Itax Compliance Certificate Form

What is the iTax Compliance Certificate?

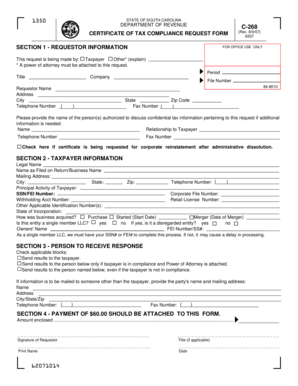

The iTax Compliance Certificate is an official document issued by the South Carolina Department of Revenue. It confirms that a business or individual is compliant with state tax obligations. This certificate is often required for various business transactions, including securing loans, bidding on contracts, or applying for licenses. It serves as proof that all tax filings are up to date and that there are no outstanding tax liabilities.

How to Obtain the iTax Compliance Certificate

To obtain the iTax Compliance Certificate in South Carolina, you need to follow a few essential steps:

- Ensure all tax returns are filed and payments are made. This includes income, sales, and any other applicable taxes.

- Visit the South Carolina Department of Revenue website or contact their office for specific instructions on requesting the certificate.

- Complete any required forms, such as the SC Form C-268, and submit them along with any necessary documentation.

- Pay any applicable fees associated with the issuance of the certificate.

Steps to Complete the iTax Compliance Certificate

Completing the iTax Compliance Certificate involves several critical steps:

- Gather all necessary documentation, including your tax returns and proof of payments.

- Fill out the SC Form C-268 accurately, ensuring all information is correct and complete.

- Review the form for any errors or omissions before submission to avoid delays.

- Submit the completed form through the designated method, whether online, by mail, or in person.

Legal Use of the iTax Compliance Certificate

The iTax Compliance Certificate holds significant legal weight in South Carolina. It is often required in various business dealings, including:

- Applying for business licenses and permits.

- Participating in government contracts or bids.

- Securing loans or financing from financial institutions.

Having this certificate demonstrates fiscal responsibility and compliance with state tax laws, which can enhance a business's credibility.

Required Documents for the iTax Compliance Certificate

When applying for the iTax Compliance Certificate, you will need to provide specific documents to verify your tax compliance. These may include:

- Completed SC Form C-268.

- Copies of recent tax returns.

- Proof of payment for any outstanding taxes.

- Identification documents for the business owner or authorized representative.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines related to the iTax Compliance Certificate. Key dates include:

- The annual filing deadline for state income tax returns.

- Quarterly deadlines for estimated tax payments.

- Specific deadlines for submitting the SC Form C-268, which may vary based on business activities.

Staying informed about these dates can help ensure that you maintain compliance and avoid penalties.

Quick guide on how to complete itax compliance certificate

Effortlessly Prepare Itax Compliance Certificate on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Itax Compliance Certificate on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign Itax Compliance Certificate with Ease

- Locate Itax Compliance Certificate and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to finalize your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Itax Compliance Certificate to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the itax compliance certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a certificate of tax compliance south carolina?

A certificate of tax compliance south carolina is an official document issued by the South Carolina Department of Revenue, confirming that a business has met all its tax obligations. This certificate is often required for bidding on contracts, applying for loans, or engaging in other signNow business transactions. It's essential for ensuring that your business is in good standing with the state's tax authority.

-

How can airSlate SignNow help me obtain a certificate of tax compliance south carolina?

airSlate SignNow provides a streamlined process for managing and signing documents related to your certificate of tax compliance south carolina application. Our platform allows you to prepare, eSign, and submit forms quickly, reducing paperwork and saving time. This efficiency is crucial for businesses looking to expedite compliance and secure their certificate.

-

What are the costs associated with obtaining a certificate of tax compliance south carolina?

While the fee for obtaining a certificate of tax compliance south carolina may vary based on specific requirements, using airSlate SignNow can help minimize costs associated with paperwork and processing times. Our affordable subscription plans offer tools for document management that can save you time and money. Additionally, we ensure transparency in all pricing, allowing you to budget effectively.

-

What documents do I need to apply for a certificate of tax compliance south carolina?

To apply for a certificate of tax compliance south carolina, you will typically need documents that outline your business’s tax filings and payments. This can include previous tax returns, proof of payments, and any other necessary documentation that shows compliance with state tax laws. Using airSlate SignNow, you can easily organize and sign these documents digitally for a more convenient process.

-

How long does it take to receive a certificate of tax compliance south carolina?

The time it takes to receive a certificate of tax compliance south carolina can vary, but using airSlate SignNow can signNowly expedite your application process. Once you've submitted the necessary documents electronically, you can expect to receive your certificate much faster than traditional methods. We help streamline communication and ensure you meet all requirements promptly.

-

Do I need to renew my certificate of tax compliance south carolina?

Yes, a certificate of tax compliance south carolina may need to be renewed periodically, depending on the specific requirements set by the South Carolina Department of Revenue. Keeping your compliance up to date is crucial to maintaining good standing for your business. airSlate SignNow can assist you in managing renewals efficiently, ensuring you receive notifications and reminders well in advance.

-

Can airSlate SignNow integrate with other software I use for tax compliance?

Absolutely! airSlate SignNow offers integrations with various accounting and financial software systems, which can streamline your process for obtaining a certificate of tax compliance south carolina. This connectivity ensures that all your documents and data are seamlessly managed across platforms, improving your overall tax compliance strategy. Let us help you enhance your productivity with simple integrations.

Get more for Itax Compliance Certificate

- Gulfstream 400 user manual spectra watermakers form

- Internettelecom floor grid 10x20 pennsylvania convention center form

- Us script prior authorization form pdf

- Hro application checklistpdf colorado national guard co ng form

- Act of de immobilization of mobile home caddo parish clerk of form

- Town of stowe special event permit application form

- Property registration form

- Traditional ira withdrawal instruction form 2306t americas uecu

Find out other Itax Compliance Certificate

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document