Cte 50 2018

What is the CTE 50?

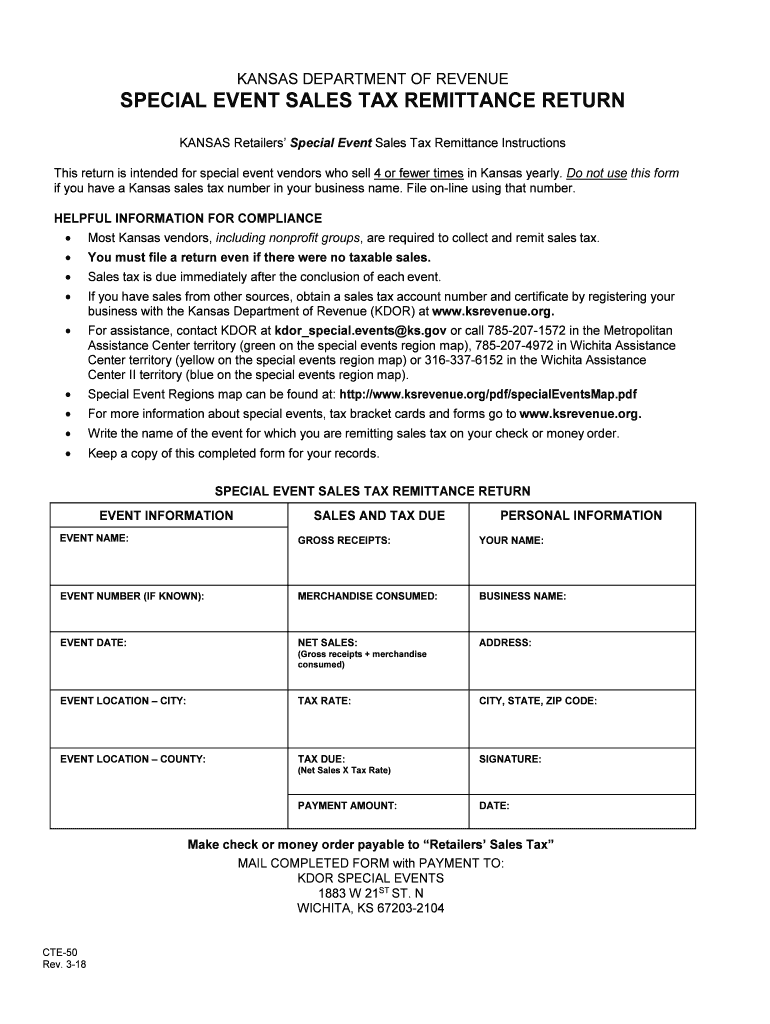

The CTE 50, or Kansas Event Form, is a specific document used for reporting certain events related to tax obligations in the state of Kansas. This form is crucial for individuals and businesses that need to comply with state tax regulations. It captures essential information regarding the taxpayer's activities, ensuring that all necessary data is submitted to the Kansas Department of Revenue. Understanding the purpose of the CTE 50 helps taxpayers navigate their responsibilities effectively.

How to Use the CTE 50

Using the CTE 50 involves several steps to ensure accurate completion and submission. First, gather all relevant information, including personal details, event specifics, and any supporting documentation. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once the form is filled, review it for any errors before submission. The CTE 50 can be submitted electronically or via traditional mail, depending on the preferences of the taxpayer and the requirements set by the Kansas Department of Revenue.

Steps to Complete the CTE 50

Completing the CTE 50 involves a systematic approach:

- Collect necessary documentation, including identification and event-related records.

- Access the CTE 50 form through the appropriate channels, ensuring you have the latest version.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Detail the event information, including dates, locations, and any relevant descriptions.

- Review the completed form for accuracy and completeness.

- Submit the form either electronically or by mailing it to the designated office.

Legal Use of the CTE 50

The CTE 50 is legally binding when completed and submitted in accordance with Kansas state law. To ensure its validity, it is essential to adhere to the guidelines set forth by the Kansas Department of Revenue. This includes using the correct form version, providing accurate information, and meeting submission deadlines. Failure to comply with these legal requirements may result in penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the CTE 50 can vary based on the specific event being reported. It is important for taxpayers to be aware of these dates to avoid penalties. Generally, the Kansas Department of Revenue provides a schedule of important dates related to tax filings, including the CTE 50. Keeping track of these deadlines ensures timely compliance with state tax obligations.

Form Submission Methods

The CTE 50 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the Kansas Department of Revenue's electronic filing system, which offers convenience and immediate confirmation of receipt. Alternatively, the form can be printed and mailed to the appropriate office. In-person submissions may also be possible at designated locations, depending on local regulations and office hours.

Quick guide on how to complete cte 50

Complete Cte 50 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without holdups. Manage Cte 50 on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Cte 50 with no hassle

- Locate Cte 50 and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Cte 50 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cte 50

Create this form in 5 minutes!

How to create an eSignature for the cte 50

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a Kansas event form, and why do I need it?

A Kansas event form is a customizable document used to manage event-related information in compliance with state regulations. By using a Kansas event form, businesses can streamline their event planning, ensuring that all necessary details are documented and signed efficiently.

-

How does airSlate SignNow facilitate the completion of a Kansas event form?

airSlate SignNow provides an intuitive platform that allows you to create, send, and eSign Kansas event forms with ease. Our user-friendly interface simplifies the document management process, ensuring that your forms are completed quickly and accurately.

-

Are there any costs associated with using airSlate SignNow for a Kansas event form?

airSlate SignNow offers flexible pricing plans that cater to various business needs when using a Kansas event form. Each plan provides a cost-effective solution with access to all essential features required to manage your event documents efficiently.

-

What features does airSlate SignNow offer for Kansas event forms?

With airSlate SignNow, you get features like customizable templates, secure eSigning, workflow automation, and cloud storage to simplify managing your Kansas event forms. These tools ensure that your documentation process is efficient, secure, and compliant with legal standards.

-

Can I integrate airSlate SignNow with other applications for processing a Kansas event form?

Yes, airSlate SignNow allows seamless integrations with popular tools like Google Drive, Salesforce, and various CRMs. This ensures that managing your Kansas event forms is streamlined across multiple platforms, enhancing productivity and collaboration.

-

How can airSlate SignNow improve the efficiency of handling Kansas event forms?

By automating document workflows and enabling electronic signatures, airSlate SignNow signNowly reduces the time spent on manually managing Kansas event forms. Businesses can easily track the status of their forms, minimizing errors and enhancing overall efficiency.

-

Is there customer support available for using Kansas event forms with airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or challenges they may face while handling Kansas event forms. Our support team is available through various channels, ensuring you always have the help you need.

Get more for Cte 50

Find out other Cte 50

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF