Dare County Occupancy Tax Report Form

What is the Dare County Occupancy Tax Report Form

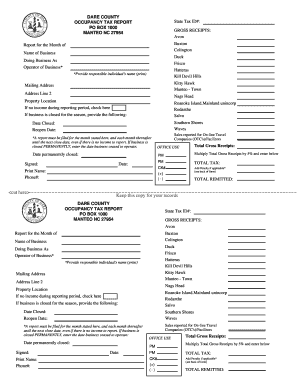

The Dare County occupancy tax report form is a crucial document for property owners and rental agencies in Dare County, North Carolina. This form is used to report and remit the occupancy tax collected from guests who stay in short-term rental properties. The occupancy tax is a percentage of the rental income and is typically charged to guests as part of their rental fees. Understanding this form is essential for compliance with local tax regulations and to ensure that the collected taxes are properly reported to the county.

How to use the Dare County Occupancy Tax Report Form

Using the Dare County occupancy tax report form involves several steps. First, property owners need to gather all relevant information regarding the rentals, including the total number of nights rented and the total rental income generated during the reporting period. Next, complete the form by accurately entering this data in the designated fields. It is essential to ensure that all calculations are correct to avoid discrepancies. Once completed, the form must be submitted to the appropriate county office, along with any taxes owed.

Steps to complete the Dare County Occupancy Tax Report Form

Completing the Dare County occupancy tax report form requires careful attention to detail. Here are the steps to follow:

- Gather all rental income data for the reporting period.

- Calculate the total occupancy tax based on the rental income.

- Fill in the form with accurate figures, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form along with the payment to the designated county office.

Legal use of the Dare County Occupancy Tax Report Form

The legal use of the Dare County occupancy tax report form is governed by local tax laws. This form must be filled out accurately to comply with the regulations set forth by Dare County. Failure to submit the form or inaccuracies in reporting can lead to penalties or fines. It is important for property owners to understand their legal obligations regarding occupancy tax collection and reporting to avoid potential legal issues.

Form Submission Methods

The Dare County occupancy tax report form can be submitted through various methods. Property owners have the option to submit the form online, by mail, or in person. Online submission is often the most efficient method, allowing for quicker processing. If submitting by mail, ensure that the form is sent to the correct county office and that it is postmarked by the filing deadline. In-person submissions can be made at the county tax office during regular business hours.

Penalties for Non-Compliance

Non-compliance with the requirements of the Dare County occupancy tax report form can lead to significant penalties. Property owners who fail to file the form on time, provide inaccurate information, or neglect to remit the owed taxes may face fines or interest charges. It is essential to stay informed about filing deadlines and to ensure that all submissions are accurate to avoid these penalties.

Quick guide on how to complete dare county occupancy tax report form

Complete Dare County Occupancy Tax Report Form effortlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Dare County Occupancy Tax Report Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Dare County Occupancy Tax Report Form with ease

- Locate Dare County Occupancy Tax Report Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically available from airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal significance as a conventional handwritten signature.

- Review the details and then select the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns over lost or mismanaged files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Dare County Occupancy Tax Report Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dare county occupancy tax report form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Dare County occupancy tax?

The Dare County occupancy tax is a tax levied on rentals and accommodations in Dare County, North Carolina. This tax is typically applied to short-term rentals and helps fund local amenities and services. Understanding this tax is crucial for landlords and property managers to ensure compliance and proper pricing.

-

How does airSlate SignNow help with managing Dare County occupancy tax?

airSlate SignNow allows you to easily create, send, and eSign documents related to Dare County occupancy tax, such as rental agreements and tax filings. Our platform streamlines the documentation process, ensuring that you stay organized and compliant with local regulations. This efficient management can ultimately save you time and reduce the risk of errors.

-

What are the pricing options for airSlate SignNow related to Dare County occupancy tax?

airSlate SignNow offers several pricing plans to fit different business needs, ensuring you have access to all necessary features for managing documents related to Dare County occupancy tax. Pricing is competitive and designed to be cost-effective, providing value through enhanced efficiency and ease of use. You can choose a plan based on the size of your business and the volume of documents you handle.

-

Can I integrate airSlate SignNow with other systems for Dare County occupancy tax management?

Yes, airSlate SignNow seamlessly integrates with various platforms, making it easier to manage documents related to Dare County occupancy tax. This includes integration with accounting and property management software, which helps streamline your document workflow. The integrations ensure that you can automate processes, reducing manual data entry to enhance accuracy and efficiency.

-

What benefits does airSlate SignNow offer for properties subject to the Dare County occupancy tax?

Using airSlate SignNow can signNowly simplify the management of properties subject to the Dare County occupancy tax. Benefit from faster document turnaround times, improved compliance with tax regulations, and the ability to securely eSign contracts on the go. These advantages can help you focus more on growing your rental business rather than getting bogged down by paperwork.

-

Is airSlate SignNow easy to use for managing Dare County occupancy tax documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, allowing anyone to manage their Dare County occupancy tax documents without extensive training. The intuitive interface makes it simple to create, send, and eSign documents quickly, ensuring you can handle your tasks efficiently. With clear guidance and support, you'll start managing your documents in no time.

-

What types of documents can I prepare for Dare County occupancy tax using airSlate SignNow?

You can prepare a variety of documents related to the Dare County occupancy tax using airSlate SignNow, including rental agreements, tax exemption forms, and tax payment authorizations. The platform allows you to customize these documents to meet local regulations and ensure compliance. By digitizing your paperwork, you can also enhance the security and accessibility of your essential documents.

Get more for Dare County Occupancy Tax Report Form

- Ohio revocation 497322704 form

- Last will and testament for other persons ohio form

- Notice to beneficiaries of being named in will ohio form

- Estate planning questionnaire and worksheets ohio form

- Document locator and personal information package including burial information form ohio

- Demand to produce copy of will from heir to executor or person in possession of will ohio form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497322711 form

- Bill of sale of automobile and odometer statement oklahoma form

Find out other Dare County Occupancy Tax Report Form

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement