Form 1062

What is the Form 1062

The Form 1062 is a tax-related document used primarily for reporting specific financial information to the Internal Revenue Service (IRS). This form is often utilized by businesses and individuals who need to disclose certain transactions or income that may not be reported on other standard tax forms. Understanding the purpose of Form 1062 is essential for ensuring compliance with federal tax regulations.

Steps to complete the Form 1062

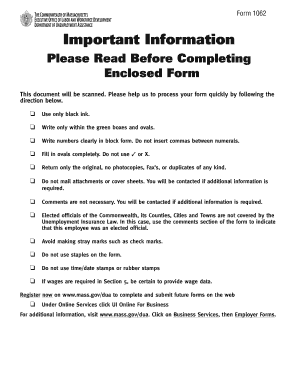

Completing Form 1062 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and transaction records. Next, clearly fill out each section of the form, providing detailed information as required. It is crucial to double-check all entries for accuracy before submission. Finally, ensure that you sign and date the form, as this validates the information provided.

Legal use of the Form 1062

The legal use of Form 1062 is governed by IRS regulations, which stipulate that the form must be completed accurately to avoid penalties. This form serves as an official record of financial reporting, and any discrepancies can lead to audits or legal issues. It is essential to adhere to all guidelines set forth by the IRS to maintain the form's validity and ensure that it is accepted for tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for Form 1062 are crucial for compliance with IRS regulations. Typically, the form must be submitted by a specific date each tax year, which can vary based on the taxpayer's circumstances. It is important to stay informed about these deadlines to avoid late filing penalties. Mark your calendar with the relevant dates to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

Form 1062 can be submitted through various methods, including online filing, mailing a physical copy, or delivering it in person to the appropriate IRS office. Online submission is often the most efficient method, allowing for quicker processing times. If opting to mail the form, ensure it is sent to the correct address and consider using a trackable mailing service for confirmation of delivery.

Required Documents

When preparing to complete Form 1062, certain documents are required to ensure accurate reporting. These may include financial statements, tax identification numbers, and any relevant transaction records. Having all necessary documentation on hand will streamline the completion process and help avoid errors that could lead to complications with the IRS.

Examples of using the Form 1062

Form 1062 is commonly used in various scenarios, such as reporting income from business transactions or disclosing specific financial activities. For instance, a small business may use this form to report income that is not captured on their standard tax filings. Understanding these examples can help taxpayers recognize when and how to utilize Form 1062 effectively.

Quick guide on how to complete form 1062 11943238

Prepare Form 1062 effortlessly on any device

Online document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents swiftly without hindrances. Manage Form 1062 on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedures today.

The easiest way to modify and eSign Form 1062 without effort

- Locate Form 1062 and click on Get Form to begin.

- Make use of the tools we offer to submit your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 1062 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1062 11943238

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1062 and how does airSlate SignNow support it?

Form 1062 is a tax-related document that businesses may need to file. airSlate SignNow provides an intuitive platform for eSigning and managing such documents, ensuring that your form 1062 is legally compliant and securely shared with all necessary parties.

-

How can I electronically sign form 1062 using airSlate SignNow?

With airSlate SignNow, signing form 1062 is simple. Users can upload the document, add signature fields quickly, and send it for eSignature. This streamlines the signing process while maintaining the integrity of your form 1062.

-

Are there any costs associated with using airSlate SignNow for form 1062?

airSlate SignNow offers various pricing plans to cater to different needs, which are cost-effective. Depending on your business size and requirements for handling documents like form 1062, you can choose a plan that suits your budget while benefiting from a robust eSigning solution.

-

What features does airSlate SignNow offer for managing form 1062?

airSlate SignNow provides features such as customizable templates, real-time tracking, and document storage that are beneficial for managing form 1062. These features ensure an organized approach to document management and eSigning, reducing errors and enhancing efficiency.

-

Can airSlate SignNow integrate with other applications for form 1062 management?

Yes, airSlate SignNow offers integration capabilities with various applications, enhancing the management of form 1062. This allows users to seamlessly connect their eSigning processes with CRM systems, accounting software, and other essential tools.

-

What are the benefits of using airSlate SignNow for form 1062 over traditional methods?

Using airSlate SignNow for your form 1062 offers numerous benefits, including increased speed, security, and convenience. Unlike traditional methods, the eSigning process is faster, helps eliminate paperwork, and ensures your documents are stored securely in the cloud.

-

Is airSlate SignNow secure for sending sensitive documents like form 1062?

Absolutely! airSlate SignNow employs advanced security protocols to protect sensitive documents such as form 1062. Your data is encrypted, and access is controlled, allowing you to eSign and share your documents with peace of mind.

Get more for Form 1062

- To practice adding and subtracting integers lcps form

- Sample mgr consulting form

- Gold crown volleyball lineup sheet form

- Puppy contracts for breeders form

- Class registration form ladies of the lakes quiltersamp39 guild ladiesofthelakes

- Exxonmobil guyana application form

- Property tax deliquent letter form

- Chili cook off sign up sheet template form

Find out other Form 1062

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy