1040 Form 1994

What is the 1040 Form

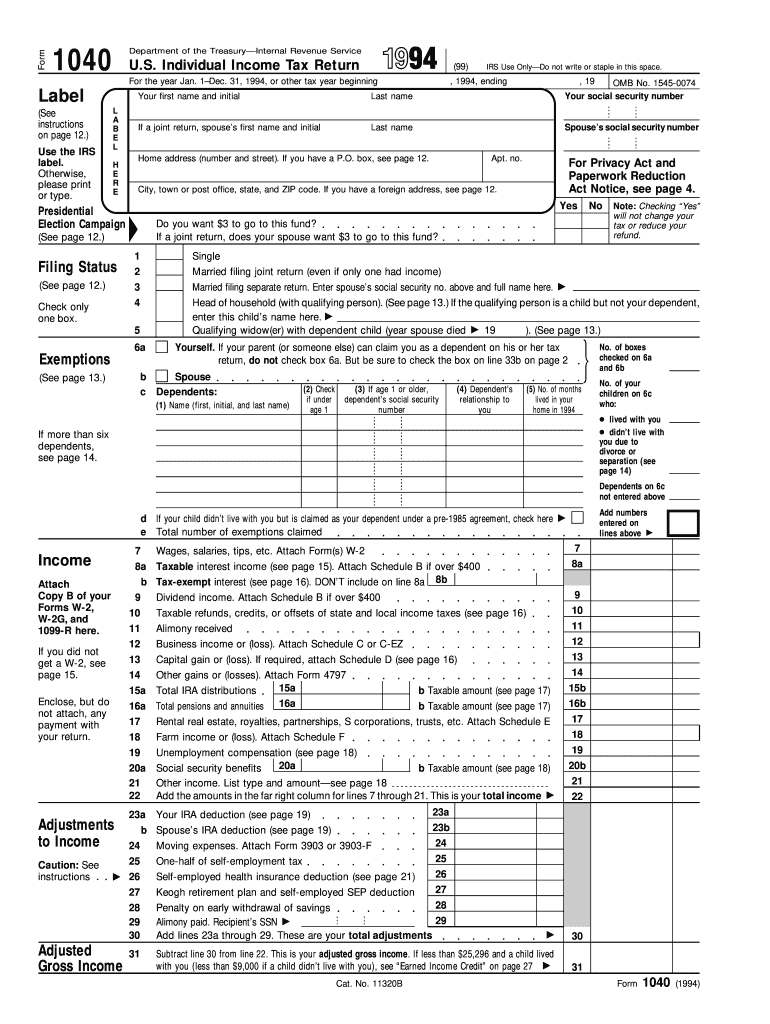

The 1040 Form is a standard federal income tax form used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form allows taxpayers to calculate their tax liability, claim deductions and credits, and determine whether they owe additional taxes or are entitled to a refund. The 1040 Form is essential for anyone who has earned income, including wages, self-employment income, and investment income. It serves as a comprehensive document that captures various financial details necessary for accurate tax reporting.

Steps to complete the 1040 Form

Completing the 1040 Form involves several key steps to ensure accuracy and compliance with IRS guidelines. Here is a simplified process:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and records of other income.

- Determine filing status: Identify your filing status, such as single, married filing jointly, or head of household, as this affects your tax rates and deductions.

- Fill out personal information: Enter your name, address, Social Security number, and information for any dependents.

- Report income: List all sources of income on the appropriate lines of the form, including wages, dividends, and capital gains.

- Claim deductions and credits: Identify and apply any eligible deductions and tax credits to reduce your taxable income.

- Calculate tax liability: Use the IRS tax tables or tax computation worksheet to determine your tax owed based on your taxable income.

- Sign and date the form: Ensure that you sign and date the form before submitting it to the IRS.

How to obtain the 1040 Form

The 1040 Form can be obtained through several convenient methods. Taxpayers can download the form directly from the IRS website, where it is available in PDF format. Alternatively, individuals can request a physical copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs also include the 1040 Form, allowing users to complete it electronically. Additionally, some libraries and community centers may provide printed copies of the form during tax season.

Legal use of the 1040 Form

The 1040 Form is legally binding when accurately completed and submitted to the IRS. It is essential to provide truthful information, as any discrepancies or fraudulent claims can result in penalties, including fines or legal action. Taxpayers are encouraged to retain copies of their filed forms and supporting documents for at least three years, as the IRS may audit returns during this period. Understanding the legal implications of the 1040 Form helps ensure compliance with tax laws and regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Form are crucial for taxpayers to avoid penalties. Typically, the deadline for submitting the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can request an extension to file, which usually provides an additional six months, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. It is important to stay informed about these dates to ensure timely and compliant tax filing.

Digital vs. Paper Version

Taxpayers have the option to file the 1040 Form either digitally or on paper. Filing electronically is often faster and more efficient, allowing for quicker processing and refunds. E-filing also reduces the risk of errors, as many software programs provide prompts and checks for common mistakes. Conversely, filing a paper version may be preferred by those who are not comfortable with technology or who wish to maintain a physical record. Both methods are valid, but understanding the benefits of each can help taxpayers choose the best approach for their needs.

Quick guide on how to complete 1994 1040 form

Complete 1040 Form seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your paperwork quickly without delays. Work on 1040 Form from any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to alter and eSign 1040 Form effortlessly

- Locate 1040 Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign 1040 Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1994 1040 form

Create this form in 5 minutes!

How to create an eSignature for the 1994 1040 form

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the 1040 Form and why do I need it?

The 1040 Form is a standard IRS form used by individual taxpayers to file their annual income tax returns. It includes information on your income, deductions, and tax credits. Using airSlate SignNow, you can easily eSign and submit your 1040 Form securely, ensuring you meet all filing deadlines.

-

How can airSlate SignNow help me with my 1040 Form?

airSlate SignNow offers an intuitive platform that allows you to complete, eSign, and send your 1040 Form effortlessly. With features like document templates and automated workflows, you can streamline the filing process and avoid errors, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for my 1040 Form?

Yes, airSlate SignNow provides several pricing plans to fit different needs, including options for individuals and businesses. You can choose a plan that offers the best value for your requirements when handling documents like the 1040 Form, ensuring you have access to all necessary features.

-

Can I integrate airSlate SignNow with other applications while filling out my 1040 Form?

Absolutely! airSlate SignNow supports integrations with various applications like Google Drive, Dropbox, and more. This means you can easily import and export your 1040 Form and other documents, streamlining your workflow and enhancing productivity.

-

What features does airSlate SignNow offer for managing my 1040 Form?

airSlate SignNow includes features such as customizable templates, in-person signing, and audit trails to ensure your 1040 Form is completed accurately and securely. Additionally, you can track the status of your documents and receive notifications when they are signed.

-

Is it safe to eSign my 1040 Form using airSlate SignNow?

Yes, it is completely safe to eSign your 1040 Form with airSlate SignNow. The platform uses advanced encryption and security measures to protect your sensitive information, ensuring that your tax documents are secure during the signing process.

-

How do I get started with airSlate SignNow for my 1040 Form?

Getting started with airSlate SignNow is simple. Just sign up for an account, upload your 1040 Form, and begin filling it out. You can then add eSignatures, share the document with others, and submit it directly to the IRS.

Get more for 1040 Form

- 2020 form 8879 pe irs e file signature authorization for form 1065

- Form 656 l offer in compromise internal revenue service

- 2020 schedule d form 1120 capital gains and losses

- P15pdf department of the treasury internal revenue service form

- 2020 form 1045 application for tentative refund

- 2020 schedule f form 990 statement of activities outside the united states

- 2020 instructions for schedule k 1 form 1041 for a beneficiary filing form 1040 or 1040 sr instructions for schedule k 1 form

- Get the internal revenue service department of the form

Find out other 1040 Form

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple