R 1042 Form

What is the R 1042

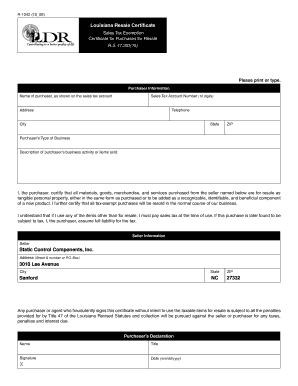

The R 1042 is a tax form used in the United States, specifically in Louisiana, to document certain tax-exempt transactions. This form is crucial for individuals and businesses that engage in activities that qualify for tax exemption under state law. By accurately completing the R 1042, taxpayers can ensure compliance with Louisiana tax regulations while benefiting from applicable exemptions.

How to use the R 1042

Using the R 1042 involves understanding the specific circumstances under which the form applies. Taxpayers should first determine if their transaction qualifies for tax exemption. Once eligibility is confirmed, the form must be filled out with accurate information regarding the transaction, including the parties involved and the nature of the exemption. After completion, the form should be submitted to the appropriate tax authority as instructed.

Steps to complete the R 1042

Completing the R 1042 requires careful attention to detail. Follow these steps:

- Gather necessary documentation that supports your claim for tax exemption.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Louisiana Department of Revenue, either online or via mail.

Legal use of the R 1042

The R 1042 must be used in accordance with Louisiana state tax laws. This means that the form should only be submitted for transactions that genuinely qualify for tax-exempt status. Misuse of the form can lead to penalties, including fines or additional tax liabilities. It is essential to understand the legal framework surrounding the use of this form to avoid any compliance issues.

Filing Deadlines / Important Dates

Timely submission of the R 1042 is critical to avoid penalties. Generally, the form should be filed by the due date of the tax return for the year in which the transaction occurred. Taxpayers should stay informed about specific deadlines, as these can vary based on individual circumstances and any changes in tax legislation.

Who Issues the Form

The R 1042 is issued by the Louisiana Department of Revenue. This state agency is responsible for overseeing tax compliance and ensuring that all forms are properly utilized according to state regulations. Taxpayers can obtain the form directly from the department's website or through authorized distribution channels.

Quick guide on how to complete r 1042

Effortlessly Prepare R 1042 on Any Device

The management of online documents has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any delays. Manage R 1042 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and eSign R 1042 with Ease

- Find R 1042 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Edit and eSign R 1042 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 1042

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable r 1042 form?

The printable r 1042 is a tax form used by foreign entities for withholding tax reporting in the United States. It helps businesses report income paid to non-resident aliens and foreign partnerships. Understanding how to properly fill out a printable r 1042 can ensure compliance with IRS regulations.

-

How can I obtain a printable r 1042?

You can easily download a printable r 1042 from the IRS website or through various tax software providers. Many platforms, including airSlate SignNow, allow you to access and eSign this form efficiently. Make sure to have the required information ready for a smooth filling process.

-

What features does airSlate SignNow offer for managing printed r 1042 forms?

airSlate SignNow provides users with a seamless way to upload, fill out, and electronically sign their printable r 1042 forms. The platform supports document tracking, secure cloud storage, and multiple signers, making it easier to manage your tax compliance. These features enhance efficiency and ensure that your documents are always accessible.

-

Is there a cost associated with using airSlate SignNow for printable r 1042?

airSlate SignNow offers various pricing plans to cater to different business needs, including a free trial for first-time users. The cost-effective solutions ensure that your tax documentation, including printable r 1042 forms, are handled efficiently without breaking the bank. It's a practical investment for businesses needing reliable document eSigning.

-

Can I integrate airSlate SignNow with other software for managing printable r 1042 forms?

Yes, airSlate SignNow supports various integrations with popular software applications such as Google Drive, Dropbox, and CRM systems. This allows for seamless management and storage of your printable r 1042 forms alongside other important documents. These integrations streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for printable r 1042 eSigning?

Using airSlate SignNow for your printable r 1042 eSigning offers convenience, speed, and security. You can sign documents from anywhere, at any time, which is particularly useful for busy professionals. Additionally, the platform utilizes advanced encryption to keep your sensitive tax information secure.

-

What should I do if I encounter issues with my printable r 1042 form on airSlate SignNow?

If you experience any issues with your printable r 1042 form while using airSlate SignNow, our customer support team is ready to assist you. You can visit our help center or get in touch with support via live chat or email. We aim to resolve any concerns quickly to ensure your experience remains smooth and efficient.

Get more for R 1042

Find out other R 1042

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe