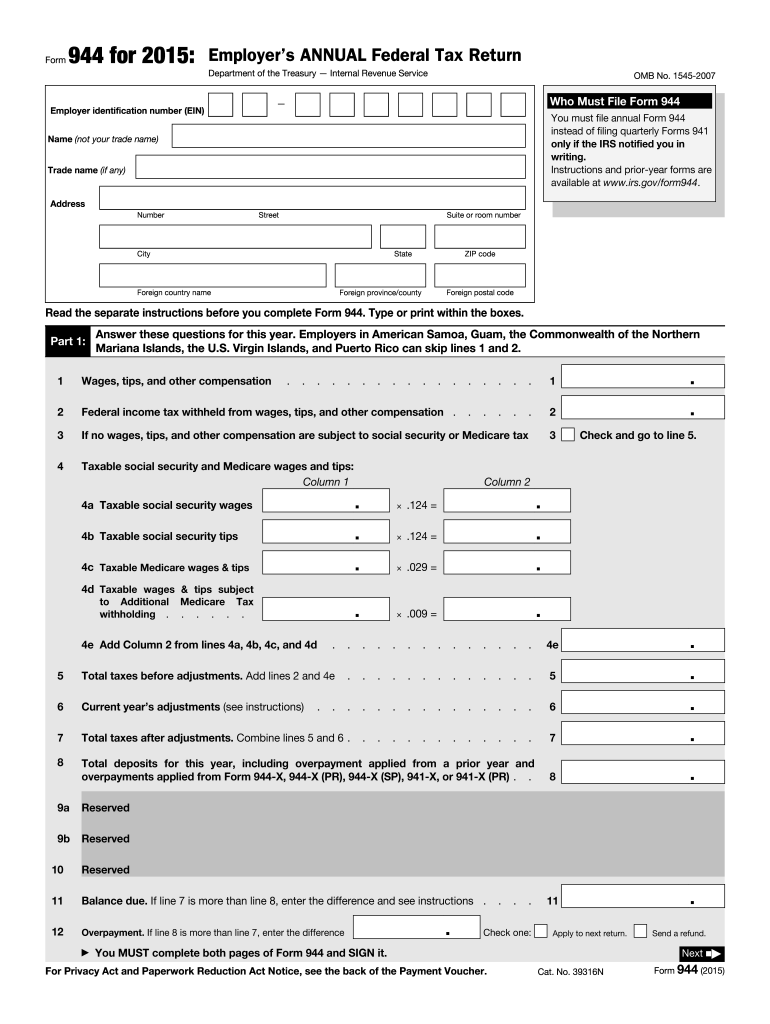

Irs Tax Return Form 2015

What is the IRS Tax Return Form

The IRS Tax Return Form is a crucial document that individuals and businesses in the United States use to report their income, calculate their tax liability, and claim any applicable tax credits or deductions. This form is essential for compliance with federal tax laws and is typically filed annually. The most common version for individuals is the Form 1040, while businesses may use forms such as the 1120 for corporations or the 1065 for partnerships. Understanding the purpose and requirements of the IRS Tax Return Form is vital for accurate and timely filing.

How to Obtain the IRS Tax Return Form

Obtaining the IRS Tax Return Form is straightforward. Taxpayers can access the forms through the official IRS website, where they can download and print them for free. Additionally, many tax preparation software programs include the necessary forms as part of their services. For those who prefer physical copies, forms can also be requested by mail from the IRS or picked up at local IRS offices and some public libraries. Ensuring you have the correct form for your specific tax situation is important for accurate filing.

Steps to Complete the IRS Tax Return Form

Completing the IRS Tax Return Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and receipts for deductions.

- Choose the correct form based on your filing status and income type.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your documents into the appropriate sections.

- Calculate your tax liability using the provided tax tables or software.

- Claim any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the completed form for accuracy before signing and dating it.

- Submit the form by the deadline, either electronically or by mail.

Legal Use of the IRS Tax Return Form

The IRS Tax Return Form serves as a legal declaration of income and tax obligations. It is essential for individuals and businesses to ensure that the information provided is accurate and complete, as discrepancies can lead to audits or penalties. The form must be signed, and eSignatures are legally recognized under the ESIGN Act, provided that the signing process meets specific criteria. Using a secure platform for electronic submission can help maintain compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Tax Return Form are critical to avoid penalties. For most individual taxpayers, the deadline is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Businesses may have different deadlines depending on their entity type. It is important to stay informed about these dates to ensure timely submission and avoid late fees.

Required Documents

To accurately complete the IRS Tax Return Form, several documents are typically required:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Receipts for deductible expenses, including medical bills, charitable contributions, and business expenses.

- Previous year’s tax return, which can provide useful reference information.

Form Submission Methods

Taxpayers have several options for submitting the IRS Tax Return Form. The most common methods include:

- Online filing through tax preparation software, which often provides guidance and ensures accuracy.

- Mailing a paper form to the appropriate IRS address, based on the taxpayer's state of residence.

- In-person submission at local IRS offices, where assistance may be available.

Quick guide on how to complete 2015 irs tax return form

Complete Irs Tax Return Form effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without holdups. Manage Irs Tax Return Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Irs Tax Return Form with ease

- Obtain Irs Tax Return Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign Irs Tax Return Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs tax return form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs tax return form

The best way to create an eSignature for a PDF in the online mode

The best way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is an IRS Tax Return Form and why do I need it?

An IRS Tax Return Form is a document that individuals and businesses use to report their income, expenses, and other tax-related information to the Internal Revenue Service. Using the correct IRS Tax Return Form is crucial for ensuring compliance with tax laws and determining your tax liability or refund.

-

How can airSlate SignNow help me with my IRS Tax Return Form?

airSlate SignNow simplifies the process of preparing and submitting your IRS Tax Return Form by allowing you to easily eSign and send documents securely. Our platform ensures that your tax documents are handled efficiently and securely, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for IRS Tax Return Forms?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different needs, from individual users to large businesses. Our cost-effective solution provides access to essential features for managing and eSigning your IRS Tax Return Form without breaking the bank.

-

What features does airSlate SignNow offer for IRS Tax Return Form management?

airSlate SignNow offers a range of features for managing your IRS Tax Return Form, including customizable templates, document sharing, and eSigning capabilities. These tools streamline the process, ensuring you can complete your tax return quickly and accurately.

-

Can I integrate airSlate SignNow with my accounting software for IRS Tax Return Forms?

Yes, airSlate SignNow seamlessly integrates with popular accounting software such as QuickBooks and Xero. This integration allows you to efficiently manage your IRS Tax Return Form alongside your financial data, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for IRS Tax Return Forms?

Using airSlate SignNow for your IRS Tax Return Form provides numerous benefits, including enhanced security, ease of use, and improved workflow efficiency. Our platform allows you to track the status of your documents and ensures compliance with IRS regulations.

-

Is airSlate SignNow compliant with IRS regulations for eSigning IRS Tax Return Forms?

Yes, airSlate SignNow complies with IRS regulations for eSigning documents, ensuring that your IRS Tax Return Form meets all necessary legal requirements. Our platform uses advanced security measures to protect your sensitive tax information.

Get more for Irs Tax Return Form

Find out other Irs Tax Return Form

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now