Hs302 2018

What is the HS302?

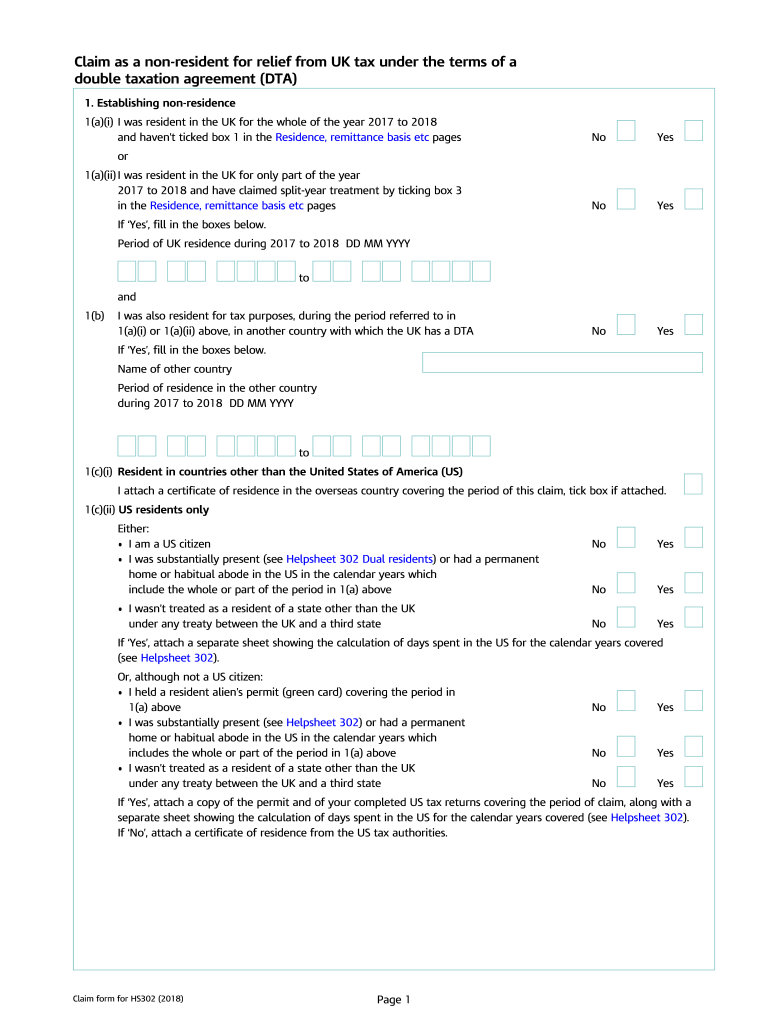

The HS302 is a specific form used for tax purposes, primarily related to claims for relief under the double taxation agreements. This form is crucial for individuals and businesses seeking to ensure they are not taxed twice on the same income in different jurisdictions. The HS302 form is issued by HM Revenue and Customs (HMRC) in the United Kingdom, and it serves to facilitate the process of claiming tax relief, ensuring compliance with international tax laws.

How to use the HS302

Using the HS302 involves several key steps to ensure that the form is completed accurately and submitted correctly. First, gather all necessary financial documents, including income statements and tax records from both jurisdictions. Next, fill out the HS302 form with accurate information regarding your income and tax paid abroad. It is essential to provide clear and truthful data to avoid any issues with compliance. Once completed, the form can be submitted to HMRC for processing, either online or by mail, depending on your preference.

Steps to complete the HS302

Completing the HS302 requires careful attention to detail. Follow these steps:

- Begin by downloading the HS302 form from the HMRC website.

- Read the instructions carefully to understand the information required.

- Fill in your personal details, including your name, address, and tax identification number.

- Provide details of your income and the taxes paid in the foreign country.

- Review the form for accuracy and completeness before submission.

Legal use of the HS302

The HS302 form is legally binding when filled out correctly and submitted to HMRC. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or legal issues. The form is designed to comply with international tax laws, and proper use can help taxpayers avoid double taxation. Understanding the legal implications of the HS302 is vital for anyone using it to claim tax relief.

Required Documents

When completing the HS302, certain documents are required to support your claim. These typically include:

- Proof of income, such as pay stubs or tax returns from the foreign country.

- Documentation of taxes paid abroad, including receipts or tax certificates.

- Your personal identification documents, such as a passport or driver's license.

Having these documents ready will streamline the process and ensure that your claim is processed without delays.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the HS302. Generally, claims for tax relief should be submitted within a specific timeframe after the end of the tax year in which the income was earned. For most taxpayers, this deadline falls on January 31 of the following year. Missing this deadline may result in the forfeiture of tax relief, so timely submission is crucial.

Quick guide on how to complete hs302 dual residents 2018 claim form claim as a non resident for relief from uk tax under the terms of a double taxation

A concise guide on how to prepare your Hs302

Finding the appropriate template can be difficult when you must submit official foreign paperwork. Even if you possess the necessary form, it can be tiresome to quickly fill it out according to all the specifications if you are using printed versions instead of managing everything digitally. airSlate SignNow is the online electronic signature platform that assists you in navigating these challenges. It allows you to obtain your Hs302 and swiftly complete and sign it on-site without the need to reprint documents if you make an error.

The following steps will guide you in preparing your Hs302 with airSlate SignNow:

- Click the Get Form button to add your document to our editor immediately.

- Begin with the first blank field, enter your information, and proceed with the Next tool.

- Complete the empty fields with the Cross and Check tools from the top menu.

- Select the Highlight or Line features to emphasize the most important details.

- Click on Image and upload one if your Hs302 requires it.

- Use the right-side panel to add more fields for you or others to complete if necessary.

- Review your answers and finalize the form by clicking Date, Initials, and Sign.

- Create your eSignature by drawing, typing, uploading, or taking a picture with a camera or QR code.

- Conclude your editing process by clicking the Done button and choosing your file-sharing preferences.

Once your Hs302 is ready, you can distribute it as you prefer—send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely archive all your completed documents in your account, organized in folders according to your choice. Don’t spend time on manual form filling; explore airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct hs302 dual residents 2018 claim form claim as a non resident for relief from uk tax under the terms of a double taxation

Create this form in 5 minutes!

How to create an eSignature for the hs302 dual residents 2018 claim form claim as a non resident for relief from uk tax under the terms of a double taxation

How to make an eSignature for your Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation in the online mode

How to generate an electronic signature for the Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation in Chrome

How to make an eSignature for putting it on the Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation in Gmail

How to make an eSignature for the Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation right from your smartphone

How to generate an eSignature for the Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation on iOS

How to generate an eSignature for the Hs302 Dual Residents 2018 Claim Form Claim As A Non Resident For Relief From Uk Tax Under The Terms Of A Double Taxation on Android devices

People also ask

-

What is hs302 and how does it relate to airSlate SignNow?

hs302 is a key feature within airSlate SignNow that enables seamless electronic signatures. This feature allows users to create, send, and manage documents efficiently, streamlining the signing process while ensuring compliance and security.

-

How much does the hs302 feature cost with airSlate SignNow?

The hs302 feature is included in the various pricing plans offered by airSlate SignNow. Depending on the plan you choose, you can enjoy access to hs302 at a competitive price, making it a cost-effective solution for businesses of all sizes.

-

What are the main benefits of using hs302 in airSlate SignNow?

Using hs302 in airSlate SignNow provides numerous benefits, including enhanced productivity, reduced turnaround time for document signing, and improved document tracking. It empowers businesses to complete transactions faster and more securely.

-

Can I integrate hs302 with other applications?

Yes, hs302 supports integration with various applications, making it easy to incorporate into your existing workflows. This flexibility allows businesses to use airSlate SignNow alongside popular tools like Google Drive, Salesforce, and more.

-

Is the hs302 feature suitable for small businesses?

Absolutely! The hs302 feature is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and affordability make it an ideal choice for smaller organizations looking to optimize their document signing process.

-

How does hs302 ensure document security?

hs302 within airSlate SignNow employs industry-standard encryption and security protocols, protecting your documents during transmission. This level of security helps ensure that sensitive information remains confidential and secure.

-

What types of documents can I send using hs302?

With hs302, you can send a wide range of document types for electronic signatures, including contracts, agreements, and forms. This versatility makes it suitable for various industries and use cases.

Get more for Hs302

- Riversource 37856forms com

- Employee information sheet complete this form for each employee

- Form ls 201

- Application for a uk certificate of equivalent competency dft gov form

- Reset footprint form amended return select if fili

- Print forrest form amended return select if filing

- 1 gross proceeds from lottery this quarter from li form

- Get in te vullen door de kandidaat huurder verhuurder form

Find out other Hs302

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement