Va Tax Form 2020

What is the Va Tax Form

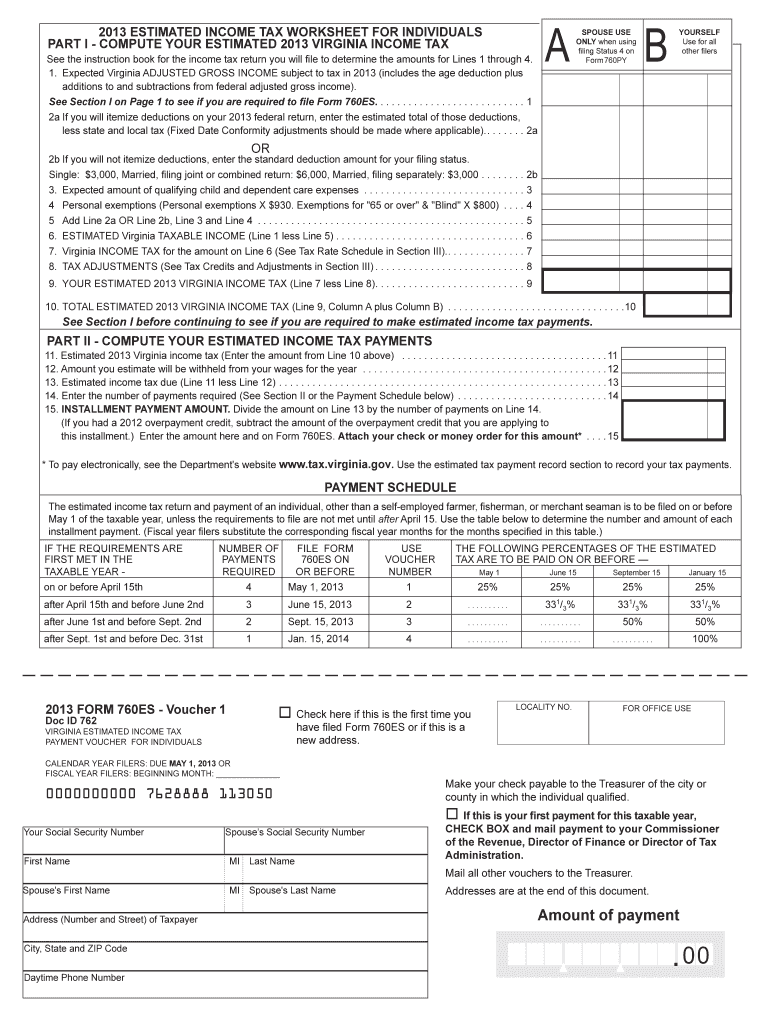

The Va Tax Form is a crucial document utilized for reporting income and calculating tax obligations for residents of Virginia. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax laws. The form collects information regarding income sources, deductions, and credits, which ultimately determine the amount of tax owed or refunded. Understanding the purpose and requirements of the Va Tax Form is vital for effective tax planning and filing.

How to use the Va Tax Form

Using the Va Tax Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as W-2s, 1099s, and records of any deductions. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your income from various sources, and apply any eligible deductions or credits. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Utilizing electronic filing options can streamline this process and enhance accuracy.

Steps to complete the Va Tax Form

Completing the Va Tax Form requires careful attention to detail. Follow these steps for effective completion:

- Gather documents: Collect all relevant financial records, including income statements and receipts for deductions.

- Fill out personal information: Enter your name, address, and Social Security number accurately.

- Report income: List all sources of income, including wages, self-employment income, and interest.

- Apply deductions: Identify and apply any deductions you qualify for, such as mortgage interest or educational expenses.

- Review and verify: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the form: File the completed form electronically or via mail to the Virginia Department of Taxation.

Legal use of the Va Tax Form

The legal use of the Va Tax Form is governed by state tax laws, which require accurate reporting of income and compliance with all filing regulations. Submitting the form is a legal obligation for residents and businesses earning income in Virginia. Failure to file or inaccuracies in reporting can result in penalties, fines, or legal action. It is essential to understand the legal implications of the information provided on the form, ensuring all details are truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Va Tax Form are critical to avoid penalties. Typically, the form must be submitted by May 1st for the previous tax year. If May 1st falls on a weekend or holiday, the deadline extends to the next business day. Taxpayers should also be aware of any extensions available and the implications of filing late. Marking these important dates on a calendar can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Va Tax Form can be submitted through various methods, including online filing, mailing, or in-person delivery. Online filing is often the most efficient option, allowing for immediate processing and confirmation. For those who prefer traditional methods, mailing the completed form to the Virginia Department of Taxation is an option, though it may result in longer processing times. In-person submissions can be made at designated tax offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete 2013 va tax form

Finish Va Tax Form effortlessly on any gadget

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly and without delays. Handle Va Tax Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Steps to modify and electronically sign Va Tax Form with ease

- Find Va Tax Form and then click Get Form to begin.

- Utilize the resources we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and then click the Done button to preserve your changes.

- Select how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Va Tax Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 va tax form

Create this form in 5 minutes!

How to create an eSignature for the 2013 va tax form

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the Va Tax Form, and who needs it?

The Va Tax Form is a document required by residents of Virginia for state income tax purposes. Individuals who earn income within the state must complete this form to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Va Tax Form?

airSlate SignNow streamlines the process of completing and eSigning your Va Tax Form. With our user-friendly platform, you can easily upload, fill out, and send your forms securely to the necessary recipients.

-

Is there a cost associated with using airSlate SignNow for Va Tax Form submissions?

Yes, airSlate SignNow offers various pricing plans to cater to your needs. You can choose from different tiers that provide access to features specifically designed for efficient management of forms, including the Va Tax Form.

-

What features does airSlate SignNow offer for managing the Va Tax Form?

airSlate SignNow includes features such as document templates, custom fields, and automated workflows to facilitate the completion of the Va Tax Form. These tools help save time and reduce errors in your tax documentation.

-

Can I integrate airSlate SignNow with other tools for my Va Tax Form?

Absolutely! airSlate SignNow integrates with various applications like Google Drive, Dropbox, and CRM systems, allowing you to manage your Va Tax Form and other documents seamlessly. Integration enhances your workflow and boosts productivity.

-

How secure is my information when using airSlate SignNow for the Va Tax Form?

airSlate SignNow prioritizes your security with advanced encryption and secure cloud storage. You can confidently complete and eSign your Va Tax Form, knowing that your personal and financial information is protected.

-

Are there templates available for the Va Tax Form in airSlate SignNow?

Yes, airSlate SignNow provides templates for the Va Tax Form, helping users simplify the document preparation process. These templates can be tailored to your specific needs, making it easier to file your taxes.

Get more for Va Tax Form

Find out other Va Tax Form

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free