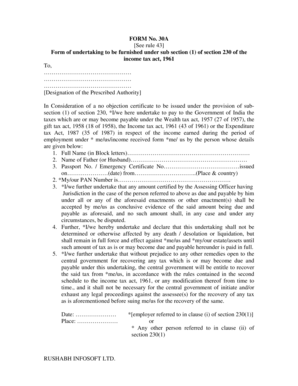

Form 30a of Income Tax Act

What is the Form 30a of Income Tax Act

The Form 30a of Income Tax Act is a crucial document used by taxpayers in the United States to report specific income details to the Internal Revenue Service (IRS). This form is primarily utilized for income tax purposes, allowing individuals and businesses to declare their earnings accurately. It plays a significant role in ensuring compliance with federal tax regulations and helps in the assessment of tax liabilities. Understanding the purpose and requirements of this form is essential for effective tax planning and reporting.

Steps to Complete the Form 30a of Income Tax Act

Completing the Form 30a of Income Tax Act involves several key steps to ensure accuracy and compliance. Follow these guidelines for a smooth process:

- Gather necessary financial documents, including income statements and receipts.

- Provide personal information, such as your name, address, and Social Security number.

- Report your total income from various sources, ensuring all figures are accurate.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your submission.

Legal Use of the Form 30a of Income Tax Act

The legal use of the Form 30a of Income Tax Act is governed by federal tax laws. When completed correctly, this form serves as a legally binding document that supports your income claims. It is essential to adhere to the guidelines set forth by the IRS to ensure that the form is accepted. The use of electronic signatures through platforms like signNow can enhance the legal standing of the document, provided that all necessary compliance measures are followed.

Filing Deadlines / Important Dates

Filing deadlines for the Form 30a of Income Tax Act are critical to avoid penalties and interest. Generally, individual taxpayers must submit their forms by April 15 each year. However, extensions may be available under specific circumstances. It is important to stay informed about any changes to deadlines, especially for businesses or individuals with unique tax situations. Marking these dates on your calendar can help ensure timely compliance.

Required Documents

When preparing to complete the Form 30a of Income Tax Act, several documents are necessary to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements and investment income records

- Previous year’s tax return for reference

Having these documents readily available can streamline the completion process and enhance accuracy.

Examples of Using the Form 30a of Income Tax Act

The Form 30a of Income Tax Act can be utilized in various scenarios, illustrating its versatility. For instance, a self-employed individual may use this form to report income from freelance work, while a small business owner might file it to declare earnings from services rendered. Additionally, individuals who have received unemployment benefits or rental income can also use this form to report their earnings accurately. Understanding these examples can help taxpayers recognize the importance of the form in their financial reporting.

Quick guide on how to complete form 30a of income tax act

Effortlessly prepare Form 30a Of Income Tax Act on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, edit, and eSign your documents without delays. Manage Form 30a Of Income Tax Act on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortless ways to edit and eSign Form 30a Of Income Tax Act

- Obtain Form 30a Of Income Tax Act and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Thoroughly review all the information and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Adjust and eSign Form 30a Of Income Tax Act to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 30a of income tax act

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is xform30a and how does it benefit my business?

xform30a is a leading electronic signature and document management solution provided by airSlate SignNow. It empowers businesses to streamline their document workflows, enhance collaboration, and improve efficiency. By adopting xform30a, organizations can reduce paper usage and accelerate transactions.

-

How much does xform30a cost?

The pricing for xform30a varies depending on the plan and features selected. airSlate SignNow offers flexible pricing tiers that cater to different business sizes and needs, ensuring a cost-effective solution. For more detailed pricing information, visit the airSlate SignNow website or contact their sales team.

-

What features are included with xform30a?

xform30a includes a variety of powerful features such as template customization, automated workflows, document tracking, and multi-user collaboration. It also provides advanced security options to ensure that your documents are safe and compliant. These features make xform30a an essential tool for any business looking to enhance its document management.

-

Can I integrate xform30a with other software?

Yes, xform30a offers seamless integrations with various popular software and applications, including CRM systems, project management tools, and cloud storage services. This allows businesses to optimize their workflow by connecting xform30a with the tools they already use. Check the integration options on the airSlate SignNow site for the full list.

-

Is xform30a user-friendly?

Absolutely! xform30a is designed with user-friendliness in mind, allowing users of all skill levels to navigate the platform easily. The intuitive interface and straightforward workflows mean that you can start sending and signing documents without extensive training. This simplicity is a major advantage for busy professionals.

-

What support options are available for xform30a users?

airSlate SignNow provides various support options for xform30a users, including comprehensive online resources, tutorials, and customer support via chat or email. They aim to ensure that you receive prompt assistance for any questions or issues you may encounter. This level of support enhances the overall user experience with xform30a.

-

How secure is the xform30a platform?

The security of your documents is a top priority with xform30a. The platform uses industry-leading encryption technology and complies with global security standards to safeguard your sensitive information. With xform30a, you can confidently manage and sign documents, knowing they are secure.

Get more for Form 30a Of Income Tax Act

- Aduana mexico online form

- Form la paf 0658

- Rental car loss damage waiver cdw insuranceavis rent form

- Archivio cartelle cliniche gemelli telefono form

- Correction application form

- Tus digital badge earner application and consent form

- Debeka formulare zum ausdrucken

- Novo nordisk patient assistance program form

Find out other Form 30a Of Income Tax Act

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document