Virginia Offer in Compromise Business Form

What is the Virginia Offer In Compromise Business Form

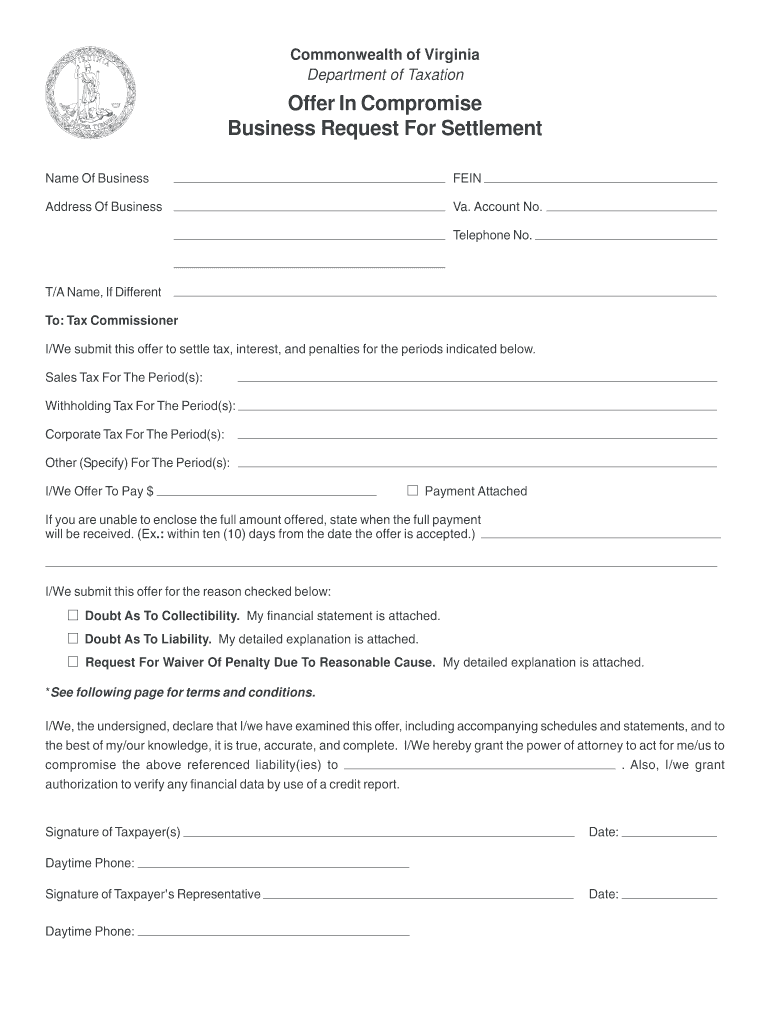

The Virginia Offer In Compromise Business Form is a legal document that allows businesses to settle tax debts for less than the total amount owed. This form is specifically designed for businesses facing financial difficulties and seeking relief from their tax obligations. By submitting this form, a business can propose a reduced payment to the Virginia Department of Taxation, which may accept the offer if it meets certain criteria. This process can provide significant financial relief and help businesses regain stability.

How to use the Virginia Offer In Compromise Business Form

Using the Virginia Offer In Compromise Business Form involves several steps. First, businesses must assess their financial situation to determine if they qualify for an offer in compromise. Next, they should gather all necessary financial documents, including income statements, balance sheets, and tax returns. Once the financial information is compiled, businesses can fill out the form accurately, ensuring all details are complete and truthful. After completing the form, it should be submitted to the Virginia Department of Taxation along with any required supporting documentation.

Steps to complete the Virginia Offer In Compromise Business Form

Completing the Virginia Offer In Compromise Business Form requires careful attention to detail. Follow these steps for successful submission:

- Gather financial documentation, including tax returns, income statements, and expenses.

- Assess eligibility by reviewing the criteria set by the Virginia Department of Taxation.

- Fill out the form accurately, providing all requested information about the business and its financial status.

- Calculate the proposed offer amount based on the business’s ability to pay.

- Review the form for accuracy and completeness before submission.

- Submit the form along with any required documents to the appropriate address.

Eligibility Criteria

To qualify for the Virginia Offer In Compromise Business Form, businesses must meet specific eligibility criteria. Generally, the business should demonstrate an inability to pay the full tax liability due to financial hardship. Factors considered include the business's income, expenses, assets, and liabilities. Additionally, the business must be compliant with all filing and payment requirements for the previous tax periods. Understanding these criteria is essential for businesses to determine their chances of acceptance.

Required Documents

Submitting the Virginia Offer In Compromise Business Form requires several supporting documents to substantiate the claim. Key documents include:

- Financial statements, such as profit and loss statements and balance sheets.

- Tax returns for the past three years.

- Documentation of any outstanding debts or liabilities.

- Proof of income, including pay stubs or bank statements.

- Any additional documentation that supports the claim of financial hardship.

Form Submission Methods

The Virginia Offer In Compromise Business Form can be submitted through various methods. Businesses may choose to submit the form online via the Virginia Department of Taxation's website, ensuring a quicker processing time. Alternatively, the form can be mailed to the appropriate address provided by the department. In some cases, businesses may also opt to deliver the form in person. Each submission method has its own processing timelines, so businesses should choose the one that best suits their needs.

Quick guide on how to complete virginia offer in compromise business form

Complete Virginia Offer In Compromise Business Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Handle Virginia Offer In Compromise Business Form on any device using airSlate SignNow’s Android or iOS applications and streamline your document-centric tasks today.

The easiest way to modify and electronically sign Virginia Offer In Compromise Business Form seamlessly

- Obtain Virginia Offer In Compromise Business Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with the specialized tools that airSlate SignNow provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to share your form, either via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced paperwork, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Virginia Offer In Compromise Business Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

What forms should I fill out to start a business?

From a legal business entity standpoint, one does not normally have to file any forms with the state the business is located in to be considered a sole proprietor (SP). However, this highly unadvisable since a SP provides no liability protection.The most popular, and most advisable business entities are a Limited Liability Company (LLC) and a Corporation. These entities are state created entities meaning that you must file the necessary paperwork in the state where you will have the business headquarters. The state’s secretary of state’s office will have all the necessary documents, forms, and rules needed to create the entity of your choice. You will also have to pay a filing fee.It is important that you further discuss the issue with experienced counsel as they will be able to help you decide which entity is best for you, and help you with the filing.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

Create this form in 5 minutes!

How to create an eSignature for the virginia offer in compromise business form

How to create an eSignature for the Virginia Offer In Compromise Business Form in the online mode

How to generate an electronic signature for your Virginia Offer In Compromise Business Form in Google Chrome

How to generate an electronic signature for signing the Virginia Offer In Compromise Business Form in Gmail

How to generate an electronic signature for the Virginia Offer In Compromise Business Form right from your smart phone

How to generate an electronic signature for the Virginia Offer In Compromise Business Form on iOS devices

How to generate an eSignature for the Virginia Offer In Compromise Business Form on Android OS

People also ask

-

What is the Virginia Offer In Compromise Business Form?

The Virginia Offer In Compromise Business Form is a legal document that allows businesses in Virginia to settle outstanding tax liabilities with the state for less than the full amount owed. This form is essential for businesses looking to resolve tax debts efficiently while minimizing financial strain. Using airSlate SignNow, you can easily complete and eSign this form to streamline the process.

-

How can airSlate SignNow help me with the Virginia Offer In Compromise Business Form?

airSlate SignNow provides an intuitive platform that allows businesses to fill out, sign, and send the Virginia Offer In Compromise Business Form quickly and securely. Our user-friendly interface ensures that you can navigate through the form without hassle, making the submission process straightforward and efficient.

-

What are the pricing options for using airSlate SignNow for the Virginia Offer In Compromise Business Form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions that provide access to features for managing the Virginia Offer In Compromise Business Form and other document needs. Visit our pricing page for detailed information and to find a plan that suits your business.

-

Are there any features specific to the Virginia Offer In Compromise Business Form on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed to enhance the management of the Virginia Offer In Compromise Business Form. These features include customizable templates, secure eSigning options, and document tracking to ensure that your submissions are handled efficiently and securely.

-

Is my information secure when I use the Virginia Offer In Compromise Business Form on airSlate SignNow?

Absolutely! When you use the Virginia Offer In Compromise Business Form on airSlate SignNow, your information is protected with advanced encryption and security protocols. We prioritize the confidentiality and integrity of your data, ensuring that your sensitive business information remains safe throughout the eSigning process.

-

Can I integrate airSlate SignNow with other software for handling the Virginia Offer In Compromise Business Form?

Yes, airSlate SignNow offers seamless integrations with various business applications to enhance your workflow. You can easily integrate with CRM systems, cloud storage, and other tools, allowing you to manage the Virginia Offer In Compromise Business Form and related documents efficiently within your existing systems.

-

What are the benefits of using airSlate SignNow for the Virginia Offer In Compromise Business Form?

Using airSlate SignNow for the Virginia Offer In Compromise Business Form streamlines the document preparation and signing process, saving you time and reducing stress. With features like automated reminders, templates, and secure eSigning, you can focus on your business while ensuring compliance with state requirements.

Get more for Virginia Offer In Compromise Business Form

Find out other Virginia Offer In Compromise Business Form

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple