Alberta Personal Tax Credits Return 2023

What is the Alberta Personal Tax Credits Return?

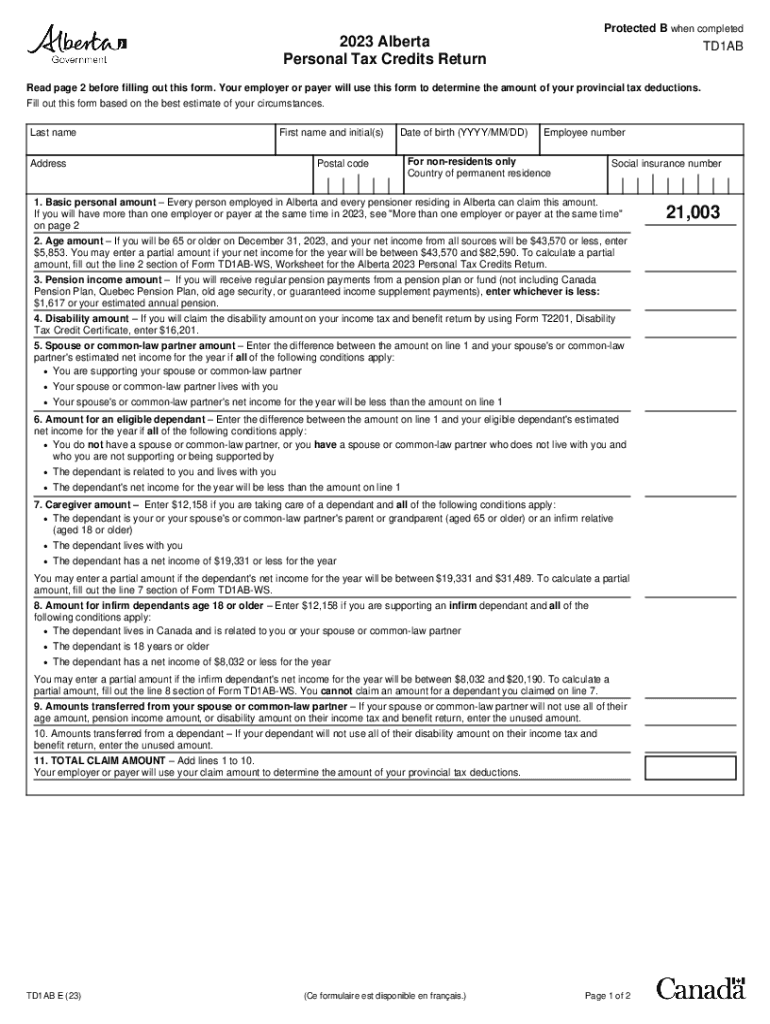

The Alberta Personal Tax Credits Return, commonly referred to as the TD1 Alberta form, is a crucial document for residents of Alberta to declare their personal tax credits. This form is essential for determining the amount of provincial tax that will be withheld from an employee's paycheck throughout the year. It allows individuals to claim various credits that can reduce their overall tax liability. Understanding this form is vital for ensuring that taxpayers do not overpay taxes and can optimize their financial situation.

How to use the Alberta Personal Tax Credits Return

Using the Alberta Personal Tax Credits Return involves filling out the TD1 Alberta form accurately to reflect your personal tax situation. Taxpayers should gather necessary information, such as marital status, dependents, and any applicable tax credits. Once the form is completed, it should be submitted to your employer or the relevant tax authority. It is important to keep a copy for your records, as it may be needed for future reference or adjustments.

Steps to complete the Alberta Personal Tax Credits Return

Completing the Alberta Personal Tax Credits Return requires careful attention to detail. Here are the steps to follow:

- Obtain the TD1 Alberta form from a reliable source.

- Fill in your personal information, including your name, address, and social insurance number.

- Indicate your marital status and number of dependents.

- Claim any applicable tax credits, such as those for disability or education.

- Review the completed form for accuracy.

- Submit the form to your employer or tax authority.

