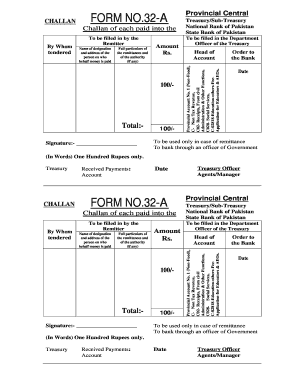

Challan Form 32a

What is the Challan Form 32a

The Challan Form 32a is a specific document used primarily for tax-related purposes in the United States. This form facilitates the payment of taxes owed to the government, ensuring that taxpayers can fulfill their obligations efficiently. It is essential for individuals and businesses alike to understand the purpose of this form, as it serves as a record of payment and can be required for various legal and financial processes.

How to use the Challan Form 32a

Using the Challan Form 32a involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be downloaded from official tax websites. Next, fill in the required information accurately, including your personal details, tax identification number, and the amount being paid. Once completed, you can submit the form either online or through traditional mail, depending on the instructions provided by the relevant tax authority.

Steps to complete the Challan Form 32a

Completing the Challan Form 32a requires careful attention to detail. Follow these steps to ensure accuracy:

- Download the form from a trusted source.

- Provide your full name and contact information.

- Enter your tax identification number.

- Specify the tax period for which you are making the payment.

- Indicate the amount you are paying.

- Review the form for any errors before submission.

After completing these steps, submit the form according to the guidelines provided by the tax authority.

Legal use of the Challan Form 32a

The Challan Form 32a is legally recognized as a valid document for tax payments in the United States. It is crucial for taxpayers to use this form correctly to ensure compliance with tax laws. Proper use of the form helps in maintaining accurate records and can protect against potential legal issues related to tax payments.

Key elements of the Challan Form 32a

Understanding the key elements of the Challan Form 32a is vital for effective completion. Important components include:

- Taxpayer Information: This includes your name, address, and tax identification number.

- Payment Details: The specific amount being paid and the tax period.

- Submission Method: Instructions on how to submit the form, whether online or by mail.

Familiarity with these elements ensures that the form is filled out correctly and submitted in compliance with regulations.

Examples of using the Challan Form 32a

There are various scenarios in which the Challan Form 32a may be utilized. For instance, self-employed individuals may use this form to report and pay estimated taxes quarterly. Similarly, businesses may need to submit the form to settle any outstanding tax liabilities. Understanding these examples can help taxpayers recognize when and how to use the form effectively.

Quick guide on how to complete challan form 32a 458979207

Complete Challan Form 32a effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Challan Form 32a on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to edit and electronically sign Challan Form 32a without any hassle

- Locate Challan Form 32a and select Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, such as email, text message (SMS), or invite link, or download it directly to your computer.

Leave behind worries about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Challan Form 32a and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the challan form 32a 458979207

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a challan and how can it be used with airSlate SignNow?

A challan is a payment receipt or a document that confirms the payment of a fee or tax. With airSlate SignNow, you can easily create, send, and eSign a challan, ensuring that all parties receive a legally binding confirmation of the transaction.

-

How does airSlate SignNow streamline the process of creating a challan?

airSlate SignNow simplifies the creation of a challan by offering customizable templates that allow users to quickly input necessary information. This leads to faster processing times and ensures that your documents are always professional and compliant.

-

What are the benefits of using airSlate SignNow for managing a challan?

Using airSlate SignNow to manage a challan provides several key benefits, including reduced paperwork, increased efficiency, and enhanced security. The platform also allows for easy tracking and management of documents, which helps businesses stay organized.

-

Is there a mobile app available for signing a challan with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to sign a challan and manage documents on the go. This ensures that approvals and transactions can be completed quickly and conveniently, regardless of location.

-

What are the pricing options for using airSlate SignNow to handle a challan?

airSlate SignNow provides several pricing plans tailored to different business needs. Each plan includes access to features that make creating and managing a challan efficient and affordable, ensuring you only pay for what you use.

-

Can I integrate airSlate SignNow with other software for managing a challan?

Absolutely! airSlate SignNow supports integrations with a variety of applications and platforms, allowing you to streamline your workflow when managing a challan. This connectivity ensures data consistency and enhances overall productivity.

-

What types of businesses can benefit from using airSlate SignNow for a challan?

Any business that requires transaction documentation can benefit from using airSlate SignNow for a challan. This includes sectors like finance, government, and education, where proper and timely documentation is critical.

Get more for Challan Form 32a

- Credit application rev 108 blue haven pools form

- Bge service application for residential modificationrelocation projects form

- Bge service application for residential single projects form

- La dpssp form

- Iww delegate form

- Dna test form how does it look like

- How to apply for tefra in south carolina 2007 form

- An important message from champus banner health form

Find out other Challan Form 32a

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter