Income Tax and Benefit Return for Non Residents and 2022

Understanding the Income Tax and Benefit Return for Non-Residents

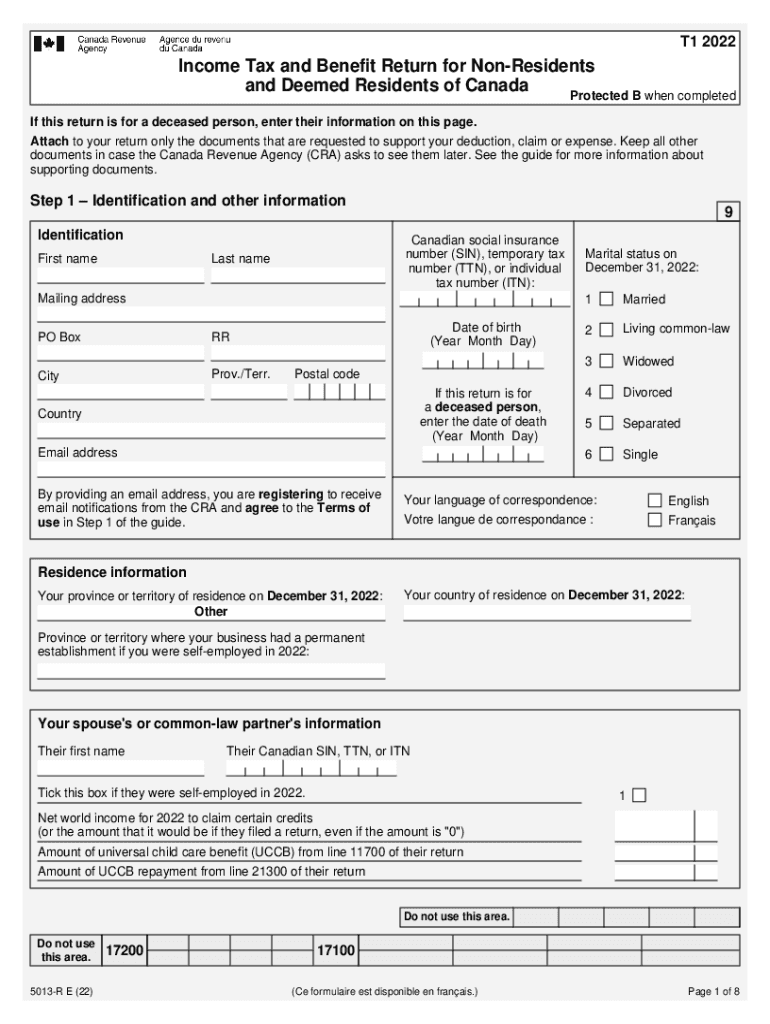

The Income Tax and Benefit Return for Non-Residents, commonly referred to as the T1 General sample, is a crucial document for individuals who are not residents of the United States but have income sourced from within the country. This form allows non-residents to report their income and claim any applicable benefits or credits. It is essential for ensuring compliance with U.S. tax laws and for determining any tax liabilities or refunds due. Understanding the specifics of this form is vital for non-residents to navigate their tax obligations effectively.

Steps to Complete the Income Tax and Benefit Return for Non-Residents

Completing the Income Tax and Benefit Return for Non-Residents involves several key steps. First, gather all necessary documentation, including income statements and any relevant tax identification numbers. Next, accurately fill out the T1 General sample form, ensuring all income sources are reported. Pay close attention to the sections related to deductions and credits, as these can significantly impact your tax liability. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority, either electronically or via mail.

Required Documents for Filing

When preparing to file the Income Tax and Benefit Return for Non-Residents, it is important to collect all required documents. These may include:

- Income statements from U.S. sources, such as W-2 forms or 1099 forms.

- Proof of residency status, if applicable.

- Tax identification numbers, such as a Social Security Number or Individual Taxpayer Identification Number.

- Documentation for any deductions or credits being claimed.

Having these documents ready will streamline the filing process and help ensure that all information is accurately reported.

Filing Deadlines and Important Dates

It is crucial for non-residents to be aware of the filing deadlines associated with the Income Tax and Benefit Return. Typically, the deadline for filing is April 15 of the year following the tax year in question. However, if you are a non-resident, you may be eligible for an automatic extension. It is advisable to check the IRS guidelines for any updates or changes to these dates, as they can vary based on specific circumstances or changes in legislation.

Eligibility Criteria for Non-Residents

To qualify for filing the Income Tax and Benefit Return for Non-Residents, individuals must meet specific eligibility criteria. Generally, non-residents are individuals who do not meet the substantial presence test or who have not established residency in the United States for tax purposes. Additionally, the income must be sourced from U.S. sources to be reportable on this form. Understanding these criteria is essential for determining whether you should file this return.

Legal Use of the Income Tax and Benefit Return for Non-Residents

The Income Tax and Benefit Return for Non-Residents serves a legal purpose in the U.S. tax system. Filing this return is not only a requirement for compliance but also provides a means for non-residents to report their income accurately. It allows individuals to claim any benefits or credits they are entitled to under U.S. tax law. Failure to file can result in penalties and legal repercussions, making it imperative for non-residents to adhere to the filing requirements.

Quick guide on how to complete income tax and benefit return for non residents and

Effortlessly prepare Income Tax And Benefit Return For Non residents And on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can easily find the correct form and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your papers swiftly without delays. Handle Income Tax And Benefit Return For Non residents And on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Income Tax And Benefit Return For Non residents And effortlessly

- Find Income Tax And Benefit Return For Non residents And and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Income Tax And Benefit Return For Non residents And and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax and benefit return for non residents and

Create this form in 5 minutes!

How to create an eSignature for the income tax and benefit return for non residents and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t1 general sample and how does it work?

A t1 general sample is a specific type of document used primarily for tax purposes. In the context of airSlate SignNow, you can easily create, edit, and eSign your t1 general sample electronically, streamlining your filing process. This enhances efficiency while ensuring compliance with relevant tax regulations.

-

How much does it cost to eSign a t1 general sample using airSlate SignNow?

Pricing for using airSlate SignNow to eSign a t1 general sample varies based on your subscription plan. We offer flexible pricing options to cater to individual needs and business scales. Visit our pricing page to find a plan that suits your requirements for signing documents like the t1 general sample.

-

What features does airSlate SignNow offer for managing a t1 general sample?

airSlate SignNow provides a wide array of features for managing a t1 general sample, such as customizable templates, advanced security measures, and real-time status tracking. These features simplify the documentation process and enhance your ability to manage important records efficiently. Start leveraging these tools today to optimize your eSigning experience.

-

Can I integrate airSlate SignNow with other software for handling a t1 general sample?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, making it easier to manage your t1 general sample alongside your existing workflows. Whether you're using CRM systems, cloud storage, or accounting software, our platform supports integrations with the tools you know and love. Enhance your productivity by connecting airSlate SignNow with your preferred applications.

-

What are the benefits of using airSlate SignNow for eSigning a t1 general sample?

Using airSlate SignNow for eSigning a t1 general sample brings numerous benefits, including increased efficiency, cost savings, and improved document security. You'll be able to sign documents quickly from anywhere, which is especially helpful during tax season. Additionally, our platform ensures that your signatures are legally binding and meet compliance standards.

-

Is it safe to use airSlate SignNow for a t1 general sample?

Absolutely! airSlate SignNow takes security seriously, particularly when handling sensitive documents like a t1 general sample. Our platform utilizes advanced encryption methods and follows industry standards to protect your data. You can confidently eSign your documents, knowing they remain secure throughout the process.

-

Can I track the status of my t1 general sample once sent for eSignature?

Yes, airSlate SignNow allows you to track the status of your t1 general sample effortlessly. You will receive notifications when your document is viewed, signed, or requires further action. This feature helps you stay informed on the progress, ensuring you never miss an important deadline.

Get more for Income Tax And Benefit Return For Non residents And

Find out other Income Tax And Benefit Return For Non residents And

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe