Form 3520 a 2012

What is the Form 3520 A

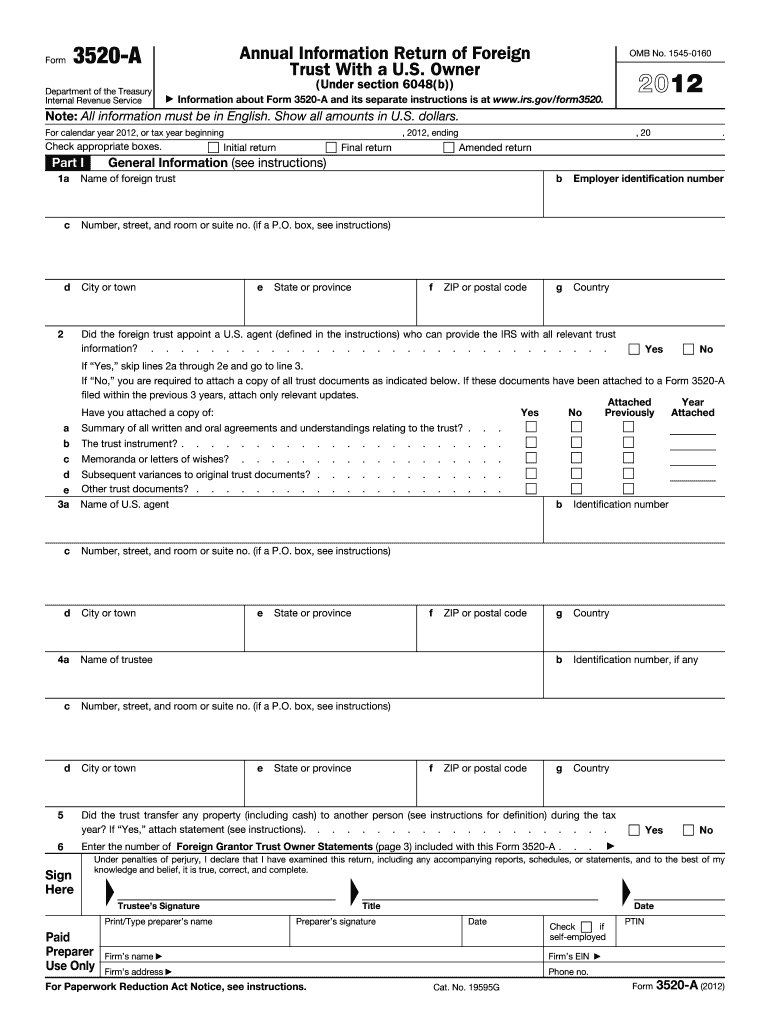

The Form 3520 A is an informational return that U.S. taxpayers must file to report transactions with foreign trusts and the receipt of certain foreign gifts. This form is crucial for ensuring compliance with U.S. tax laws regarding foreign assets. It is specifically designed for reporting the activities of foreign trusts, including the trust's income and distributions made to U.S. beneficiaries. Understanding the purpose of Form 3520 A is essential for individuals involved with foreign trusts to avoid potential penalties.

How to use the Form 3520 A

Using the Form 3520 A involves accurately reporting all relevant information regarding the foreign trust and any distributions received. Taxpayers must complete the form by providing details about the trust, including its name, address, and taxpayer identification number. Additionally, information about any distributions received by U.S. beneficiaries must be included. It is important to ensure that all sections of the form are filled out completely and accurately to comply with IRS regulations.

Steps to complete the Form 3520 A

Completing the Form 3520 A requires careful attention to detail. Follow these steps to ensure accurate submission:

- Gather necessary documents, including trust agreements and records of distributions.

- Fill out the identification section with the trust's details.

- Report the income earned by the trust during the tax year.

- Detail any distributions made to U.S. beneficiaries, including amounts and dates.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Legal use of the Form 3520 A

The legal use of Form 3520 A is governed by IRS regulations, which mandate that U.S. taxpayers report foreign trusts to maintain compliance with tax laws. Failure to file this form or inaccuracies in reporting can lead to significant penalties. The form must be filed in accordance with the rules set forth in the Internal Revenue Code, ensuring that all required information is disclosed to the IRS. Proper use of the form helps protect taxpayers from legal repercussions and demonstrates transparency in financial dealings with foreign trusts.

Filing Deadlines / Important Dates

Filing deadlines for Form 3520 A are critical for compliance. The form is generally due on the 15th day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the form is due by April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should be aware of these dates to avoid late filing penalties and ensure timely submission of their tax documents.

Penalties for Non-Compliance

Non-compliance with Form 3520 A can result in severe penalties. The IRS imposes a penalty of up to $10,000 for failing to file the form or for filing it late. Additional penalties may apply if the failure to report is deemed willful. It is crucial for taxpayers to understand these consequences and to file the form accurately and on time to avoid incurring these financial penalties. Seeking professional advice can help ensure compliance and mitigate risks associated with non-filing.

Quick guide on how to complete 2012 form 3520 a

Effortlessly Prepare Form 3520 A on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed paperwork, enabling you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without complications. Manage Form 3520 A on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

Efficiently Edit and eSign Form 3520 A with Ease

- Locate Form 3520 A and select Get Form to begin.

- Utilize the tools available to complete your document.

- Mark important sections or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form 3520 A while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 3520 a

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 3520 a

The best way to create an eSignature for a PDF online

The best way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

How to generate an electronic signature for a PDF file on Android

People also ask

-

What is Form 3520 A and why is it important?

Form 3520 A is an annual information return required by the IRS for foreign trusts and their U.S. owners. It is important because it provides crucial information regarding the trust's activities and transactions, ensuring compliance with U.S. tax laws.

-

How does airSlate SignNow facilitate the process of signing Form 3520 A?

airSlate SignNow simplifies the process of signing Form 3520 A by allowing users to electronically sign documents securely and efficiently. Our platform ensures that the signature process is compliant with legal standards, making it easier for you to manage your forms.

-

What are the pricing options for using airSlate SignNow to manage Form 3520 A?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Whether you're a small business or a large enterprise, you can choose a plan that provides the features necessary to manage documents like Form 3520 A effectively.

-

Can I integrate airSlate SignNow with other tools for managing Form 3520 A?

Yes, airSlate SignNow offers seamless integrations with a variety of third-party applications. This means you can connect with your favorite accounting or tax software to streamline the process of managing Form 3520 A and other important documents.

-

What are the key features of airSlate SignNow for managing Form 3520 A?

Key features of airSlate SignNow for managing Form 3520 A include customizable templates, in-app notifications, and advanced security options. These features help ensure that your documents are completed accurately and securely, providing peace of mind during the filing process.

-

Is airSlate SignNow compliant with legal requirements for Form 3520 A?

Absolutely. airSlate SignNow is designed to comply with all legal requirements for electronic signatures, including those for Form 3520 A. Our compliance ensures that your signed documents are valid and enforceable.

-

How can airSlate SignNow benefit my business when dealing with Form 3520 A?

By using airSlate SignNow for Form 3520 A, your business can reduce turnaround times and increase efficiency in document management. The easy-to-use interface helps streamline the signing process, enhancing productivity and allowing teams to focus on more important tasks.

Get more for Form 3520 A

- 2020 instructions for form 1099 k instructions for form 1099 k payment card and third party network transactions

- Pdf atf form 1 bureau of alcohol tobacco firearms and explosives

- 2020 form 2441 child and dependent care expenses

- 2020 form 1042 annual withholding tax return for us source income of foreign persons

- 2020 schedule b form 1040 internal revenue service

- Federal vita intakeinterview ampampamp quality review sheet form

- 2020 form 1120 ric internal revenue service

- Form 1120 f schedules m 1 m 2

Find out other Form 3520 A

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form