Worksheet for the Alberta Personal Tax Credits Return 2024-2026

Understanding the Worksheet for the Alberta Personal Tax Credits Return

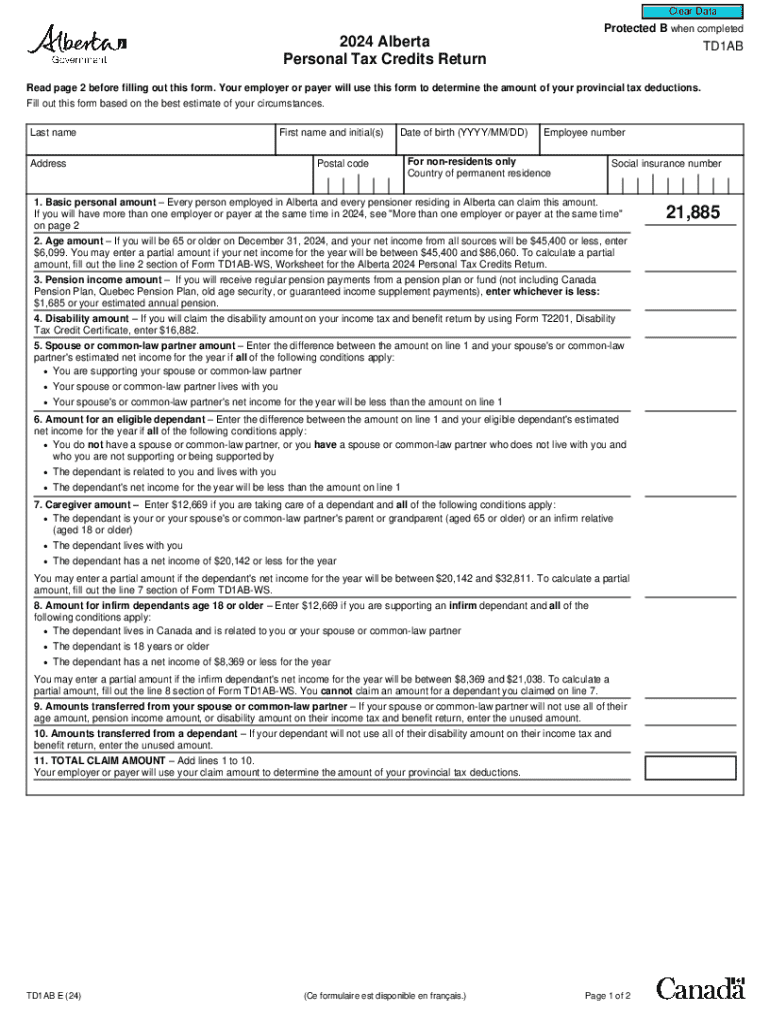

The Worksheet for the Alberta Personal Tax Credits Return is designed to help individuals calculate their personal tax credits accurately. This worksheet is essential for anyone filing their personal income tax in Alberta, as it helps determine the amount of tax credits they are eligible for based on their personal circumstances. The worksheet includes various sections that guide users through the process of identifying applicable credits, including those related to dependents, disabilities, and other personal situations.

How to Use the Worksheet for the Alberta Personal Tax Credits Return

Using the Worksheet for the Alberta Personal Tax Credits Return involves several steps. First, gather all necessary personal information, including details about your income, dependents, and any relevant deductions. Next, follow the instructions on the worksheet to fill out each section carefully. Be sure to provide accurate information to ensure that your tax credits are calculated correctly. Once completed, the worksheet should be submitted along with your tax return to the appropriate tax authority.

Steps to Complete the Worksheet for the Alberta Personal Tax Credits Return

Completing the Worksheet for the Alberta Personal Tax Credits Return requires careful attention to detail. Here are the steps to follow:

- Start by entering your personal information, including your name and address.

- Identify any dependents and enter their details as required.

- Review the list of available tax credits and determine which ones apply to your situation.

- Calculate the total amount of credits you qualify for by following the worksheet's guidelines.

- Double-check all entries for accuracy before submitting the worksheet with your tax return.

Obtaining the Worksheet for the Alberta Personal Tax Credits Return

The Worksheet for the Alberta Personal Tax Credits Return can be obtained from various sources. It is typically available on the official government website, where users can download a PDF version. Additionally, tax preparation offices and financial advisors may provide copies of the worksheet. Ensure you are using the most current version to avoid any discrepancies in your tax filing.

Key Elements of the Worksheet for the Alberta Personal Tax Credits Return

Several key elements make up the Worksheet for the Alberta Personal Tax Credits Return. These include:

- Personal Information: Basic details about the taxpayer and their dependents.

- Tax Credit Categories: Sections for different types of credits, such as those for children, disabilities, and education.

- Calculation Fields: Areas where taxpayers can compute their total credits based on the information provided.

- Signature Line: A space for the taxpayer's signature, confirming the accuracy of the information submitted.

Legal Use of the Worksheet for the Alberta Personal Tax Credits Return

The Worksheet for the Alberta Personal Tax Credits Return is legally recognized as part of the tax filing process in Alberta. It serves as an official document that taxpayers must complete to claim their eligible credits. Using this worksheet correctly helps ensure compliance with tax laws and regulations, reducing the risk of penalties or audits. It is important to retain a copy of the completed worksheet for personal records and future reference.

Quick guide on how to complete worksheet for the alberta personal tax credits return

Accomplish Worksheet For The Alberta Personal Tax Credits Return effortlessly on any platform

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the needed form and securely archive it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage Worksheet For The Alberta Personal Tax Credits Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Worksheet For The Alberta Personal Tax Credits Return with ease

- Obtain Worksheet For The Alberta Personal Tax Credits Return and click on Get Form to begin.

- Use the resources we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Worksheet For The Alberta Personal Tax Credits Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct worksheet for the alberta personal tax credits return

Create this form in 5 minutes!

How to create an eSignature for the worksheet for the alberta personal tax credits return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Alberta tax forms and why are they important?

Alberta tax forms are official documents required for filing taxes in Alberta, Canada. They ensure that individuals and businesses comply with provincial tax regulations. Understanding these forms is crucial for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow help with Alberta tax forms?

airSlate SignNow simplifies the process of completing and signing Alberta tax forms. Our platform allows users to easily fill out, eSign, and send these forms securely, ensuring a hassle-free experience during tax season.

-

Are there any costs associated with using airSlate SignNow for Alberta tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the management of Alberta tax forms, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Alberta tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Alberta tax forms. These tools enhance efficiency and ensure that all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other software for Alberta tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Alberta tax forms alongside your existing tools. This integration helps streamline workflows and improves overall productivity.

-

Is airSlate SignNow secure for handling Alberta tax forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all Alberta tax forms are handled with the utmost care. Our platform uses advanced encryption and security protocols to protect sensitive information.

-

What are the benefits of using airSlate SignNow for Alberta tax forms?

Using airSlate SignNow for Alberta tax forms offers numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our user-friendly platform makes it easy to manage tax documents efficiently, allowing you to focus on your business.

Get more for Worksheet For The Alberta Personal Tax Credits Return

- Commonwealth of virginia department of taxation w 9 form

- Affidavit of fraud and forgery forum credit union form

- 203 k homeowner contractor agreement doc form

- Ncis forms

- Google hunter disability status application form

- Pc 180 connecticut probate courts form

- Custody conciliation orderdoc form

- Study certificate jawahar navodaya vidyalaya form

Find out other Worksheet For The Alberta Personal Tax Credits Return

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF