Cdtfa 401 A2 Form

What is the CDTFA 401 A2 Form

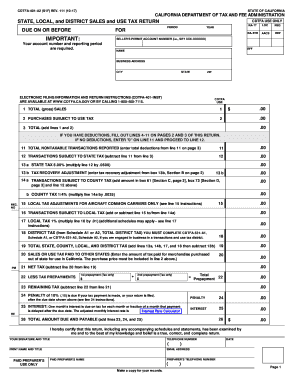

The CDTFA 401 A2 form is a crucial document used by businesses in California to report and claim a refund for overpaid sales and use taxes. This form is specifically designed for those who have made purchases that are exempt from sales tax or have been incorrectly charged tax. Understanding the purpose and function of the CDTFA 401 A2 form is essential for businesses seeking to ensure compliance with California's tax regulations.

How to Use the CDTFA 401 A2 Form

Using the CDTFA 401 A2 form involves several steps. First, businesses must gather relevant documentation related to the overpaid taxes. This may include receipts, invoices, and any other pertinent records. Once the necessary information is collected, the form can be filled out, detailing the amounts in question and the reasons for the refund request. After completing the form, it must be submitted to the California Department of Tax and Fee Administration (CDTFA) for processing.

Steps to Complete the CDTFA 401 A2 Form

Completing the CDTFA 401 A2 form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary documentation, including proof of payment and exemption certificates.

- Fill out the form accurately, ensuring that all required fields are completed.

- Double-check the information for any errors or omissions.

- Sign and date the form, as required.

- Submit the completed form to the CDTFA via the preferred submission method.

Legal Use of the CDTFA 401 A2 Form

The CDTFA 401 A2 form is legally recognized as a formal request for a tax refund. To ensure its legal validity, it must be completed in accordance with California tax laws. This includes providing accurate information and adhering to deadlines for submission. Failure to comply with legal requirements may result in delays or denial of the refund request.

Form Submission Methods

The CDTFA 401 A2 form can be submitted through various methods. Businesses may choose to file online via the CDTFA's official website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate CDTFA office or submitted in person at designated locations. Each submission method has its own advantages, and businesses should select the one that best suits their needs.

Key Elements of the CDTFA 401 A2 Form

Understanding the key elements of the CDTFA 401 A2 form is vital for effective completion. Important sections typically include:

- Taxpayer information, including name, address, and identification number.

- Details about the transactions in question, such as dates and amounts.

- Reason for the refund request, which must be clearly articulated.

- Signature of the taxpayer or authorized representative.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the CDTFA 401 A2 form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to adhere to all regulations and deadlines to avoid these consequences and ensure a smooth refund process.

Quick guide on how to complete cdtfa 401 a2 form

Effortlessly prepare Cdtfa 401 A2 Form on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Cdtfa 401 A2 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to modify and eSign Cdtfa 401 A2 Form with ease

- Obtain Cdtfa 401 A2 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhausting searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and eSign Cdtfa 401 A2 Form while ensuring exceptional communication at every step of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 401 a2 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cdtfa 401 a2 form?

The cdtfa 401 a2 form is a tax document that businesses in California use to report sales and use tax. This form is crucial for ensuring compliance with state tax regulations, making it essential for businesses operating in California. Utilizing an efficient eSigning solution like airSlate SignNow can streamline the process of completing and submitting the cdtfa 401 a2 form.

-

How can airSlate SignNow help with the cdtfa 401 a2 form?

airSlate SignNow offers a user-friendly platform that enables businesses to easily fill out and eSign the cdtfa 401 a2 form electronically. By digitizing the process, businesses can save time, reduce paperwork, and ensure that their forms are submitted accurately and on time. The platform's intuitive features optimize the management of tax documents, including the cdtfa 401 a2 form.

-

Is there a cost associated with using airSlate SignNow for the cdtfa 401 a2 form?

Yes, airSlate SignNow offers various pricing plans, allowing businesses to choose a solution that fits their budget. The cost-effective nature of airSlate SignNow makes it a great option for businesses that need to manage documents like the cdtfa 401 a2 form. Each plan provides access to valuable features designed to simplify the eSigning process.

-

What features does airSlate SignNow offer for handling the cdtfa 401 a2 form?

airSlate SignNow provides several essential features for managing the cdtfa 401 a2 form, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the user experience by streamlining the process of completing and signing tax documents. Additionally, users benefit from easy access to completed forms at any time.

-

Can I integrate airSlate SignNow with other software for the cdtfa 401 a2 form?

Absolutely! airSlate SignNow offers integrations with various popular applications that can streamline the process of managing the cdtfa 401 a2 form. By connecting with tools like CRMs, document management systems, and cloud storage services, users can enhance their workflow efficiency and ensure that the eSigning process is fully integrated into their business operations.

-

What are the benefits of using airSlate SignNow for the cdtfa 401 a2 form?

Using airSlate SignNow for your cdtfa 401 a2 form offers numerous benefits, including increased efficiency, reduced printing costs, and enhanced security for sensitive information. The intuitive interface allows users to complete forms quickly, which is especially beneficial during tax season. Additionally, the ability to track document progress ensures that you stay on top of your filing responsibilities.

-

Is airSlate SignNow compliant with regulations for the cdtfa 401 a2 form?

Yes, airSlate SignNow is designed to comply with industry regulations and standards to ensure that your cdtfa 401 a2 form submissions meet legal requirements. This compliance is crucial for businesses looking to maintain their adherence to tax laws. By using a compliant eSigning solution, you can avoid potential penalties and ensure your tax documents are handled appropriately.

Get more for Cdtfa 401 A2 Form

Find out other Cdtfa 401 A2 Form

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself