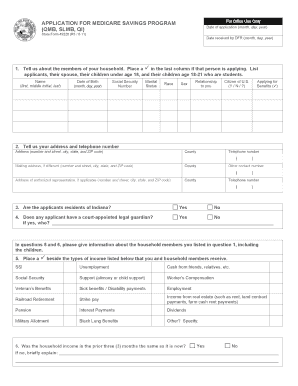

Medicare Savings Application Form

What is the Medicare Savings Application

The Medicare Savings Application is a form that allows eligible individuals to apply for assistance with their Medicare costs. This program helps cover premiums, deductibles, and co-payments associated with Medicare. By completing the application, individuals can determine their eligibility for various savings programs, ensuring they receive the financial support necessary for their healthcare needs.

Steps to complete the Medicare Savings Application

Completing the Medicare Savings Application involves several key steps:

- Gather necessary information, including personal identification details and financial information.

- Download the Medicare Savings Program application PDF from a reliable source.

- Fill out the application form carefully, ensuring all required fields are completed accurately.

- Review the application for any errors or missing information.

- Submit the completed application via the preferred method: online, by mail, or in person.

How to obtain the Medicare Savings Application

The Medicare Savings Application can be obtained through various channels. Individuals can access the application PDF online through government websites or local health department offices. Additionally, some community organizations may provide physical copies of the application to assist those who may not have internet access.

Eligibility Criteria

Eligibility for the Medicare Savings Program typically depends on several factors, including income and asset limits. Generally, individuals must meet specific income thresholds that vary by state. It is important to review these criteria to determine if one qualifies for assistance. Those who are eligible can significantly reduce their out-of-pocket healthcare costs.

Required Documents

When filling out the Medicare Savings Application, certain documents are required to verify eligibility. Commonly needed documents include:

- Proof of income, such as pay stubs or tax returns.

- Social Security number or Medicare number.

- Bank statements or asset documentation.

- Identification, such as a driver's license or state ID.

Form Submission Methods

Applicants can submit the Medicare Savings Application through various methods. Options typically include:

- Online submission through designated state or federal websites.

- Mailing the completed application to the appropriate local or state office.

- In-person submission at local health department offices or community organizations.

Legal use of the Medicare Savings Application

The Medicare Savings Application is legally binding when completed and submitted according to the established guidelines. It is essential to ensure that all information provided is accurate and truthful to avoid potential legal issues. Utilizing a reliable platform for electronic submission can enhance the legitimacy of the application process.

Quick guide on how to complete medicare savings application

Complete Medicare Savings Application effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Medicare Savings Application on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to edit and electronically sign Medicare Savings Application with ease

- Find Medicare Savings Application and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark signNow areas of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Medicare Savings Application and ensure excellent communication at any step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the medicare savings application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Medicare savings program application PDF?

The Medicare savings program application PDF is a form that allows eligible individuals to apply for financial assistance with their Medicare costs. This application helps beneficiaries reduce their out-of-pocket expenses, ensuring they receive the necessary medical care without financial strain.

-

How can I obtain the Medicare savings program application PDF?

You can obtain the Medicare savings program application PDF from the official Medicare website or various state health department sites. Additionally, airSlate SignNow can provide easy access to this document, enabling you to download and fill it out seamlessly.

-

Is there a cost associated with the Medicare savings program application PDF?

There is no cost to obtain the Medicare savings program application PDF, as it is provided for free by Medicare and state agencies. However, utilizing airSlate SignNow for electronic signing and submission may involve minimal fees, offering a convenient solution for users.

-

What features does airSlate SignNow offer for the Medicare savings program application PDF?

airSlate SignNow enables you to fill out, eSign, and securely share the Medicare savings program application PDF in a digital format. The platform is user-friendly, ensuring that you can complete your application quickly and efficiently from any device.

-

What are the benefits of applying with the Medicare savings program application PDF through airSlate SignNow?

Using airSlate SignNow to apply with the Medicare savings program application PDF streamlines the process, making it faster and more efficient. You can conveniently sign documents electronically, track your application status, and receive notifications, ensuring you never miss important updates.

-

Can I integrate airSlate SignNow with other applications for the Medicare savings program application PDF?

Yes, airSlate SignNow supports integrations with various applications and services, allowing you to seamlessly manage your documents and workflows. This compatibility ensures that you can efficiently handle the Medicare savings program application PDF alongside other tools you may be using.

-

How long does it take to process the Medicare savings program application PDF?

The processing time for the Medicare savings program application PDF can vary depending on your state and specific circumstances. Typically, applicants can expect to receive a response within 30 days after submission, but airSlate SignNow helps you track the status for peace of mind.

Get more for Medicare Savings Application

- Department of pediatrics apc and allied health professionals off boarding checklist form

- Pdf english file pre intermediate students book answer form

- Occupational health enrollment form uh

- Myuhid form

- Ub parent family orientation waiver form parent and family orientation waiver form

- Images for what need to knowtasf20myuh iduniversity of houston tasfa reference guide 20192020be sure to complete all sections form

- Igetc_02 03 napa valley college napavalley form

- Non custodial parents form us domestic 2020 21 academic year non custodial parents form

Find out other Medicare Savings Application

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage