T1 Gerneral Form Bc 2010

What is the T1 General Form BC?

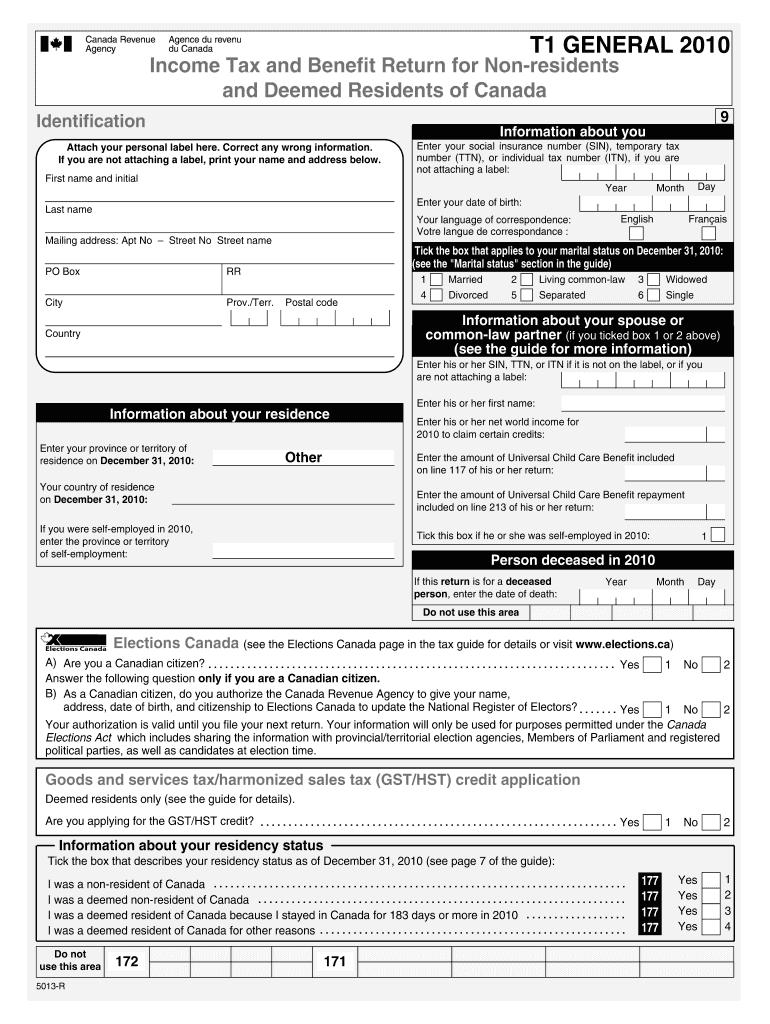

The T1 General Form BC is a crucial document used by individuals in British Columbia to file their personal income tax returns. This form collects essential information about a taxpayer's income, deductions, and credits for the tax year. It is designed for residents of Canada who need to report their income to the Canada Revenue Agency (CRA). The T1 General allows taxpayers to calculate their tax liability accurately and claim any eligible tax benefits. Understanding the T1 General is vital for ensuring compliance with Canadian tax laws and maximizing potential refunds.

How to Obtain the T1 General Form BC

Obtaining the T1 General Form BC is straightforward. Taxpayers can access the form through the Canada Revenue Agency's website, where it is available for download in PDF format. Additionally, many community organizations and libraries offer printed copies of the form. For those who prefer digital solutions, tax preparation software often includes the T1 General Form BC, making it easy to fill out and submit electronically. Ensuring you have the correct version of the form for the tax year is essential for accurate filing.

Steps to Complete the T1 General Form BC

Completing the T1 General Form BC involves several key steps:

- Gather all necessary documents, including T4 slips, receipts for deductions, and information on other income sources.

- Fill out personal information, including your name, address, and Social Insurance Number (SIN).

- Report all income sources in the designated sections, ensuring accuracy to avoid issues with the CRA.

- Claim eligible deductions and credits, which can reduce your taxable income and increase potential refunds.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Legal Use of the T1 General Form BC

The T1 General Form BC is legally recognized as the official document for reporting personal income to the CRA. To ensure its legal validity, taxpayers must complete the form accurately and submit it by the specified deadlines. The information provided on the form must be truthful and complete, as the CRA may audit returns for discrepancies. Utilizing eSignature solutions can enhance the legal standing of the document when filed electronically, ensuring compliance with eSignature regulations.

Required Documents for the T1 General Form BC

When preparing to complete the T1 General Form BC, it is essential to gather all required documents to ensure accurate reporting. Key documents include:

- T4 slips from employers, detailing employment income.

- Other income statements, such as T5 slips for investment income.

- Receipts for deductible expenses, including medical expenses and charitable donations.

- Documentation for any tax credits you intend to claim.

Having these documents ready will streamline the process of filling out the T1 General and help avoid delays in filing.

Filing Deadlines and Important Dates

Understanding filing deadlines is critical for compliance with tax regulations. The typical deadline for submitting the T1 General Form BC is April 30 of the following tax year. If you are self-employed, the deadline extends to June 15, but any taxes owed must still be paid by April 30 to avoid interest charges. It is advisable to keep track of these dates to ensure timely submission and avoid penalties.

Quick guide on how to complete t1 gerneral form 2019 bc

Complete T1 Gerneral Form Bc effortlessly on any device

Online document administration has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to generate, modify, and eSign your documents swiftly without interruptions. Manage T1 Gerneral Form Bc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign T1 Gerneral Form Bc effortlessly

- Locate T1 Gerneral Form Bc and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Edit and eSign T1 Gerneral Form Bc to guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1 gerneral form 2019 bc

Create this form in 5 minutes!

How to create an eSignature for the t1 gerneral form 2019 bc

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is a T1 General?

A T1 General is a tax form used by individuals and businesses in Canada to report their income. Understanding what a T1 General is essential for accurate tax filing and compliance with Canadian tax laws.

-

How does airSlate SignNow facilitate the signing of a T1 General?

airSlate SignNow allows you to easily upload and eSign your T1 General form electronically. With its user-friendly interface, you can complete your tax documents quickly and efficiently without the hassle of printing.

-

What are the pricing options for using airSlate SignNow for T1 General eSigning?

airSlate SignNow offers flexible pricing plans that cater to both individual users and businesses. Choosing the right plan will depend on your specific needs, but each option ensures cost-effective access to features tailored for signing documents like the T1 General.

-

What features does airSlate SignNow provide for T1 General document management?

With airSlate SignNow, you get features such as secure eSigning, document tracking, and templates that can greatly simplify managing your T1 General. These tools enhance efficiency and keep your tax documents organized.

-

What benefits does airSlate SignNow offer when working with a T1 General?

The primary benefit of using airSlate SignNow for your T1 General is the ease of use and speed it provides in signing tax documents. Additionally, its compliance with security standards ensures that your sensitive tax information is protected.

-

Can I integrate airSlate SignNow with other software for T1 General processing?

Yes, airSlate SignNow offers integrations with various software applications that can help streamline your T1 General processing. These integrations can enhance your workflow, allowing you to manage tax documents more efficiently.

-

Is airSlate SignNow compliant with Canadian tax regulations for T1 General submissions?

Absolutely, airSlate SignNow ensures compliance with Canadian tax regulations, making it a secure choice for submitting your T1 General. You can trust that your electronic signatures and documents meet all necessary legal requirements.

Get more for T1 Gerneral Form Bc

- Alternative workweek quick referencemachining survival news form

- Notice of results of election form

- Five documents employers should provide to employees separating form

- Request for entry of default a california courts state of california form

- Em 100 form

- This option to purchase addendum to residential lease agreement is entered into by and between form

- Colorado revised statute 38 22 117 form

- 521 real estate transfer statement nebraska department of revenue form

Find out other T1 Gerneral Form Bc

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement