Form 941bn Me Fillable

What is the Form 941bn Me Fillable

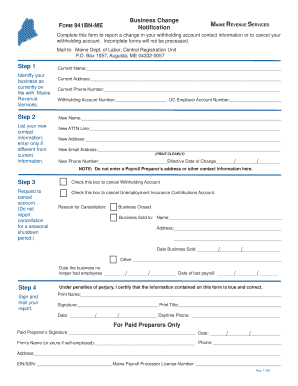

The Form 941bn Me Fillable is a tax document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is critical for ensuring compliance with federal tax regulations. It allows employers to provide the IRS with information about their payroll, including the total wages paid and the taxes withheld during a specific quarter. The fillable version of this form simplifies the process, enabling users to complete and submit it electronically.

How to use the Form 941bn Me Fillable

Using the Form 941bn Me Fillable involves several straightforward steps. Initially, employers should gather all necessary payroll information for the reporting period. This includes total wages paid, the number of employees, and taxes withheld. Once the information is compiled, users can access the fillable form online. The form allows for easy entry of data, and users can save their progress. After completing the form, it can be electronically submitted to the IRS, ensuring a timely filing.

Steps to complete the Form 941bn Me Fillable

Completing the Form 941bn Me Fillable requires careful attention to detail. Follow these steps for accurate completion:

- Gather payroll records for the reporting period.

- Access the fillable form online.

- Enter total wages paid in the appropriate fields.

- Input the amount of federal income tax withheld.

- Calculate and enter Social Security and Medicare taxes.

- Review all entries for accuracy.

- Submit the completed form electronically to the IRS.

Legal use of the Form 941bn Me Fillable

The legal use of the Form 941bn Me Fillable is governed by federal tax laws. To be considered valid, the form must be completed accurately and submitted by the due date. Employers are required to retain copies of the form and supporting documents for at least four years. Additionally, electronic signatures on the form are legally binding, provided they comply with the ESIGN Act and UETA regulations, ensuring that the submission is recognized by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941bn Me Fillable are crucial for compliance. Employers must file this form quarterly, with specific due dates for each quarter:

- First quarter (January to March): Due by April 30.

- Second quarter (April to June): Due by July 31.

- Third quarter (July to September): Due by October 31.

- Fourth quarter (October to December): Due by January 31 of the following year.

Form Submission Methods (Online / Mail / In-Person)

The Form 941bn Me Fillable can be submitted through various methods, providing flexibility for employers. The primary submission method is electronic filing, which is efficient and ensures timely processing. Employers can also choose to mail a printed copy of the completed form to the IRS. In-person submission is generally not available for this form, as the IRS encourages electronic filing for quicker processing and confirmation.

Quick guide on how to complete form 941bn me fillable

Complete Form 941bn Me Fillable effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly without delays. Manage Form 941bn Me Fillable on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 941bn Me Fillable without hassle

- Obtain Form 941bn Me Fillable and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select how you want to send your form, through email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 941bn Me Fillable and guarantee excellent communication at each stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941bn me fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 941bn me fillable'?

The 'form 941bn me fillable' is a customizable digital version of IRS Form 941, specifically designed for Maine residents and businesses. Utilizing airSlate SignNow, users can easily fill out, eSign, and manage their form 941bn electronically, streamlining the filing process.

-

How much does it cost to use airSlate SignNow for the 'form 941bn me fillable'?

airSlate SignNow offers competitive pricing plans that cater to various business sizes and needs. Users can choose from monthly or annual subscriptions, and the cost provides access to the 'form 941bn me fillable' along with various other document management features.

-

What are the key features of the 'form 941bn me fillable' with airSlate SignNow?

The 'form 941bn me fillable' on airSlate SignNow includes features such as drag-and-drop document creation, easy eSigning, and cloud storage. Additionally, users can track document status and send reminders, making it easier to manage tax forms.

-

How can the 'form 941bn me fillable' improve my business efficiency?

Using the 'form 941bn me fillable' from airSlate SignNow signNowly enhances business efficiency by reducing paperwork and the time spent on manual data entry. The platform automates the signing process and provides real-time updates, allowing businesses to focus on their core operations.

-

Does airSlate SignNow integrate with other software for filing the 'form 941bn me fillable'?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easier to file the 'form 941bn me fillable.' Users can connect with accounting software and cloud storage services, ensuring a smooth workflow when managing tax documents.

-

Can I access the 'form 941bn me fillable' from any device?

Absolutely! The 'form 941bn me fillable' on airSlate SignNow is designed for accessibility across devices, whether you are using a computer, tablet, or smartphone. This flexibility allows users to complete and eSign their forms anytime and anywhere.

-

Is the 'form 941bn me fillable' secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The 'form 941bn me fillable' is protected with bank-level encryption, ensuring that all personal and financial information remains secure throughout the eSigning process.

Get more for Form 941bn Me Fillable

- Do you sen w2 with g 1003 2012 form

- Transcript request form san joaquin delta college deltacollege

- Vehicle suitable for safe use declaration 2014 form

- Surrey police shotgun certificate form

- Ann arbor schools medication administration form

- Kra c32 form

- Rfp kinship support services county of kern co kern ca form

- Consumer complaint form

Find out other Form 941bn Me Fillable

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament