Ri Estate Tax Forms

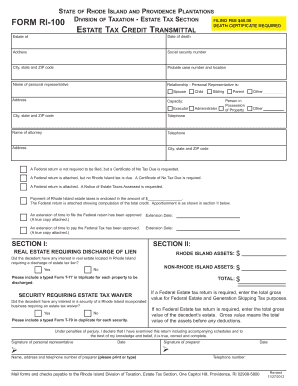

What is the RI Form 100?

The RI Form 100 is the official estate tax return form used in Rhode Island. This form is required for estates that exceed a certain value threshold, which is determined by state law. The purpose of the form is to report the value of the deceased's estate and calculate any estate taxes owed to the state. Understanding the RI Form 100 is essential for executors and administrators of estates, as it ensures compliance with state tax regulations and facilitates the proper distribution of assets.

Steps to Complete the RI Form 100

Completing the RI Form 100 involves several key steps to ensure accuracy and compliance. Here is a general outline of the process:

- Gather necessary documentation, including the death certificate, asset valuations, and any debts owed by the estate.

- Calculate the total value of the estate, including real estate, personal property, and financial accounts.

- Complete the form by entering the required information, ensuring that all values are accurate and reflect the current market conditions.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with any required supporting documents to the appropriate state office.

Legal Use of the RI Form 100

The RI Form 100 must be completed and filed in accordance with Rhode Island state law. It is legally binding and serves as the official record of the estate's tax obligations. Proper use of the form ensures that the estate is in compliance with tax regulations, thereby avoiding potential penalties or legal issues. Executors should be aware of the legal implications of the information reported on the form, as inaccuracies can lead to audits or disputes with the state.

Filing Deadlines / Important Dates

Filing deadlines for the RI Form 100 are critical to avoid penalties. The form must be filed within nine months of the date of death of the decedent. If the return is not filed within this timeframe, the estate may incur interest and penalties on any taxes owed. Executors should also be aware of any extensions that may be available, as well as the specific dates for payment of any estate taxes due.

Required Documents

To complete the RI Form 100 accurately, certain documents are required. These include:

- The death certificate of the deceased.

- Valuations of all assets within the estate, including real estate, bank accounts, and personal property.

- Documentation of any debts or liabilities that the estate must settle.

- Any previous tax returns or documents that may impact the estate's tax obligations.

Who Issues the Form

The RI Form 100 is issued by the Rhode Island Division of Taxation. This state agency is responsible for overseeing tax compliance and ensuring that all estate tax returns are processed according to state laws. Executors and administrators can obtain the form directly from the Division of Taxation's website or by contacting their office for assistance.

Quick guide on how to complete ri estate tax forms

Complete Ri Estate Tax Forms seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage Ri Estate Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Ri Estate Tax Forms effortlessly

- Obtain Ri Estate Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it onto your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing out new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ri Estate Tax Forms and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri estate tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ri form 100 and why is it important?

The ri form 100 is a tax form used by businesses in Rhode Island to report their income, credits, and taxes owed. It is important because it helps ensure compliance with state tax laws and allows businesses to accurately calculate their tax obligations.

-

Can airSlate SignNow help me complete my ri form 100?

Yes, airSlate SignNow provides an easy-to-use platform for filling out and eSigning documents, including the ri form 100. With features like templates and easy editing, you can complete your form efficiently while ensuring it's accurate and ready for submission.

-

Is airSlate SignNow cost-effective for filing ri form 100?

Absolutely! airSlate SignNow offers affordable pricing plans that can fit various budgets, making it a cost-effective solution for filing your ri form 100. You can manage multiple forms without incurring signNow costs.

-

What features does airSlate SignNow offer for the ri form 100?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure cloud storage, all designed to streamline the process of filling out the ri form 100. These features enhance accuracy and efficiency in document management.

-

Are there integrations available for handling ri form 100 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to import and export data easily when working on the ri form 100. This integration helps to streamline your workflow and improve overall productivity.

-

How does airSlate SignNow ensure the security of my ri form 100?

airSlate SignNow takes security seriously, employing encryption and secure access protocols to protect your ri form 100. You can eSign and share documents confidently without the fear of unauthorized access or data bsignNowes.

-

Can I store my completed ri form 100 in airSlate SignNow?

Yes, once you complete your ri form 100, you can securely store it in your airSlate SignNow account. This feature allows you to access your documents anytime and ensures they are safely backed up in a cloud-based environment.

Get more for Ri Estate Tax Forms

- How do i sign the online pa100 2006 form

- 2016 property tax or rent rebate claim pa 1000 formspublications

- Statement of financial condition for individuals rev 488 formspublications

- 2015 pennsylvania income tax return pa 40 revenuepagov form

- Sc 2644 on line hacienda 2012 form

- 2011 form 48020 puerto rico 2000

- 499 r 1b 2012 form

- Forma c2745 2003

Find out other Ri Estate Tax Forms

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online