Legal use of the Alberta Personal Tax Credits Return

The Alberta Personal Tax Credits Return is legally recognized as a valid document for tax purposes. To ensure its legal standing, it must be filled out correctly and submitted to the appropriate parties. Compliance with relevant tax laws is essential, as inaccuracies or omissions can lead to penalties. Utilizing a trusted electronic signing solution can enhance the legal validity of the document, providing an electronic certificate that confirms the authenticity of the submission.

Key elements of the Alberta Personal Tax Credits Return

Several key elements must be included in the Alberta Personal Tax Credits Return to ensure its effectiveness:

- Personal Information: Name, address, and social insurance number.

- Marital Status: Indicate whether you are single, married, or in a common-law relationship.

- Dependents: List any dependents you are claiming for tax credits.

- Tax Credits: Specify any applicable credits, such as those for disability or education expenses.

Filing Deadlines / Important Dates

Filing deadlines for the Alberta Personal Tax Credits Return are typically aligned with the general tax filing deadlines in Canada. It is crucial to submit the TD1 Alberta form to your employer at the start of the tax year or whenever your personal circumstances change. Keeping track of these deadlines helps prevent any potential penalties or issues with tax withholding.

Quick guide on how to complete alberta personal tax credits return

Manage Alberta Personal Tax Credits Return easily on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a seamless eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delay. Handle Alberta Personal Tax Credits Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Alberta Personal Tax Credits Return effortlessly

- Locate Alberta Personal Tax Credits Return and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Craft your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method for sharing your form, by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Alberta Personal Tax Credits Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alberta personal tax credits return

Create this form in 5 minutes!

How to create an eSignature for the alberta personal tax credits return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the td1 alberta 2024 form and how does it relate to airSlate SignNow?

The td1 alberta 2024 form is a tax form used in Alberta to determine the amount of tax to be deducted from employees' earnings. With airSlate SignNow, you can easily eSign and send the td1 alberta 2024 form, streamlining your payroll process and ensuring compliance.

-

How can airSlate SignNow help with the td1 alberta 2024 submission process?

airSlate SignNow provides a secure platform for sending and eSigning the td1 alberta 2024 form. This not only simplifies the submission process but also enhances the efficiency of your workflow, allowing you to focus on other crucial business operations.

-

What features does airSlate SignNow offer for managing the td1 alberta 2024 form?

With airSlate SignNow, you gain access to features such as customizable templates, secure document storage, and real-time tracking, specifically designed to simplify the management of the td1 alberta 2024 form. These features help you stay organized while ensuring that documents are processed promptly.

-

Is airSlate SignNow cost-effective for businesses needing the td1 alberta 2024?

Absolutely! airSlate SignNow is a cost-effective solution for businesses looking to manage the td1 alberta 2024 form. Its subscription pricing allows you to access advanced features without breaking the bank, making it an excellent choice for companies of all sizes.

-

Can I integrate airSlate SignNow with other software for managing the td1 alberta 2024?

Yes, airSlate SignNow offers integrations with various software applications that can streamline the management of the td1 alberta 2024 form. This ensures that you can incorporate the eSigning process smoothly into your existing systems, enhancing productivity and efficiency.

-

How secure is the airSlate SignNow platform when handling the td1 alberta 2024?

The airSlate SignNow platform employs advanced security measures, including encryption and secure access controls, to protect your documents such as the td1 alberta 2024 form. You can trust that your sensitive information is safeguarded throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for the td1 alberta 2024?

Using airSlate SignNow for the td1 alberta 2024 provides numerous benefits, including improved efficiency, enhanced compliance, and reduced paper usage. By adopting electronic signatures, you can accelerate the signing process and make tax management a breeze.

Get more for Alberta Personal Tax Credits Return

- Commercial lease assignment from tenant to new tenant wisconsin form

- Tenant consent to background and reference check wisconsin form

- Wisconsin month form

- Residential rental lease agreement wisconsin form

- Tenant welcome letter wisconsin form

- Warning of default on commercial lease wisconsin form

- Warning of default on residential lease wisconsin form

- Landlord tenant closing statement to reconcile security deposit wisconsin form

Find out other Alberta Personal Tax Credits Return

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement