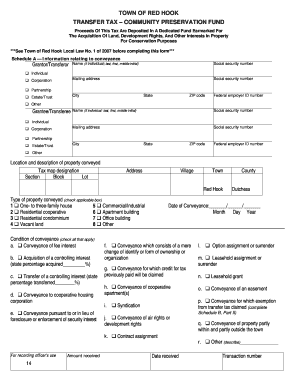

Red Hook Transfer Tax Form

What is the Red Hook Transfer Tax

The Red Hook Transfer Tax is a municipal tax imposed on the transfer of real property within the Town of Red Hook, New York. This tax is applicable to both residential and commercial real estate transactions and is typically calculated as a percentage of the sale price. Understanding the specifics of this tax is essential for property buyers and sellers, as it affects the overall cost of the transaction.

Steps to complete the Red Hook Transfer Tax

Completing the fillable Red Hook Transfer Tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the property address, sale price, and the names of the buyer and seller. Next, access the fillable form, which can be completed digitally for convenience. Carefully enter the required details, ensuring that all information is accurate and matches the supporting documents. After filling out the form, review it for any errors before submitting it to the appropriate local authority, either online or via mail.

Legal use of the Red Hook Transfer Tax

The legal use of the Red Hook Transfer Tax is governed by local laws and regulations. It is crucial for both buyers and sellers to understand their obligations under these laws. The tax must be paid at the time of the property transfer, and failure to comply can result in penalties. Additionally, the completed transfer tax form must be submitted to the local tax office to ensure proper record-keeping and compliance with municipal regulations.

Required Documents

When completing the fillable Red Hook Transfer Tax form, several documents are typically required to support the transaction. These may include the deed of the property, a copy of the purchase agreement, and any additional documentation that verifies the sale price and parties involved. Having these documents ready can facilitate a smoother completion process and ensure compliance with local regulations.

Form Submission Methods

The completed Red Hook Transfer Tax form can be submitted through various methods, depending on local regulations. Common submission methods include online filing through the town's official website, mailing a physical copy to the local tax office, or delivering it in person. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to comply with the Red Hook Transfer Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for property buyers and sellers to understand their responsibilities regarding this tax to avoid these consequences. Timely submission of the form and payment of the tax can help ensure compliance and prevent any legal issues.

Quick guide on how to complete red hook transfer tax

Finish Red Hook Transfer Tax effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documentation, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without hold-ups. Manage Red Hook Transfer Tax on any device with airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

How to edit and eSign Red Hook Transfer Tax with ease

- Obtain Red Hook Transfer Tax and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, taxing form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Red Hook Transfer Tax ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the red hook transfer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fillable red hook transfer tax form?

The fillable red hook transfer tax form is a customizable document designed for real estate transactions in Red Hook. It allows users to electronically fill out necessary details, ensuring that all information is accurately captured and submitted as needed. This form simplifies the process of transferring property ownership while adhering to local regulations.

-

How can I access the fillable red hook transfer tax form?

You can access the fillable red hook transfer tax form through the airSlate SignNow platform. Simply sign up for an account, and you'll have immediate access to a range of templates, including this specific form. The platform is user-friendly and guides you through the process of filling out and signing each document efficiently.

-

Is there a cost associated with using the fillable red hook transfer tax form?

Yes, there is a cost to use the fillable red hook transfer tax form on airSlate SignNow. However, the platform offers various pricing plans designed to suit different user needs. By choosing the right plan, you can benefit from a cost-effective solution that provides access to this form along with many other document management tools.

-

What are the benefits of using the fillable red hook transfer tax form?

Using the fillable red hook transfer tax form offers numerous advantages, including time savings and accuracy in document preparation. By completing the form electronically, you can ensure that all fields are filled correctly, signNowly reducing the risk of errors. Additionally, the electronic submission process streamlines the overall transaction, making it more efficient.

-

Can I integrate other tools with the fillable red hook transfer tax form?

Yes, airSlate SignNow supports integration with various business tools when utilizing the fillable red hook transfer tax form. You can connect it with CRM systems, file storage solutions, and other applications to enhance your document management workflows. This integration capability allows for seamless information sharing and improved productivity.

-

Is it easy to share the fillable red hook transfer tax form with others?

Absolutely! Sharing the fillable red hook transfer tax form is simple with airSlate SignNow. You can easily send the form to parties involved in the transaction via email or generate a shareable link, allowing others to fill out or review the document collaboratively. This feature enhances communication and promotes a smoother transaction process.

-

Can I save and edit the fillable red hook transfer tax form later?

Yes, airSlate SignNow allows you to save your progress on the fillable red hook transfer tax form. This means you can return to the document at any time to make edits or add additional information. The ability to save and edit your forms ensures flexibility and convenience throughout the completion process.

Get more for Red Hook Transfer Tax

Find out other Red Hook Transfer Tax

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document