Virginia Vk 1 Instructions Form

What is the Virginia Vk 1 Instructions

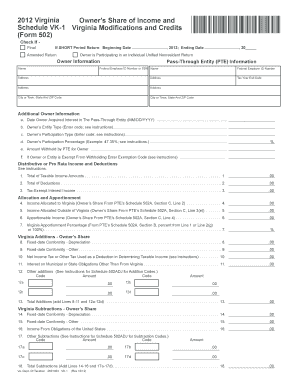

The Virginia Vk 1 instructions pertain to the Schedule VK-1 form, which is used for reporting income, deductions, and credits from pass-through entities, such as partnerships and S corporations. This form is essential for individuals who receive income from these entities, as it provides the necessary information to accurately report on their individual tax returns. Understanding the purpose and requirements of the Virginia Vk 1 instructions is crucial for ensuring compliance with state tax laws.

Steps to complete the Virginia Vk 1 Instructions

Completing the Virginia Vk 1 instructions involves several key steps. First, gather all relevant financial documents related to the pass-through entity, including K-1 forms and any supporting schedules. Next, carefully follow the detailed instructions provided on the form to input your income, deductions, and credits accurately. It is important to double-check all entries for accuracy to avoid potential issues with the Virginia Department of Taxation. Finally, ensure that you retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Key elements of the Virginia Vk 1 Instructions

The Virginia Vk 1 instructions include several critical elements that taxpayers must understand. These elements encompass the types of income that must be reported, such as ordinary business income, rental income, and capital gains. Additionally, the instructions outline allowable deductions and credits that can reduce taxable income. Familiarity with these key components ensures that taxpayers can maximize their tax benefits while remaining compliant with state regulations.

Legal use of the Virginia Vk 1 Instructions

Using the Virginia Vk 1 instructions legally requires adherence to state tax laws and regulations. The information provided on the form must be accurate and complete, reflecting the taxpayer's actual financial situation. Misrepresentation or failure to comply with the instructions can lead to penalties, including fines or audits. Therefore, it is essential to utilize the form as intended and to seek professional assistance if there are uncertainties regarding its completion.

Filing Deadlines / Important Dates

Filing deadlines for the Virginia Vk 1 instructions align with the overall tax filing schedule in Virginia. Typically, the deadline for submitting the Schedule VK-1 is the same as the individual income tax return deadline, which is usually April 15. However, taxpayers should verify specific dates each tax year, as they may vary slightly. It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Who Issues the Form

The Virginia Vk 1 form is issued by the Virginia Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for individuals and businesses to understand their tax obligations, including the issuance of forms like the Schedule VK-1. Taxpayers can access these forms through the department's official website or by contacting their office directly for assistance.

Quick guide on how to complete virginia vk 1 instructions

Prepare Virginia Vk 1 Instructions effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal green alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Virginia Vk 1 Instructions on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign Virginia Vk 1 Instructions with ease

- Locate Virginia Vk 1 Instructions and then click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether through email, SMS, invite link, or by downloading it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Virginia Vk 1 Instructions to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia vk 1 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform relevant to virginia vk 1 instructions?

The airSlate SignNow platform includes essential features like eSignature capabilities, document templates, and real-time collaboration tools that are particularly useful for users following virginia vk 1 instructions. These features streamline the signing process, enhance document management, and improve overall workflow efficiency.

-

How does pricing work for airSlate SignNow, especially for those looking for virginia vk 1 instructions?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it accessible for those who need to follow virginia vk 1 instructions. Users can choose from monthly or annual subscriptions, ensuring they select a plan that aligns with their budget and needs.

-

Can I integrate airSlate SignNow with other software for managing virginia vk 1 instructions?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Zapier, providing a comprehensive solution for managing virginia vk 1 instructions. These integrations can enhance productivity and ensure that all tools work together smoothly.

-

What are the benefits of using airSlate SignNow when following virginia vk 1 instructions?

Using airSlate SignNow while following virginia vk 1 instructions allows for a more efficient document signing process, reducing paper usage and turnaround time. The platform's user-friendly interface ensures that even those new to eSignature technology can easily navigate through their tasks.

-

Are there any mobile features in airSlate SignNow for users needing virginia vk 1 instructions?

Absolutely! airSlate SignNow offers a mobile app that allows users to manage their documents and follow virginia vk 1 instructions on the go. This flexibility enables users to sign documents, send requests, and track workflows from anywhere, enhancing overall convenience.

-

How secure is the airSlate SignNow platform for processing virginia vk 1 instructions?

airSlate SignNow prioritizes security by utilizing bank-level encryption and compliant practices to protect your data related to virginia vk 1 instructions. This commitment to security ensures that your sensitive information remains safe throughout the signing process.

-

Is there a free trial available for using airSlate SignNow to learn virginia vk 1 instructions?

Yes, airSlate SignNow provides a free trial that gives prospective users the opportunity to explore the platform while following virginia vk 1 instructions. This trial allows users to experience the features and interface before committing to a subscription.

Get more for Virginia Vk 1 Instructions

- Illinois form il 1040 x amended individual income tax

- 2020 form or tm tri county metropolitan transportation districtself employment tax 150 555 001

- 2021 form 590 withholding exemption certificate

- 2020 form or 40 oregon individual income tax return for full year residents 150 101 040

- Ty 2021 mw506a maryland employer return of income tax withheld form

- Ptax 300 application for non homestead st clair form

- Illinois form il 4562 special depreciation 2020

- 2020 occupational tax reconciliation form whitley county

Find out other Virginia Vk 1 Instructions

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage