Zakat Form

What is the zakat form

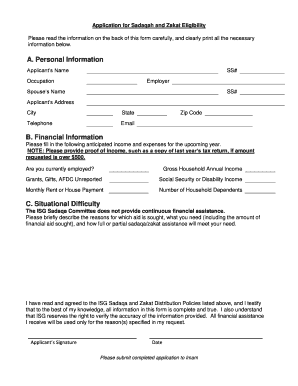

The zakat form is a document used by individuals and organizations to calculate and report their zakat obligations, which are a form of almsgiving treated in Islam as a religious obligation. This form helps ensure that the zakat is calculated accurately based on the individual's or organization's financial situation. It typically includes sections for reporting income, assets, and liabilities, allowing for a clear assessment of zakat due. Understanding the zakat form is crucial for fulfilling religious duties while adhering to applicable financial regulations.

How to use the zakat form

Using the zakat form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements, bank statements, and records of assets. Next, fill out the form by entering your financial details in the appropriate sections. Calculate your zakat based on the provided guidelines, which often include specific percentages of your wealth. Finally, review the completed form for accuracy before submitting it to the relevant authorities or organizations that manage zakat distribution.

Steps to complete the zakat form

Completing the zakat form requires careful attention to detail. Follow these steps:

- Gather financial records, including income and asset documentation.

- Identify your zakat base, which typically includes cash, savings, investments, and other assets.

- Calculate your total zakat due, usually at a rate of two and a half percent of your zakat base.

- Fill out the zakat form accurately, ensuring all figures are correct.

- Review the form to confirm all information is complete and accurate before submission.

Legal use of the zakat form

The zakat form holds legal significance as it provides a documented account of an individual's or organization's zakat obligations. When completed correctly, it can serve as evidence of compliance with religious and financial regulations. It is essential to ensure that the form adheres to local laws and guidelines to maintain its legal validity. Using a reliable platform for electronic submission can enhance the form's legitimacy and security.

Key elements of the zakat form

Key elements of the zakat form include:

- Personal Information: Details of the individual or organization responsible for zakat.

- Financial Overview: A summary of income, assets, and liabilities.

- Zakat Calculation: A section dedicated to calculating the total zakat due.

- Signature: A signature or electronic signature affirming the accuracy of the information provided.

Form Submission Methods

The zakat form can be submitted through various methods, depending on the requirements of the organization or authority receiving it. Common submission methods include:

- Online Submission: Many organizations allow for electronic submission of the zakat form through secure online platforms.

- Mail: The form can be printed and mailed to the appropriate address.

- In-Person: Some may prefer to submit the form in person, particularly when seeking guidance or assistance.

Quick guide on how to complete zakat form

Effortlessly Complete Zakat Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork since you can obtain the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage Zakat Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

Easily Alter and Electronically Sign Zakat Form without Stress

- Locate Zakat Form and click on Get Form to initiate.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to record your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Zakat Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the zakat form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of a zakat form?

A zakat form is a document used to calculate and declare your zakat obligations. It provides a structured way for individuals and businesses to ensure they are fulfilling their zakat responsibilities accurately and efficiently. Using a zakat form helps in maintaining records and makes the calculation process simpler.

-

How can airSlate SignNow help with my zakat form?

AirSlate SignNow provides a user-friendly platform to create, send, and eSign your zakat form. By leveraging our electronic signature solutions, you can complete your forms quickly and securely, ensuring that your zakat obligations are met without unnecessary delay. This streamlines the entire process, making it easy for both individuals and organizations.

-

Is there a cost associated with using the zakat form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, allowing you to choose one that fits your budget. The cost will depend on the features you require, including the ability to manage multiple zakat forms and access advanced integrations. Be sure to review our pricing options to pick the best plan for your zakat form needs.

-

Can I customize my zakat form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to fully customize your zakat form. You can add specific fields, adjust layouts, and incorporate branding elements to ensure your zakat form meets your personal or organizational requirements. This feature enhances user experience and ensures that all necessary information is gathered accurately.

-

What features does airSlate SignNow offer for managing zakat forms?

AirSlate SignNow boasts several features that make managing zakat forms efficient and effective. Key features include eSignature capabilities, templates for quick creation, and tracking for document status. These tools help streamline the workflow and ensure that all zakat-related documentation is handled with ease.

-

Are there integration options available with airSlate SignNow for my zakat form?

Yes, airSlate SignNow offers integration with various applications that can enhance the functionality of your zakat form. You can connect with CRM systems, cloud storage solutions, and payment processors to automate and manage your zakat obligations effectively. This flexibility ensures seamless operation and supports your overall financial management.

-

How secure is the information in my zakat form with airSlate SignNow?

Your security is our priority at airSlate SignNow. We utilize advanced encryption methods and adhere to strict security protocols to protect all information submitted through your zakat form. This ensures that your sensitive data remains confidential and safe from unauthorized access.

Get more for Zakat Form

Find out other Zakat Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy