Oklahoma Form 901

What is the Oklahoma Form 901

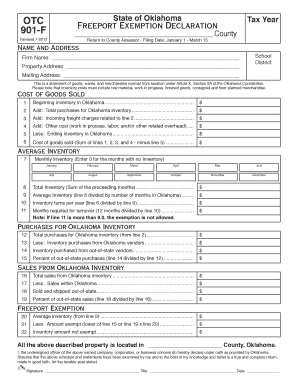

The Oklahoma Form 901 is a crucial document used for various administrative purposes within the state of Oklahoma. It is often related to tax filings or compliance requirements, serving as a formal declaration or request for specific actions. Understanding the purpose and function of this form is essential for individuals and businesses to ensure compliance with state regulations.

How to use the Oklahoma Form 901

Using the Oklahoma Form 901 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including personal identification details and any relevant financial data. Next, fill out the form carefully, ensuring that all fields are completed as required. Once the form is filled, it can be submitted through the designated channels, which may include online submission, mailing, or in-person delivery, depending on the specific requirements outlined by the issuing authority.

Steps to complete the Oklahoma Form 901

Completing the Oklahoma Form 901 requires attention to detail. Follow these steps for successful completion:

- Read the instructions carefully to understand the requirements.

- Gather all necessary documents and information needed for the form.

- Fill out the form accurately, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method as specified in the guidelines.

Legal use of the Oklahoma Form 901

The legal use of the Oklahoma Form 901 is governed by state regulations. For the form to be considered valid, it must be completed accurately and submitted within the specified timeframes. Additionally, the information provided must be truthful and verifiable, as any discrepancies could lead to legal repercussions or penalties. It is important to familiarize oneself with the relevant laws and regulations to ensure compliance.

Key elements of the Oklahoma Form 901

Key elements of the Oklahoma Form 901 include personal identification information, financial details, and any required signatures. Each section of the form is designed to capture specific information necessary for processing. Ensuring that all key elements are accurately filled out is vital for the acceptance of the form by the relevant authorities.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Form 901 can be submitted through various methods, depending on the preferences of the filer and the requirements set forth by the issuing agency. Common submission methods include:

- Online: Many agencies provide an online portal for electronic submission.

- Mail: The form can be printed and mailed to the appropriate address.

- In-Person: Filers may have the option to deliver the form in person at designated offices.

Quick guide on how to complete oklahoma form 901

Complete Oklahoma Form 901 seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct forms and store them securely online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and without complications. Manage Oklahoma Form 901 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The most efficient way to modify and electronically sign Oklahoma Form 901 effortlessly

- Acquire Oklahoma Form 901 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your method of delivering the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Oklahoma Form 901 while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 901

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 901 and how can I use it with airSlate SignNow?

Form 901 is a specific document format that airSlate SignNow allows you to easily fill out and eSign. With our platform, you can upload, edit, and share your Form 901 to streamline your workflow. Our intuitive interface ensures that completing Form 901 is straightforward, even for new users.

-

What features does airSlate SignNow offer for managing Form 901?

airSlate SignNow provides a variety of features specifically designed to enhance the management of Form 901. You can customize the form, add fields for signatures, and track its status in real-time. Additionally, templates can be saved for repeated use of Form 901, making it even easier for your business.

-

How much does it cost to use airSlate SignNow for Form 901?

Pricing for airSlate SignNow varies based on the plan but is designed to be cost-effective for businesses of all sizes. Each plan includes features that make managing Form 901 affordable and efficient. We also offer a free trial so you can experience the benefits before committing.

-

Can I integrate airSlate SignNow with other software to manage Form 901?

Yes, airSlate SignNow seamlessly integrates with numerous platforms to manage Form 901 more effectively. You can connect it with CRM systems, payment processors, and cloud storage services to optimize your workflow. This integration capability enhances your ability to handle Form 901 and other business documents.

-

What are the benefits of using airSlate SignNow for Form 901?

Using airSlate SignNow for Form 901 offers numerous benefits, including increased efficiency, improved accuracy, and better document security. By enabling eSigning, you eliminate the delay of physical signatures, allowing faster processing of your Form 901. Additionally, your documents are stored securely, giving you peace of mind.

-

How does airSlate SignNow ensure the security of my Form 901?

airSlate SignNow takes document security seriously, offering features such as encryption and secure cloud storage for your Form 901. We ensure that all eSigned documents comply with industry standards to protect your sensitive information. Our platform is built to keep your data safe every step of the way.

-

Is it easy to track the status of my Form 901 in airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly dashboard that allows you to track the status of your Form 901 in real-time. You will receive notifications when it's opened, signed, or completed, ensuring you are always in the loop. This transparency helps in managing deadlines effectively.

Get more for Oklahoma Form 901

- Appreciated securities transfer giving to stanford form

- Online and mobile business banking application ampamp terms and form

- Mobile phone coverage claim form

- Human achievement quotient haq assessment cityofchicago form

- Request for waiver of bfa sdsu form

- 1728a form

- Long term camps form

- Creative curriculum weekly planning form template 12790400

Find out other Oklahoma Form 901

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT