It1040x Form

What is the It1040x Form

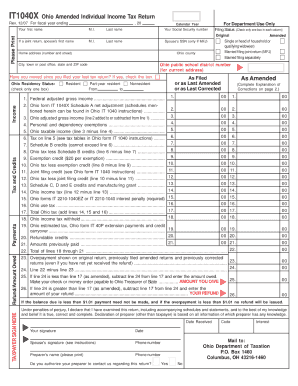

The It1040x Form is a tax form used by individuals in the United States to amend their previously filed federal income tax returns. This form allows taxpayers to correct errors or make changes to their tax filings, such as adjusting income, deductions, or credits. It is essential for ensuring that your tax return accurately reflects your financial situation and complies with IRS regulations.

How to use the It1040x Form

Using the It1040x Form involves several steps to ensure that your amendments are processed correctly. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make. Next, complete the It1040x Form by providing the necessary information, including your name, Social Security number, and the tax year you are amending. Be sure to clearly explain the reasons for the changes in the designated section of the form. Finally, submit the completed form to the IRS according to their guidelines.

Steps to complete the It1040x Form

Completing the It1040x Form requires careful attention to detail. Follow these steps:

- Obtain a copy of your original tax return for reference.

- Fill out your personal information at the top of the form.

- Indicate the tax year you are amending.

- Complete the sections that require changes, including income, deductions, and credits.

- Provide a detailed explanation for each change made.

- Sign and date the form before submission.

Legal use of the It1040x Form

The It1040x Form is legally binding when completed and submitted according to IRS regulations. To ensure that your amendments are recognized, it is crucial to follow the proper procedures for filing. This includes providing accurate information and any necessary documentation to support your claims. Additionally, using a reliable platform for electronic submission can enhance the legal standing of your amended return, as it may offer features such as secure e-signatures and compliance with relevant laws.

Filing Deadlines / Important Dates

Timely filing of the It1040x Form is essential to avoid penalties and interest on any additional taxes owed. Generally, the form must be filed within three years from the original due date of the tax return being amended or within two years from the date you paid the tax, whichever is later. It is advisable to keep track of these deadlines to ensure compliance and to minimize any potential issues with the IRS.

Who Issues the Form

The It1040x Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax administration in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to amend their tax returns accurately. It is important to reference the official IRS website or publications for the most current information regarding the form and its requirements.

Quick guide on how to complete it1040x form

Effortlessly Prepare It1040x Form on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without holdups. Manage It1040x Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and eSign It1040x Form with Ease

- Locate It1040x Form and click Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Complete button to save your modifications.

- Choose your delivery method for the form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from the device of your preference. Modify and eSign It1040x Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it1040x form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the It1040x Form?

The It1040x Form is a revised version of your original tax return that allows you to correct errors or make changes. It's important for taxpayers who need to amend their filed tax returns, ensuring accurate reporting to the IRS. Using airSlate SignNow, you can easily eSign your It1040x Form and submit it for processing.

-

How can airSlate SignNow help with the It1040x Form?

airSlate SignNow offers a seamless solution for signing and sending your It1040x Form electronically. With our platform, you can quickly upload your amended tax form, secure electronic signatures, and send it directly to the IRS, streamlining the entire process. This means less time worrying about paperwork and more time focusing on your finances.

-

Is airSlate SignNow cost-effective for filing the It1040x Form?

Yes, airSlate SignNow is designed to provide a cost-effective solution for businesses and individuals alike. Our competitive pricing plans ensure that filing the It1040x Form doesn't have to break the bank. With our service, you get efficient processing and eSignature capabilities without hidden fees.

-

What features does airSlate SignNow offer for the It1040x Form?

airSlate SignNow offers a range of features specifically for managing the It1040x Form, including customizable templates and automated workflows. Our user-friendly interface allows you to easily navigate through the signing process, while advanced security features keep your documents safe. This ensures that your amended tax return is handled with the utmost care.

-

Can I track the status of my It1040x Form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking of your It1040x Form throughout the signing and submission process. You'll receive notifications and updates, so you always know where your document stands. This transparency helps you stay informed and reduces anxiety about your tax filing.

-

Are there any integrations available for better managing the It1040x Form?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your It1040x Form. This allows for smooth transfers of data and documents between systems, enhancing efficiency and accuracy. By utilizing our integrations, you can streamline your entire tax filing process.

-

What are the benefits of using airSlate SignNow for the It1040x Form?

Using airSlate SignNow for your It1040x Form provides numerous benefits, including speed, efficiency, and convenience. Electronic signatures eliminate the need for printing, signing, and scanning, saving you time and effort. Additionally, our secure platform ensures that your sensitive information remains protected throughout the process.

Get more for It1040x Form

Find out other It1040x Form

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe