enables real-time collaboration, allowing multiple parties to contribute to the document seamlessly. This ensures that all necessary approvals and signatures are obtained efficiently.

-

Is there a cost associated with using airSlate SignNow for CT 1040NR PY forms?

Yes, there is a cost associated with airSlate SignNow, but it is designed to be cost-effective, especially for small businesses or individuals managing forms like the CT 1040NR PY. Our pricing plans are flexible, allowing you to choose one that fits your needs without breaking the bank. Consider the value of your time saved and the accuracy ensured by our platform when evaluating the cost.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, helping you manage your CT 1040NR PY forms alongside your other financial tools. This allows for smooth data transfer and collaboration, ensuring your documents are always up-to-date. Integration reduces manual entry errors and streamlines your workflow.

-

What are the benefits of using airSlate SignNow for eSigning the CT 1040NR PY?

Using airSlate SignNow to eSign your CT 1040NR PY form offers numerous benefits, including enhanced security and reduced processing time. ESignatures are legally binding, making it a reliable solution for your tax documents. Additionally, you can track the status of your signings in real-time, allowing you to manage deadlines effectively.

-

Is airSlate SignNow suitable for individuals or just for businesses, especially for CT 1040NR PY?

airSlate SignNow is perfect for both individuals and businesses needing to handle documents like the CT 1040NR PY. Our platform caters to a wide array of users, from freelancers to large corporations, providing flexibility and ease of use regardless of your tax filing needs. Everyone can benefit from our simple document management solutions.

Get more for To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D

- Living trust for individual who is single divorced or widow or widower with children alaska form

- Living trust for husband and wife with one child alaska form

- Living trust for husband and wife with minor and or adult children alaska form

- Amendment to living trust alaska form

- Living trust property record alaska form

- Financial account transfer to living trust alaska form

- Alaska assignment 497294076 form

- Notice of assignment to living trust alaska form

Find out other To Prevent Any Delay In Processing Your Return, The Correct Years Form Must Be Submitted To The Department Of Revenue Services D

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer