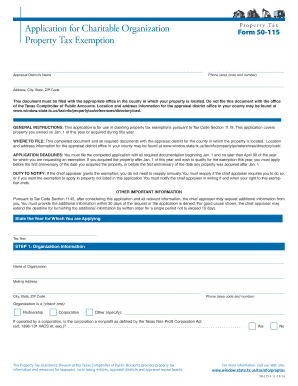

50 115 2013

What is the 50 115

The 50 115 form is a specific document used primarily for reporting certain financial information to the IRS. It is often utilized by businesses and individuals to disclose income, deductions, or other tax-related information. Understanding the purpose of the 50 115 is crucial for compliance with U.S. tax laws and regulations.

How to use the 50 115

Using the 50 115 form involves several steps to ensure accurate reporting. First, gather all necessary financial records that pertain to the information you need to report. This may include income statements, receipts for deductions, and any other relevant documentation. Next, fill out the form carefully, ensuring all sections are completed with accurate information. Finally, submit the form to the IRS by the designated deadline to avoid any penalties.

Steps to complete the 50 115

Completing the 50 115 form requires a systematic approach:

- Step 1: Collect all relevant financial documents.

- Step 2: Carefully read the instructions provided with the form.

- Step 3: Fill out each section of the form, ensuring accuracy.

- Step 4: Review the completed form for any errors or omissions.

- Step 5: Submit the form to the IRS by the specified deadline.

Legal use of the 50 115

The legal use of the 50 115 form is governed by IRS regulations. It is essential to ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed in accordance with the IRS guidelines to maintain compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 50 115 form can vary based on the type of filer and the specific tax year. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. Businesses may have different deadlines depending on their fiscal year. It is important to stay informed about these dates to ensure timely submission.

Who Issues the Form

The 50 115 form is issued by the Internal Revenue Service (IRS). As the federal agency responsible for tax collection and enforcement, the IRS provides the necessary forms for taxpayers to report their financial information accurately. It is essential to obtain the most current version of the form directly from the IRS to ensure compliance with any updates or changes.

Quick guide on how to complete 50 115

Effortlessly Prepare 50 115 on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the required form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle 50 115 on any device with airSlate SignNow Android or iOS applications and simplify your document-oriented processes today.

The Easiest Way to Edit and Electronically Sign 50 115 with Ease

- Locate 50 115 and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 50 115 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 50 115

Create this form in 5 minutes!

How to create an eSignature for the 50 115

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 50 115 and how is it used?

Form 50 115 is a specific document that can be used for various business transactions. With airSlate SignNow, you can easily create, send, and eSign form 50 115, streamlining the entire process. Our platform ensures that your documents are legally binding and securely stored, enhancing your workflow efficiency.

-

How much does it cost to use airSlate SignNow for form 50 115?

The pricing for airSlate SignNow is competitive and depends on the plan you select. This allows businesses to choose a cost-effective solution that meets their needs, whether they are frequently using form 50 115 or just occasionally. We offer various subscription options to provide flexibility in your usage.

-

What are the key features of airSlate SignNow for creating form 50 115?

AirSlate SignNow offers a user-friendly interface for creating form 50 115, along with features such as customizable templates, real-time tracking, and secure cloud storage. These features help ensure that your document workflow is efficient and organized. Additionally, electronic signatures on form 50 115 are legally valid, saving you time and resources.

-

Can I integrate airSlate SignNow with other software for form 50 115?

Yes, airSlate SignNow supports integration with various third-party applications, making it easier to manage form 50 115 alongside your existing tools. This interoperability allows for seamless data transfer and enhanced functionality within your business systems. Whether you use CRM or other document management software, integrations can simplify your processes.

-

What benefits does airSlate SignNow provide for businesses using form 50 115?

Using airSlate SignNow for form 50 115 offers numerous benefits, including faster turnaround times, reduced paper usage, and improved organization. Electronic signatures save you the hassle of printing and scanning, while our template features make it easy to reuse your documents. These enhancements contribute to a more efficient, cost-effective operation.

-

Is airSlate SignNow compliant with regulations for form 50 115?

Absolutely! airSlate SignNow is compliant with eSignature laws and regulations, ensuring that your form 50 115 is legally valid and secure. We've implemented industry-standard security measures to protect your data and maintain compliance, so you can confidently use our platform for all your signing needs.

-

How does airSlate SignNow improve collaboration on form 50 115?

AirSlate SignNow enhances collaboration on form 50 115 by allowing multiple users to review, comment, and sign documents in real-time. This feature is particularly useful for teams that need to work together efficiently, ensuring everyone has access to the latest version of your form. Enhanced collaboration leads to faster decision-making and approvals.

Get more for 50 115

- Workers comp form 100

- Sample documentation a skin lesion form

- Irs form1915

- Authorization to view electronic patient information

- How to set up direct deposit form

- Session documentation form post this form

- Completed form should be returned to the employer and retained for the employers records

- Seiu 1107 form

Find out other 50 115

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT