Hotel and Motel Remittance BFormb Suffolk County Suffolkcountyny

What is the New York Remittance?

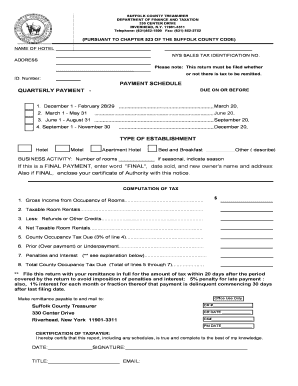

The New York remittance is a specific form used by businesses in New York to report and remit taxes related to hotel and motel occupancy. This form is essential for ensuring compliance with state tax regulations, allowing establishments to accurately report their earnings from lodging services. The remittance process helps maintain transparency and accountability in the hospitality industry.

Steps to Complete the New York Remittance

Completing the New York remittance involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records related to your hotel or motel operations. This includes occupancy rates, total revenue, and any applicable deductions. Next, fill out the remittance form, ensuring that all figures are accurate and reflect your business activities for the reporting period. Finally, submit the completed form by the designated deadline to avoid penalties.

Legal Use of the New York Remittance

The New York remittance is legally binding when completed correctly and submitted on time. Compliance with state regulations is crucial, as failure to submit the form can result in penalties or legal repercussions. The form serves as an official record of your business's tax obligations and must be retained for auditing purposes. Understanding the legal implications of this remittance is vital for all hotel and motel operators in New York.

Filing Deadlines / Important Dates

Filing deadlines for the New York remittance are typically set quarterly. It is important to stay informed about these dates to ensure timely submissions. Missing a deadline can lead to fines and interest on unpaid taxes. Keeping a calendar of important dates related to tax filings can help businesses manage their obligations effectively.

Required Documents

To complete the New York remittance, several documents are required. These include financial statements that detail your revenue from hotel and motel operations, previous tax returns, and any supporting documentation for deductions claimed. Having these documents organized and readily available will facilitate a smoother filing process.

Penalties for Non-Compliance

Non-compliance with the New York remittance requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand the consequences of failing to submit the remittance on time or providing inaccurate information. Regularly reviewing compliance requirements can help mitigate these risks.

Quick guide on how to complete hotel and motel remittance bformb suffolk county suffolkcountyny

Prepare Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

How to modify and eSign Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny with ease

- Locate Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hotel and motel remittance bformb suffolk county suffolkcountyny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is New York remittance and how does it work?

New York remittance refers to the process of sending money or payments from New York to other locations, often for personal or business purposes. Using airSlate SignNow, you can quickly eSign necessary documents related to remittance, ensuring a fast and secure transaction process. This integration streamlines the entire workflow, making sending and managing remittances in New York simpler than ever.

-

How can airSlate SignNow help with New York remittance transactions?

airSlate SignNow offers a user-friendly platform that allows businesses to send and eSign documents related to New York remittance. This ensures that all legal and financial documents are completed swiftly and securely. Plus, the electronic signature feature improves the speed of your transaction, which is crucial when dealing with remittances.

-

What features does airSlate SignNow offer for New York remittance?

The features of airSlate SignNow for New York remittance include secure electronic signatures, real-time document tracking, and customizable templates for various remittance documents. These features help streamline your financial transactions, allowing you to focus on your business while ensuring compliance and security. Plus, the mobile-friendly interface means you can manage your remittance needs on-the-go.

-

Is there a cost associated with using airSlate SignNow for New York remittance?

Yes, there is a cost associated with using airSlate SignNow, but it’s designed to be an affordable solution for all businesses. Pricing plans vary based on features and number of users, but the cost reflects the value and time savings you gain when handling New York remittance. Investing in airSlate SignNow can lead to signNow efficiencies in your remittance processes.

-

Can I integrate airSlate SignNow with other tools for New York remittance?

Absolutely! airSlate SignNow offers integrations with various tools and platforms that are commonly used for New York remittance. This seamless integration allows for enhanced functionality and efficiency, helping businesses automate their remittance workflows. Whether you use CRM systems or accounting software, connecting airSlate SignNow can optimize your operations.

-

What benefits does airSlate SignNow provide for my New York remittance needs?

Using airSlate SignNow for your New York remittance needs provides numerous benefits, including increased security, faster processing times, and reduced paperwork. The ability to eSign and manage documents electronically not only speeds up transactions but also minimizes the chances of errors. Additionally, it enhances customer satisfaction, as clients appreciate the efficiency of electronic transactions.

-

How secure is airSlate SignNow for New York remittance?

airSlate SignNow prioritizes security and compliance, especially when it comes to financial transactions like New York remittance. It employs advanced encryption protocols and follows industry standards to ensure that your documents and personal information remain protected. You can confidently send and eSign documents, knowing that your remittance data is secure.

Get more for Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny

Find out other Hotel And Motel Remittance BFormb Suffolk County Suffolkcountyny

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF