5013 R T1 General Income Tax Benefit Return for Non Residents and Deemed Residents of Canada Non Residents of Canada 2023-2026

Understanding the 2 R T1 General Income Tax Benefit Return

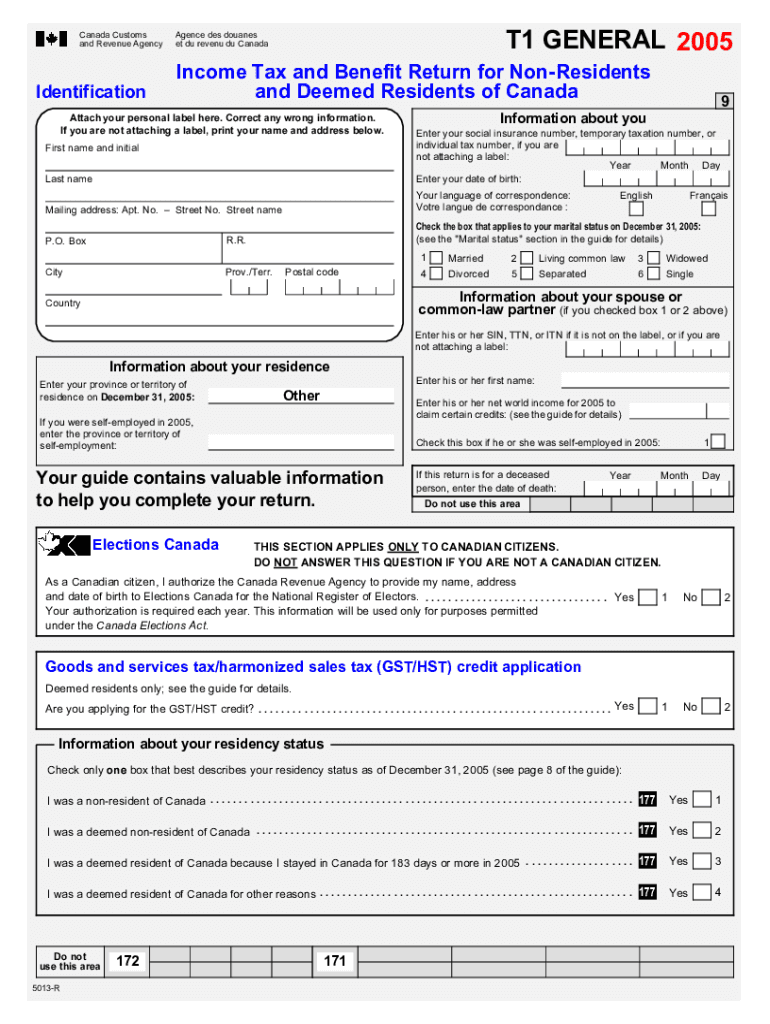

The 2 R T1 General Income Tax Benefit Return is specifically designed for non-residents and deemed residents of Canada. This form allows eligible individuals to claim tax benefits while ensuring compliance with Canadian tax regulations. It is essential for those who may not be permanent residents but still earn income in Canada, as it helps determine their tax obligations and potential refunds.

Steps to Complete the 2 R T1 General Income Tax Benefit Return

Completing the 2 R T1 General Income Tax Benefit Return involves several key steps:

- Gather necessary documents, including income statements and any relevant tax forms.

- Fill out the personal information section accurately, ensuring all details match official identification.

- Report all sources of income earned in Canada, including employment and investment income.

- Claim any eligible deductions or credits to reduce taxable income.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the 2 R T1 General Income Tax Benefit Return

To qualify for the 2 R T1 General Income Tax Benefit Return, individuals must meet specific eligibility criteria:

- Must be a non-resident or deemed resident of Canada.

- Must have earned income from Canadian sources during the tax year.

- Must not be a permanent resident or citizen of Canada.

Required Documents for the 2 R T1 General Income Tax Benefit Return

When filing the 2 R T1 General Income Tax Benefit Return, it is crucial to have the following documents ready:

- Income statements from Canadian employers.

- Any tax slips related to investments or other income sources.

- Identification documents to verify residency status.

Form Submission Methods for the 2 R T1 General Income Tax Benefit Return

The 2 R T1 General Income Tax Benefit Return can be submitted through various methods:

- Online submission through the Canada Revenue Agency (CRA) portal.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Penalties for Non-Compliance with the 2 R T1 General Income Tax Benefit Return

Failure to comply with the requirements of the 2 R T1 General Income Tax Benefit Return may result in penalties, including:

- Fines for late submission or failure to file.

- Interest on any unpaid taxes owed.

- Potential legal action for severe non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct 5013 r t1 general income tax benefit return for non residents and deemed residents of canada non residents of canada

Create this form in 5 minutes!

How to create an eSignature for the 5013 r t1 general income tax benefit return for non residents and deemed residents of canada non residents of canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2010 5013 r form and how does airSlate SignNow help with it?

The 2010 5013 r form is essential for organizations seeking tax-exempt status under IRS regulations. airSlate SignNow simplifies the process of completing and submitting this form by providing an intuitive platform for eSigning and document management, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for managing 2010 5013 r forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those handling 2010 5013 r forms. With flexible subscription options, you can choose a plan that fits your budget while benefiting from our robust eSigning features.

-

What features does airSlate SignNow offer for 2010 5013 r document management?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for 2010 5013 r forms. These tools enhance collaboration and streamline the document workflow, making it easier to manage important submissions.

-

Can I integrate airSlate SignNow with other software for handling 2010 5013 r forms?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage 2010 5013 r forms alongside your existing tools. This integration capability enhances productivity and ensures that your document processes are efficient and cohesive.

-

What are the benefits of using airSlate SignNow for 2010 5013 r submissions?

Using airSlate SignNow for 2010 5013 r submissions offers numerous benefits, including faster processing times and reduced paperwork. Our platform ensures that your documents are securely signed and stored, providing peace of mind and compliance with IRS requirements.

-

Is airSlate SignNow user-friendly for completing 2010 5013 r forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete 2010 5013 r forms. The intuitive interface allows users to navigate the platform effortlessly, even if they have limited technical skills.

-

How does airSlate SignNow ensure the security of 2010 5013 r documents?

airSlate SignNow prioritizes the security of your 2010 5013 r documents by employing advanced encryption and secure storage solutions. Our platform complies with industry standards to protect sensitive information, giving you confidence in your document management.

Get more for 5013 R T1 General Income Tax Benefit Return For Non Residents And Deemed Residents Of Canada Non residents Of Canada

- Staar science tutorial 27 answer key 228572129 form

- Soap format for progress notes

- Download nutrition facts labels worksheet form

- Blank sermon outline template pdf form

- New india professional indemnity proposal form

- Halachic prenup pdf form

- Form id 10a identity malta agency

- New claims process faqs care n care form

Find out other 5013 R T1 General Income Tax Benefit Return For Non Residents And Deemed Residents Of Canada Non residents Of Canada

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy