Income Tax and Benefit Returns PDF Protected B When 2021

What is the 2r tax form?

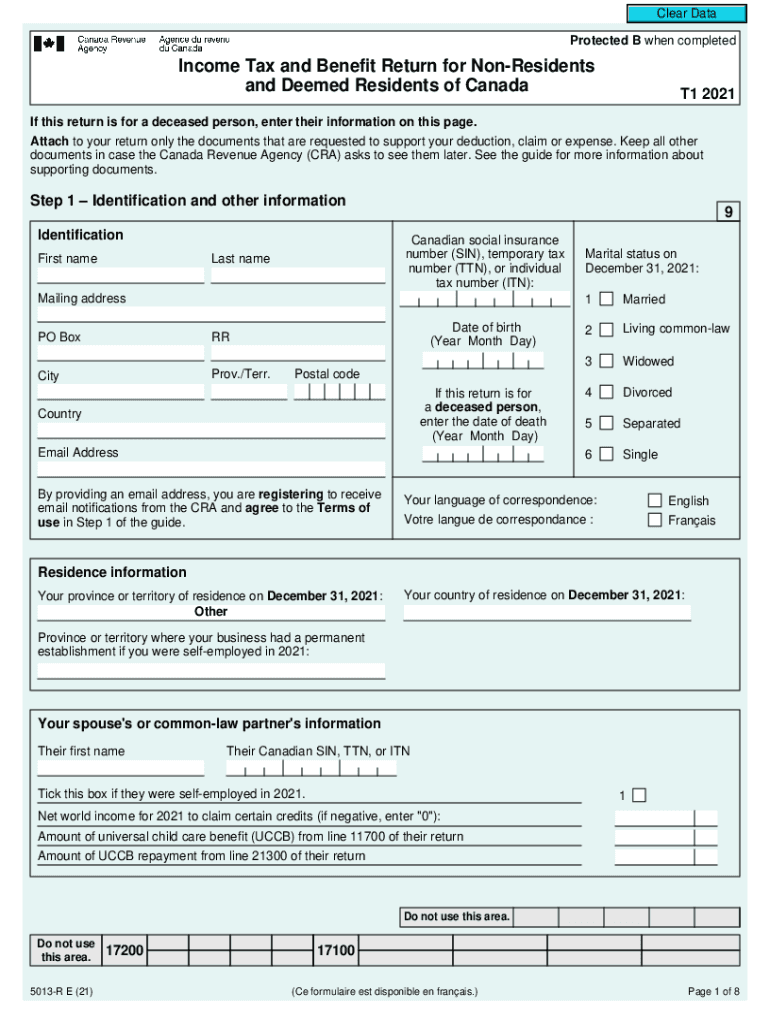

The 2r tax form, also known as the Income Tax and Benefit Return, is a crucial document for individuals in Canada who are considered deemed residents for tax purposes. This form is essential for reporting income and calculating benefit entitlements. It captures various types of income, deductions, and credits that may apply to the taxpayer's situation. The 5013r form is specifically designed to ensure that individuals comply with tax regulations while maximizing their eligible benefits.

Steps to complete the 2r tax form

Completing the 2r tax form involves several key steps:

- Gather all necessary documents, including income statements, receipts for deductions, and previous tax returns.

- Fill out personal information, including your name, address, and social security number.

- Report all sources of income, including employment income, investment income, and any other taxable income.

- Claim eligible deductions and credits, ensuring you have the appropriate documentation to support your claims.

- Review the completed form for accuracy and completeness before submission.

Legal use of the 2r tax form

The 2r tax form is legally recognized as a valid document for reporting income and claiming benefits. To ensure its legal standing, it must be completed accurately and submitted by the designated deadline. Compliance with relevant tax laws and regulations is essential to avoid penalties. Utilizing secure and compliant electronic signature tools, such as airSlate SignNow, can further enhance the legitimacy of your submission by providing an electronic certificate and maintaining compliance with eSignature laws.

Filing deadlines for the 2r tax form

It is important to be aware of the filing deadlines for the 2r tax form to avoid late penalties. Generally, the deadline for submitting the form is April 30 of the following year. However, if you or your spouse/common-law partner is self-employed, the deadline extends to June 15. It is advisable to check for any updates or changes to these deadlines, as they may vary based on specific circumstances or government announcements.

Required documents for the 2r tax form

To complete the 2r tax form, you will need to gather several important documents:

- Income statements from employers or payers.

- Receipts for deductible expenses, such as medical expenses or charitable donations.

- Information on any investment income or capital gains.

- Previous tax returns, if applicable, for reference.

Form submission methods for the 2r tax form

The 2r tax form can be submitted through various methods:

- Online submission via the Canada Revenue Agency (CRA) website, which allows for quick processing.

- Mailing a paper copy of the completed form to the appropriate CRA address.

- In-person submission at designated CRA offices, if available.

Quick guide on how to complete income tax and benefit returnspdf protected b when

Prepare Income Tax And Benefit Returns pdf Protected B When effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Income Tax And Benefit Returns pdf Protected B When on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-based process today.

The easiest way to modify and eSign Income Tax And Benefit Returns pdf Protected B When with ease

- Obtain Income Tax And Benefit Returns pdf Protected B When and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Income Tax And Benefit Returns pdf Protected B When and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax and benefit returnspdf protected b when

Create this form in 5 minutes!

People also ask

-

What is the 2021 5013r tax form and who needs it?

The 2021 5013r tax form is crucial for organizations seeking tax-exempt status under IRS regulations. It is primarily needed by non-profit entities that wish to apply for 501(c)(3) classification. Understanding this form helps organizations manage their tax obligations effectively and maintain compliance.

-

How can airSlate SignNow assist with the 2021 5013r tax form process?

airSlate SignNow simplifies the signing and submission of the 2021 5013r tax form by providing a user-friendly platform for document management. Users can easily send documents for eSignature, ensuring that their applications are completed quickly and securely. This efficiency helps organizations focus more on their missions rather than paperwork.

-

What pricing plans are available for airSlate SignNow when handling the 2021 5013r tax?

airSlate SignNow offers various pricing plans that cater to different organizational needs, especially for those managing the 2021 5013r tax. Pricing is competitive and includes options for small to large businesses. Choosing the right plan ensures that organizations have the necessary tools to manage their tax documents effectively.

-

What features does airSlate SignNow provide for 2021 5013r tax-related documents?

airSlate SignNow offers advanced features such as custom templates, API integration, and real-time tracking for the 2021 5013r tax documents. These features enhance user experience by making document preparation and signing seamless. Additionally, airSlate SignNow provides secure cloud storage for easy document retrieval.

-

Can airSlate SignNow integrate with other software for managing 2021 5013r tax documents?

Yes, airSlate SignNow easily integrates with numerous software solutions commonly used for financial management and tax coordination. This interoperability allows for efficient workflows when dealing with the 2021 5013r tax form. By integrating with existing tools, organizations can streamline their processes and reduce errors.

-

What benefits can organizations expect when using airSlate SignNow for the 2021 5013r tax?

Using airSlate SignNow for the 2021 5013r tax process yields signNow benefits including enhanced efficiency and reduced turnaround time for document processing. The platform also improves collaboration among team members, making it easier to gather necessary signatures. Overall, organizations can save time and resources while ensuring compliance.

-

Is airSlate SignNow suitable for small non-profits handling the 2021 5013r tax?

Absolutely, airSlate SignNow is designed to meet the needs of small non-profits managing the 2021 5013r tax. Its affordability and ease of use make it a great option for organizations with limited resources. Small non-profits can leverage this tool to handle important documents without the complexity or cost associated with traditional methods.

Get more for Income Tax And Benefit Returns pdf Protected B When

- Ct corporation llc 497301003 form

- Affidavit of original contractor by individual connecticut form

- Quitclaim deed by two individuals to corporation connecticut form

- Warranty deed from two individuals to corporation connecticut form

- Ct corporation llc 497301008 form

- Ct notice 497301010 form

- Quitclaim deed from individual to corporation connecticut form

- Warranty deed from individual to corporation connecticut form

Find out other Income Tax And Benefit Returns pdf Protected B When

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement