Assets Publishing Service Gov UkgovernmentIHT35Claim for Reliefloss on Sale of Shares GOV UK 2022-2026

What is the IHT35 form?

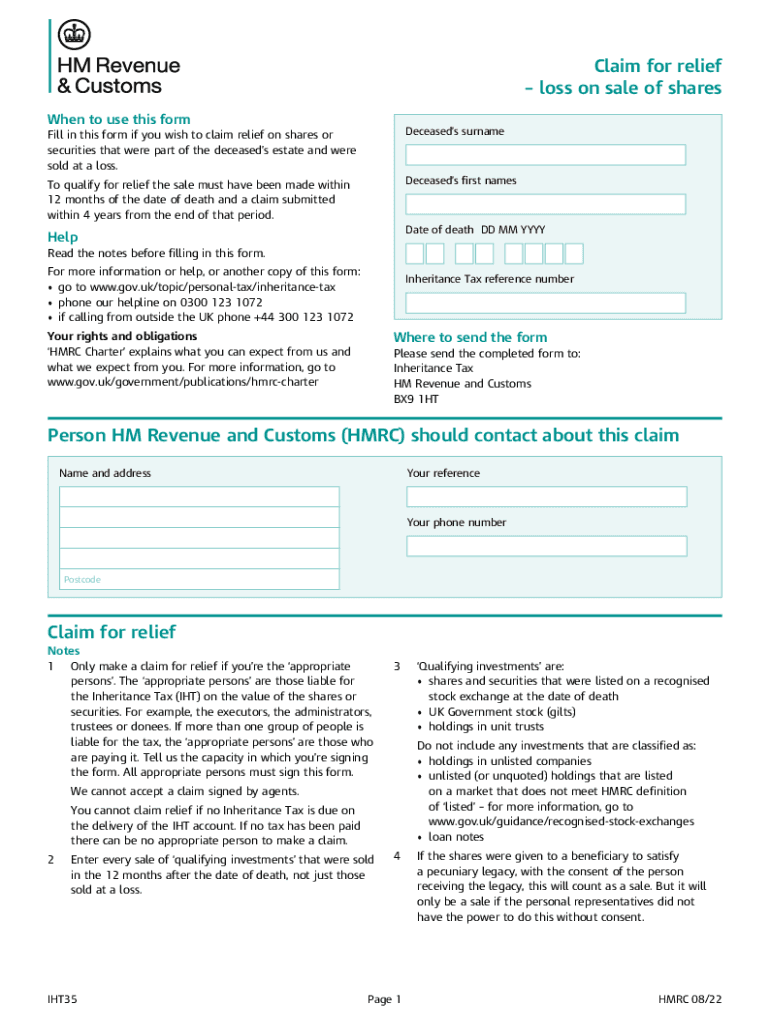

The IHT35 form, also known as the Claim for Relief on Sale of Shares, is a specific form used in the context of inheritance tax in the United Kingdom. It allows individuals to claim relief on the sale of shares that may have been subject to inheritance tax. This form is particularly relevant for individuals who have sold shares that were part of an estate and are seeking to recover some of the tax paid on those shares. Understanding the purpose of the IHT35 form is essential for ensuring compliance with tax regulations and optimizing tax liabilities.

Key elements of the IHT35 form

The IHT35 form includes several key elements that are crucial for completing the application accurately. These elements typically include:

- Personal Information: Details about the individual making the claim, including name, address, and contact information.

- Share Details: Information regarding the shares sold, including the number of shares, sale price, and date of sale.

- Tax Information: A summary of the inheritance tax paid on the shares, including any relevant calculations.

- Supporting Documentation: Any necessary documents that support the claim, such as sale agreements or tax payment receipts.

Steps to complete the IHT35 form

Completing the IHT35 form involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather all necessary documentation related to the sale of shares and inheritance tax.

- Fill out the personal information section accurately.

- Provide detailed information about the shares sold, including sale dates and amounts.

- Calculate the inheritance tax paid and include this information in the appropriate section.

- Attach any supporting documents required to substantiate the claim.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the IHT35 form

To be eligible to use the IHT35 form, individuals must meet certain criteria. Generally, the following conditions apply:

- The individual must have sold shares that were part of an estate subject to inheritance tax.

- The claim must be made within the specified time frame following the sale of the shares.

- The individual must have paid inheritance tax on the shares sold.

Form Submission Methods

The IHT35 form can be submitted through various methods, depending on the preferences of the individual. Common submission methods include:

- Online Submission: Many individuals prefer to submit forms electronically through the relevant tax authority's website, ensuring faster processing.

- Mail Submission: The form can also be printed and mailed to the appropriate tax office, though this method may take longer for processing.

- In-Person Submission: In some cases, individuals may choose to submit the form in person at designated tax offices.

Filing Deadlines / Important Dates

Filing deadlines for the IHT35 form are critical to ensure compliance and avoid penalties. Typically, the form should be submitted within a specific period following the sale of shares. It is important to check the latest guidelines from the tax authority for exact dates, as these may vary based on individual circumstances or changes in tax regulations.

Quick guide on how to complete assets publishing service gov ukgovernmentiht35claim for reliefloss on sale of shares gov uk

Complete Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK effortlessly on any device

Managing documents online has gained signNow popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents quickly and without delays. Handle Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK on any platform with the airSlate SignNow apps for Android or iOS, simplifying any document-related process today.

The easiest way to modify and eSign Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK with ease

- Locate Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct assets publishing service gov ukgovernmentiht35claim for reliefloss on sale of shares gov uk

Create this form in 5 minutes!

How to create an eSignature for the assets publishing service gov ukgovernmentiht35claim for reliefloss on sale of shares gov uk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the iht35 form and why is it important?

The iht35 form is a crucial document used for reporting the value of an estate for inheritance tax purposes. It helps ensure compliance with tax regulations and provides a clear overview of the assets involved. Understanding the iht35 form is essential for anyone managing an estate.

-

How can airSlate SignNow help with the iht35 form?

airSlate SignNow simplifies the process of completing and signing the iht35 form by providing an intuitive platform for electronic signatures. Users can easily fill out the form, add necessary signatures, and send it securely. This streamlines the workflow and reduces the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the iht35 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides excellent value for the features included, such as unlimited document signing and secure storage. Investing in airSlate SignNow can save you time and resources when handling the iht35 form.

-

What features does airSlate SignNow offer for managing the iht35 form?

airSlate SignNow provides features like customizable templates, real-time tracking, and automated reminders for the iht35 form. These tools enhance efficiency and ensure that all parties are informed throughout the signing process. Additionally, the platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other applications for the iht35 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the iht35 form alongside your existing tools. This includes CRM systems, cloud storage services, and more, ensuring a smooth workflow and enhanced productivity.

-

What are the benefits of using airSlate SignNow for the iht35 form?

Using airSlate SignNow for the iht35 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are safely stored and easily accessible, while also expediting the signing process. This ultimately leads to a more organized and stress-free experience.

-

Is airSlate SignNow secure for handling the iht35 form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the iht35 form. The platform employs advanced encryption and authentication measures to protect your data. You can trust that your information is secure while using airSlate SignNow.

Get more for Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK

- Naso officiating evaluation form

- Niceic qs application form

- Large fragment dcp and lc dcp icp form

- Naturalike dental lab form

- Special permission gas request application form mass gov mass

- Specify the employment income you want to claim form

- Va form 21 0781

- Craft fair vendor agreement template 787741132 form

Find out other Assets publishing service gov ukgovernmentIHT35Claim For Reliefloss On Sale Of Shares GOV UK

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement