Schedule D Form 1065 Capital Gains and Losses 2010

What is the Schedule D Form 1065 Capital Gains And Losses

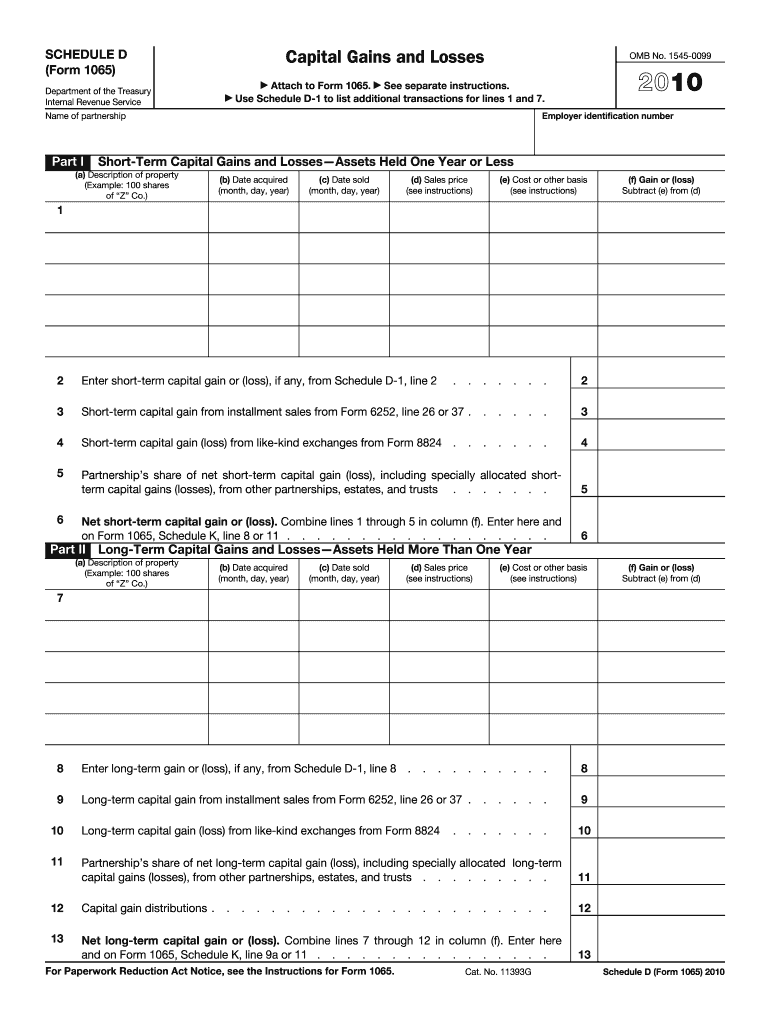

The Schedule D Form 1065 is a tax document used by partnerships to report capital gains and losses. This form is essential for partnerships that need to disclose the sale of assets, including stocks, bonds, and real estate. The information reported on this form is then passed on to the partners, who must include it in their individual tax returns. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D Form 1065 Capital Gains And Losses

Using the Schedule D Form 1065 involves several steps. First, gather all necessary financial records related to capital transactions. Next, complete the form by detailing each capital gain or loss, including the date of acquisition, date of sale, and the gain or loss amount. After filling out the form, ensure that it is included with the partnership's tax return. It is important for partners to review the information to ensure accuracy before submission.

Steps to complete the Schedule D Form 1065 Capital Gains And Losses

Completing the Schedule D Form 1065 requires careful attention to detail. Follow these steps:

- Collect all relevant documents, such as purchase and sale agreements.

- List each asset sold, including the acquisition and sale dates.

- Calculate the capital gain or loss for each transaction.

- Fill in the appropriate sections of the form with the calculated amounts.

- Review the completed form for accuracy.

- Submit the form along with the partnership's tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule D Form 1065. These guidelines include instructions on how to report various types of capital gains and losses, including short-term and long-term transactions. It is essential to refer to the latest IRS instructions to ensure compliance with current tax laws and to avoid errors that could lead to penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1065 align with the partnership's tax return due date. Generally, partnerships must file their tax returns by the fifteenth day of the third month following the end of their tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is crucial to be aware of these dates to avoid late filing penalties.

Penalties for Non-Compliance

Failing to file the Schedule D Form 1065 or inaccuracies in reporting can result in penalties from the IRS. These penalties may include fines for late filing, as well as additional taxes owed due to underreporting income. It is important for partnerships to ensure that all information is accurate and submitted on time to avoid these consequences.

Quick guide on how to complete 2010 schedule d form 1065 capital gains and losses

Easily Prepare Schedule D Form 1065 Capital Gains And Losses on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary forms and safely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without interruptions. Handle Schedule D Form 1065 Capital Gains And Losses on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

Effortlessly Edit and eSign Schedule D Form 1065 Capital Gains And Losses

- Find Schedule D Form 1065 Capital Gains And Losses and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Modify and eSign Schedule D Form 1065 Capital Gains And Losses to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule d form 1065 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule d form 1065 capital gains and losses

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Schedule D Form 1065 Capital Gains And Losses?

The Schedule D Form 1065 Capital Gains And Losses is used by partnerships to report gains and losses from the sale of capital assets. It details the disposition of capital assets and helps in calculating the overall capital gains for a partnership. Understanding this form is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow assist with the Schedule D Form 1065 Capital Gains And Losses?

airSlate SignNow simplifies the process of eSigning and sending the Schedule D Form 1065 Capital Gains And Losses. Our platform ensures that documents are securely signed and quickly sent, enhancing operational efficiency for tax reporting. This helps businesses focus on their finances without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, making it cost-effective for managing documents like the Schedule D Form 1065 Capital Gains And Losses. Each plan includes features designed to streamline document workflows and improve productivity. You can select a plan that fits your requirements without overspending.

-

What features does airSlate SignNow provide for handling capital gains documents?

airSlate SignNow offers features like customizable templates, secure electronic signatures, and document tracking that enhance your experience with capital gains documents such as the Schedule D Form 1065 Capital Gains And Losses. These tools help streamline the signing process while ensuring compliance and security in document management.

-

Can I integrate airSlate SignNow with other software for enhanced functionality?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to optimize workflows related to tax documentation like the Schedule D Form 1065 Capital Gains And Losses. This integration capability enables you to sync data across platforms, improving overall efficiency and reducing manual entry.

-

How secure is the information processed through airSlate SignNow?

airSlate SignNow prioritizes security by employing industry-standard encryption to protect your data, including documents like the Schedule D Form 1065 Capital Gains And Losses. Our platform undergoes regular security assessments, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with digital signing?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to send and eSign documents such as the Schedule D Form 1065 Capital Gains And Losses. Our intuitive interface ensures that even those unfamiliar with digital signing can navigate through the process without difficulty, promoting accessibility.

Get more for Schedule D Form 1065 Capital Gains And Losses

- About form 8689 allocation of individual income tax to the us

- Publication 1494 rev 2021 internal revenue service form

- 2020 schedule a form 940 multi state employer and credit reduction information

- About schedule k form 990 supplemental information on

- Reason for public charity status form

- About form 8959 additional medicare taxinternal revenue

- 2020 instructions for form 1120 h internal revenue service

- Schedule g supplemental information regarding form 990 or

Find out other Schedule D Form 1065 Capital Gains And Losses

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile