Printable Abn Form for Commercial Insurance

What is the Printable ABN Form for Commercial Insurance

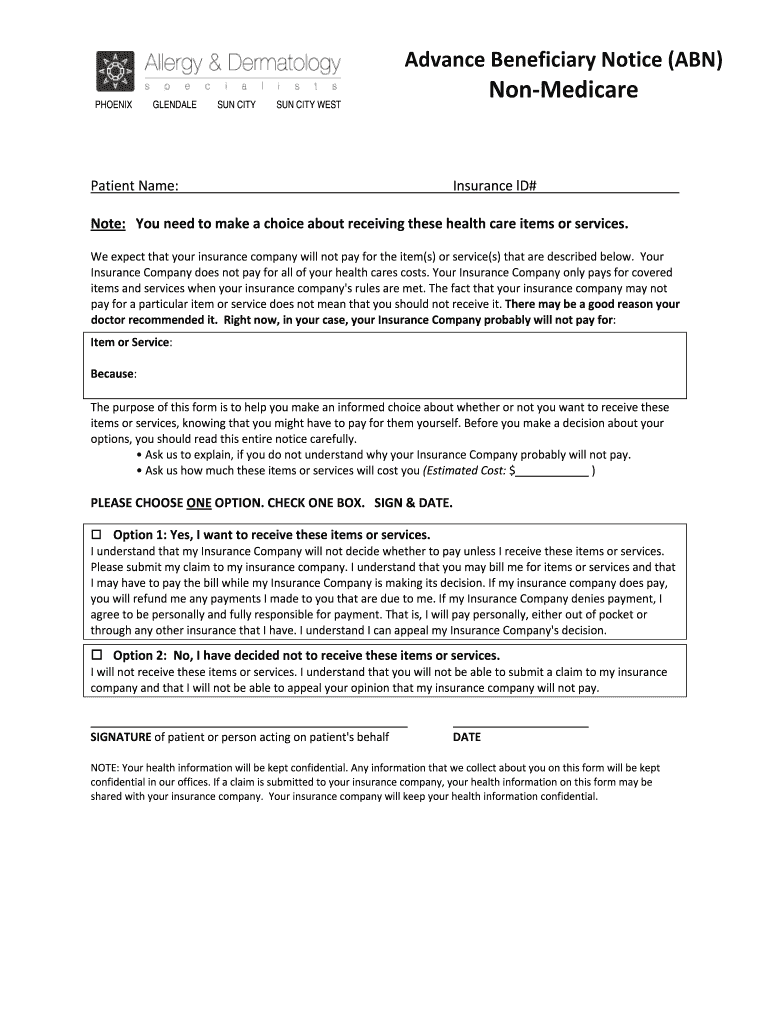

The Printable ABN form for commercial insurance is a crucial document that allows healthcare providers to inform patients about their financial responsibilities when services are not covered by Medicare. This form serves as a notification to patients, ensuring they understand that they may be liable for costs associated with their care. It is particularly relevant for non-Medicare patients, who may receive services that do not fall under traditional Medicare guidelines. By using this form, healthcare providers can maintain transparency and compliance with legal requirements.

How to Use the Printable ABN Form for Commercial Insurance

Using the Printable ABN form for commercial insurance involves several straightforward steps. First, healthcare providers must download the form from a reliable source. Next, they should fill in the necessary details, including patient information, the specific services provided, and the reason for non-coverage. After completing the form, it should be presented to the patient for review and signature. This process ensures that patients are fully informed about their financial obligations before receiving care.

Steps to Complete the Printable ABN Form for Commercial Insurance

Completing the Printable ABN form for commercial insurance requires careful attention to detail. Follow these steps for accurate completion:

- Download the form from a trusted source.

- Enter the patient's name and contact information.

- Specify the services that may not be covered by Medicare.

- Provide a clear explanation of why these services are not covered.

- Include any relevant billing codes or identifiers.

- Have the patient sign and date the form to acknowledge their understanding.

Once completed, retain a copy for your records and provide one to the patient.

Legal Use of the Printable ABN Form for Commercial Insurance

The legal use of the Printable ABN form for commercial insurance is essential for compliance with federal regulations. This form must be used when a provider believes that a service may not be covered by Medicare. By obtaining the patient's signature, the provider protects themselves from potential disputes regarding payment. It's important to ensure that the form is filled out correctly and that patients are given adequate information regarding their financial responsibilities. This adherence to legal standards helps maintain trust between providers and patients.

Key Elements of the Printable ABN Form for Commercial Insurance

The Printable ABN form for commercial insurance includes several key elements that must be clearly articulated:

- Patient Information: Name, address, and contact details.

- Service Description: Specific services that may not be covered.

- Reason for Non-Coverage: Explanation of why the services are not covered by Medicare.

- Patient Acknowledgment: Signature and date from the patient confirming their understanding.

These elements ensure that the form is comprehensive and legally binding.

Who Issues the Form

The Printable ABN form for commercial insurance is typically issued by healthcare providers, including hospitals, clinics, and private practices. These entities are responsible for providing the form to patients when they anticipate that certain services may not be covered by Medicare. It is crucial for providers to ensure that they are using the most up-to-date version of the form to comply with current regulations.

Quick guide on how to complete abn non medicare form

The optimal method to acquire and endorse Printable Abn Form For Commercial Insurance

At the level of an entire organization, ineffective workflows related to document approval can consume a signNow amount of working hours. Endorsing documents like Printable Abn Form For Commercial Insurance is a routine aspect of operations in any sector, which is why the effectiveness of each agreement’s lifecycle is crucial to the organization's overall productivity. With airSlate SignNow, endorsing your Printable Abn Form For Commercial Insurance can be as simple and swift as possible. You will discover with this platform the latest version of almost any form. Even better, you can endorse it instantly without the necessity of installing external software on your device or printing anything as physical copies.

Steps to acquire and endorse your Printable Abn Form For Commercial Insurance

- Browse our library by category or utilize the search bar to locate the form you require.

- View the form preview by clicking on Learn more to ensure it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and include any necessary details using the toolbar.

- Once finished, click the Sign tool to endorse your Printable Abn Form For Commercial Insurance.

- Select the signature option that is most suitable for you: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options as required.

With airSlate SignNow, you have everything you need to handle your documents efficiently. You can find, fill out, edit, and even send your Printable Abn Form For Commercial Insurance in a single tab without any difficulty. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

-

How do I find out whether I belong to the OBC creamy or non-creamy layer while filling out a form?

Please go to the caste census of 2011 to find out whether you are a backward caste . Then find out from the website of Backward Classes Commission whether you fall in OBC list .Having found that , the criteria is as under -You will be in non-creamy layer if your parents’ total annual income is not more than Rs.8 lakh . Your own income , if any , is not included . Any agricultural income of your parents is also not included .

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the abn non medicare form

How to make an eSignature for your Abn Non Medicare Form in the online mode

How to make an electronic signature for the Abn Non Medicare Form in Chrome

How to make an eSignature for putting it on the Abn Non Medicare Form in Gmail

How to generate an eSignature for the Abn Non Medicare Form from your smart phone

How to create an electronic signature for the Abn Non Medicare Form on iOS

How to create an electronic signature for the Abn Non Medicare Form on Android devices

People also ask

-

What is the Printable Abn Form For Commercial Insurance?

The Printable Abn Form For Commercial Insurance is a crucial document that enables businesses to register for an Australian Business Number (ABN) specifically for commercial insurance purposes. This form simplifies the process of obtaining insurance coverage for businesses operating in Australia, ensuring compliance with local regulations.

-

How can I obtain the Printable Abn Form For Commercial Insurance?

You can easily obtain the Printable Abn Form For Commercial Insurance through our platform, airSlate SignNow. Our solution allows you to download the form, fill it out electronically, and eSign it, streamlining the process of acquiring your ABN for commercial insurance.

-

Is there a cost associated with the Printable Abn Form For Commercial Insurance?

Using airSlate SignNow to access the Printable Abn Form For Commercial Insurance is cost-effective. We offer flexible pricing plans that cater to different business needs, ensuring you get the best value while managing your document signing and insurance requirements.

-

What features does airSlate SignNow offer for the Printable Abn Form For Commercial Insurance?

airSlate SignNow provides features such as easy document editing, electronic signatures, and secure cloud storage for your Printable Abn Form For Commercial Insurance. These features enhance collaboration and ensure that your documents are easily accessible and compliant with legal standards.

-

Can I customize the Printable Abn Form For Commercial Insurance?

Yes, airSlate SignNow allows you to customize the Printable Abn Form For Commercial Insurance according to your business requirements. You can add your logo, modify fields, and ensure that the form aligns with your branding while maintaining its essential legal components.

-

How does eSigning the Printable Abn Form For Commercial Insurance work?

eSigning the Printable Abn Form For Commercial Insurance with airSlate SignNow is straightforward. After filling out the form, you can invite your signers to eSign it electronically, ensuring a fast and secure signing process that eliminates the need for printing and scanning.

-

What are the benefits of using airSlate SignNow for the Printable Abn Form For Commercial Insurance?

Using airSlate SignNow for the Printable Abn Form For Commercial Insurance offers multiple benefits, including efficiency, cost savings, and enhanced security. Our platform simplifies the documentation process, allowing you to focus on your business while ensuring your insurance paperwork is handled correctly.

Get more for Printable Abn Form For Commercial Insurance

Find out other Printable Abn Form For Commercial Insurance

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document