Business Tax Receipt Collier County 2010

What is the Business Tax Receipt Collier County

The Business Tax Receipt Collier County is a legal document that allows businesses to operate within Collier County, Florida. This receipt serves as proof that a business has registered with the local government and has met all necessary requirements to conduct business activities. It is essential for compliance with local regulations and provides legitimacy to the business operations. Without this receipt, businesses may face penalties or be prohibited from operating legally.

How to Obtain the Business Tax Receipt Collier County

To obtain the Business Tax Receipt Collier County, businesses must complete an application process that typically involves several steps. First, applicants need to gather necessary documentation, which may include proof of identity, business registration details, and any relevant licenses. Next, the completed application form must be submitted to the appropriate county office, either online or in person. Upon review and approval, the county will issue the business tax receipt, allowing the business to operate legally.

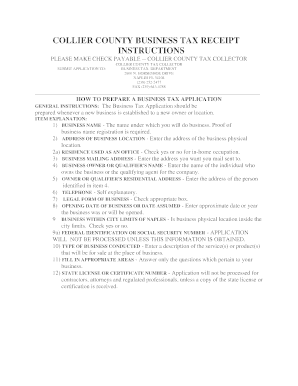

Steps to Complete the Business Tax Receipt Collier County

Completing the Business Tax Receipt Collier County involves a series of steps to ensure all requirements are met. Start by filling out the application form accurately, providing all requested information. Next, attach any required documents, such as identification and proof of business registration. Once the application is complete, submit it to the designated county office. After submission, keep track of the application status and be prepared to respond to any requests for additional information from county officials.

Legal Use of the Business Tax Receipt Collier County

The Business Tax Receipt Collier County is legally binding and must be displayed prominently at the business location. This document verifies that the business complies with local laws and regulations, thus protecting both the business owner and the consumers. It is crucial for businesses to renew their receipts annually to maintain legal standing and avoid penalties. Failure to display a valid receipt can result in fines or other legal repercussions.

Required Documents

When applying for the Business Tax Receipt Collier County, several documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID

- Business registration documents

- Any applicable licenses or permits specific to the business type

- Tax identification number (TIN) or Employer Identification Number (EIN)

Ensuring that all documents are accurate and up-to-date is essential for a smooth application process.

Form Submission Methods

The Business Tax Receipt Collier County can be submitted through various methods, depending on the preferences of the applicant and the county's regulations. Common submission methods include:

- Online submission through the county's official website

- Mailing the completed application to the designated county office

- In-person submission at the county office during business hours

Choosing the most convenient method can help streamline the application process and reduce delays.

Quick guide on how to complete business tax receipt collier county

Effortlessly Prepare Business Tax Receipt Collier County on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly and without issues. Manage Business Tax Receipt Collier County on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to alter and eSign Business Tax Receipt Collier County with minimal effort

- Obtain Business Tax Receipt Collier County and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Modify and eSign Business Tax Receipt Collier County and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax receipt collier county

Create this form in 5 minutes!

How to create an eSignature for the business tax receipt collier county

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Collier County business tax receipt?

A Collier County business tax receipt is a permit issued by the local government that allows businesses to operate legally in the area. This receipt is essential for ensuring compliance with local regulations and tax obligations. Obtaining this receipt is a crucial step for new and existing businesses in Collier County.

-

How do I apply for a Collier County business tax receipt?

To apply for a Collier County business tax receipt, you must complete the application through the Collier County Tax Collector's office. This can typically be done online, where you will provide necessary documentation about your business. Once your application is approved, you will receive your business tax receipt promptly.

-

What are the fees associated with a Collier County business tax receipt?

Fees for a Collier County business tax receipt can vary based on business type and size. Typically, the cost is determined by the gross revenue of the business and the specific licensing requirements. It's important to check the Collier County Tax Collector’s website for the most up-to-date fee structure.

-

How long is a Collier County business tax receipt valid?

A Collier County business tax receipt is usually valid for one year, after which it must be renewed. Renewal is important as it ensures that your business remains compliant with local laws and regulations. Make sure to keep track of your receipt’s expiration date to avoid any penalties.

-

Can I use airSlate SignNow to manage my Collier County business tax receipt?

Yes, airSlate SignNow provides an effective way to manage your Collier County business tax receipt digitally. Our platform allows you to eSign and send documents securely, streamlining the process of maintaining and renewing necessary permits. This can save you time and enhance your business's organization.

-

What features does airSlate SignNow offer for managing documents like the Collier County business tax receipt?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are ideal for managing important documents like the Collier County business tax receipt. These features help you ensure compliance and keep your business organized. Integration with other tools also enables efficient document management.

-

How does airSlate SignNow integrate with other business systems?

airSlate SignNow seamlessly integrates with various business systems, including CRM, project management tools, and cloud storage services. This enables you to manage processes related to your Collier County business tax receipt within your existing workflows. These integrations can enhance productivity and streamline your operations.

Get more for Business Tax Receipt Collier County

- Mvp healthplan fax in admission notification form

- Acct columbia rheumatology derek j columbiarheumatology form

- Wound care and hyperbaric medicine hyperbaric monoplace support providencehospital form

- Pathfinder health record form

- Written assessment care plan and recommendations outline for older adult assessment form

- Impella flow sheet form

- Diabetic foot exam documentation form

- Rex hospital medical records form

Find out other Business Tax Receipt Collier County

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation