Payroll Deduction Authorization Form

What is the Payroll Deduction Authorization Form

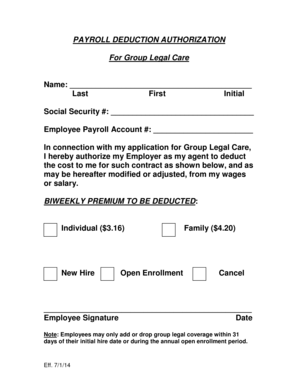

The payroll deduction authorization form is a document that allows employees to authorize their employer to deduct specific amounts from their paychecks. These deductions can be for various purposes, such as health insurance premiums, retirement contributions, or other voluntary deductions. By completing this form, employees provide their consent for these deductions, ensuring that the process is transparent and legally compliant.

Key elements of the Payroll Deduction Authorization Form

When filling out the payroll deduction authorization form, several key elements must be included to ensure its validity:

- Employee Information: This section typically requires the employee's name, address, and employee identification number.

- Deduction Details: Employees must specify the type of deduction, the amount to be deducted, and the frequency of the deduction (e.g., weekly, bi-weekly).

- Employer Information: The form should include the employer's name and contact information to ensure proper processing.

- Signature and Date: The employee's signature and the date of signing are essential for validating the authorization.

Steps to complete the Payroll Deduction Authorization Form

Completing the payroll deduction authorization form involves several straightforward steps:

- Gather Necessary Information: Collect all required personal and employment details, including the specific deduction amounts.

- Fill Out the Form: Complete each section of the form accurately, ensuring all information is correct.

- Review the Form: Double-check all entries for accuracy and completeness to avoid any processing delays.

- Sign and Date: Provide your signature and the date to confirm your authorization.

- Submit the Form: Deliver the completed form to your employer's HR or payroll department according to their submission guidelines.

Legal use of the Payroll Deduction Authorization Form

The payroll deduction authorization form must comply with various legal standards to be considered valid. In the United States, employers are required to adhere to federal and state laws regarding payroll deductions. This includes obtaining explicit consent from employees before making any deductions. Additionally, the form should clearly outline the purpose of the deductions and comply with regulations set forth by agencies such as the Department of Labor. Ensuring these legal requirements are met protects both the employer and employee from potential disputes.

How to obtain the Payroll Deduction Authorization Form

Employees can obtain the payroll deduction authorization form through several channels:

- Employer's HR Department: Most employers provide this form directly through their human resources department or payroll office.

- Company Intranet: Many organizations have an intranet where employees can access and download necessary forms.

- Online Resources: Various websites offer templates for payroll deduction authorization forms that can be customized for specific needs.

Digital vs. Paper Version

Both digital and paper versions of the payroll deduction authorization form are valid, but each has its advantages. Digital forms offer convenience, allowing employees to fill out and submit the form electronically, which can streamline the process and reduce paperwork. On the other hand, paper forms may be preferred by some employees for their tangible nature and ease of use in certain environments. Regardless of the format, it is essential that the form meets all legal requirements and is properly signed by the employee.

Quick guide on how to complete payroll deduction authorization form 43119056

Manage Payroll Deduction Authorization Form seamlessly on any device

Digital document management has become widely embraced by both companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents quickly and without delays. Handle Payroll Deduction Authorization Form across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Payroll Deduction Authorization Form effortlessly

- Find Payroll Deduction Authorization Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Payroll Deduction Authorization Form while ensuring effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll deduction authorization form 43119056

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payroll deduction authorization form?

A payroll deduction authorization form is a document that allows employees to authorize deductions from their paycheck for various purposes, such as benefits or loans. Using airSlate SignNow, you can easily create and manage these forms, ensuring that all authorizations are properly documented and securely stored.

-

How does airSlate SignNow improve the payroll deduction authorization process?

airSlate SignNow streamlines the payroll deduction authorization process by enabling businesses to create, send, and eSign forms digitally. This cuts down on processing time, reduces paperwork, and enhances compliance by ensuring that all forms are securely signed and stored.

-

Can I customize the payroll deduction authorization form?

Yes, with airSlate SignNow, you can fully customize your payroll deduction authorization form to fit your business needs. You can add your company logo, tailor the fields to capture necessary information, and set up workflows to automate the approval processes.

-

Is airSlate SignNow cost-effective for small businesses looking to implement payroll deduction forms?

Absolutely! airSlate SignNow offers competitive pricing plans that cater specifically to small businesses. By implementing payroll deduction authorization forms digitally, you can save on printing and administrative costs, making it a budget-friendly choice.

-

What integrations does airSlate SignNow offer for managing payroll deduction authorization forms?

airSlate SignNow integrates seamlessly with various HR and payroll systems, allowing you to manage your payroll deduction authorization forms alongside your existing processes. These integrations ensure that data flows smoothly across platforms, reducing the risk of errors and saving time.

-

How secure is the payroll deduction authorization form with airSlate SignNow?

Security is a top priority for airSlate SignNow. All payroll deduction authorization forms are protected with industry-leading encryption, and the platform offers features such as two-factor authentication to ensure that sensitive employee information remains secure throughout the signing process.

-

Can employees fill out payroll deduction authorization forms on their mobile devices?

Yes, airSlate SignNow is mobile-friendly, allowing employees to fill out and eSign payroll deduction authorization forms from their smartphones or tablets. This flexibility enables quicker completion and submission, which is especially beneficial for remote or on-the-go employees.

Get more for Payroll Deduction Authorization Form

- Certificate of participation application american board of form

- St luke application form

- Get the authorization to use and disclose pdffiller form

- Facility ancillary application form

- Miip treatment form pdf

- Hipaa privacy rule authorization form

- Bauthorizationb to share personal binformation formb unitedhealthcare

- Medical certificate form

Find out other Payroll Deduction Authorization Form

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself