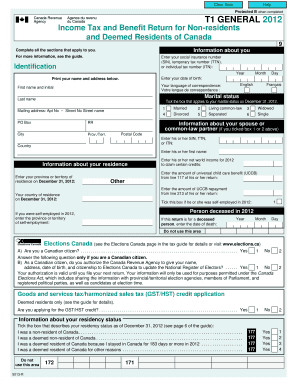

Form 5013 R T1 2021

What is the Form 5013 R T1

The Form 5013 R T1 is a specific document used primarily for tax purposes in the United States. This form is designed to facilitate the reporting of certain financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal tax regulations. The information collected on this form helps the IRS assess tax liabilities and ensure proper tax administration.

How to use the Form 5013 R T1

Using the Form 5013 R T1 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, making sure to provide all required information. It is crucial to double-check entries for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferred method of filing.

Steps to complete the Form 5013 R T1

Completing the Form 5013 R T1 involves a systematic approach:

- Collect all relevant financial documents.

- Fill in personal and business information as required.

- Report income and deductions accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the appropriate IRS address or electronically through an authorized platform.

Legal use of the Form 5013 R T1

The legal use of the Form 5013 R T1 is governed by IRS regulations. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated time frames. Additionally, electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Understanding these legal requirements is essential for maintaining compliance and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5013 R T1 are critical to avoid penalties. Typically, the form must be submitted by April 15th of the tax year, but extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, which can vary based on specific situations or IRS announcements. Marking these dates on a calendar can help ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form 5013 R T1 can be submitted through various methods, providing flexibility for users. The options include:

- Online submission through the IRS e-file system.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if applicable.

Choosing the right submission method can depend on individual preferences and the urgency of processing.

Quick guide on how to complete form 5013 r t1

Complete Form 5013 R T1 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 5013 R T1 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign Form 5013 R T1 without stress

- Obtain Form 5013 R T1 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 5013 R T1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5013 r t1

Create this form in 5 minutes!

How to create an eSignature for the form 5013 r t1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 5013 r and how does it relate to document signing solutions?

5013 r refers to a specific document type relevant for non-profit organizations. airSlate SignNow provides tools to easily eSign and manage 5013 r documents, ensuring compliance and streamlining the signing process.

-

How much does airSlate SignNow cost for handling 5013 r?

The pricing for airSlate SignNow varies based on the plan selected, offering affordable solutions for businesses dealing with 5013 r documentation. With flexible pricing tiers, organizations can choose a plan that fits their budget and needs.

-

What features does airSlate SignNow offer for 5013 r document management?

airSlate SignNow offers various features tailored for 5013 r documents, including secure eSigning, automated workflows, and document templates. These tools help enhance efficiency and ensure that all signatures are captured accurately.

-

Can airSlate SignNow integrate with other software for managing 5013 r forms?

Yes, airSlate SignNow supports integration with numerous third-party applications, making it easy to manage 5013 r forms alongside other tools. This feature helps streamline operations, providing a seamless user experience.

-

What are the benefits of using airSlate SignNow for 5013 r documentation?

Using airSlate SignNow for 5013 r documentation offers numerous benefits, including faster turnaround times, reduced paper costs, and improved security. The platform's user-friendly interface makes it accessible for all team members, enhancing collaboration.

-

Is airSlate SignNow compliant with regulations for 5013 r documents?

Absolutely! airSlate SignNow is designed to comply with all regulatory requirements for eSigning, including those specific to 5013 r documents. This compliance assures users that their signed documents are legally valid and secure.

-

How can I get started with airSlate SignNow for my 5013 r requirements?

To get started with airSlate SignNow for your 5013 r requirements, simply sign up for a free trial on our website. Once registered, you can begin uploading your documents, utilizing templates, and making the most of our eSigning features.

Get more for Form 5013 R T1

Find out other Form 5013 R T1

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple