Kern County Grant Deed Form

What is the Kern County Grant Deed Form

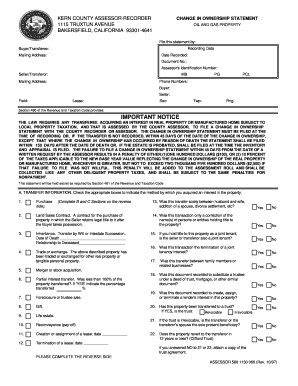

The Kern County Grant Deed Form is a legal document used to transfer property ownership in Kern County, California. This form is essential for ensuring that the title of the property is conveyed from the seller to the buyer. It includes important details such as the names of the parties involved, a description of the property, and any specific terms of the transfer. Unlike other types of deeds, a grant deed guarantees that the property has not been sold to anyone else and that it is free from undisclosed encumbrances.

How to use the Kern County Grant Deed Form

To effectively use the Kern County Grant Deed Form, start by obtaining the blank form from the Kern County Recorder's Office or a trusted online source. Fill out the form with accurate information regarding the property and the parties involved. It is important to ensure that all details are correct to avoid any legal complications. Once completed, the form must be signed by the grantor (the person transferring the property) in the presence of a notary public. After notarization, the document should be filed with the Kern County Recorder's Office to make the transfer official.

Key elements of the Kern County Grant Deed Form

Several key elements must be included in the Kern County Grant Deed Form for it to be valid. These include:

- Grantor and Grantee Information: Full names and addresses of the seller and buyer.

- Property Description: A detailed description of the property being transferred, including its legal description.

- Consideration: The amount paid for the property, which may be stated as a dollar amount or as "for love and affection."

- Signature and Notarization: The grantor's signature, along with the notarization to verify the identity of the signer.

Steps to complete the Kern County Grant Deed Form

Completing the Kern County Grant Deed Form involves several important steps:

- Obtain the blank grant deed form from the Kern County Recorder's Office or a reliable source.

- Fill in the grantor and grantee information accurately.

- Provide a detailed description of the property, ensuring it meets legal requirements.

- State the consideration amount for the property transfer.

- Sign the form in the presence of a notary public.

- Submit the completed form to the Kern County Recorder's Office for filing.

Legal use of the Kern County Grant Deed Form

The legal use of the Kern County Grant Deed Form is crucial for ensuring that property transfers are recognized by law. This form serves as a public record of the ownership change and protects the rights of both the grantor and grantee. It is important to comply with California state laws regarding property transfers, including proper execution and filing procedures. Failure to use the grant deed correctly may result in disputes over property ownership or claims against the title.

How to obtain the Kern County Grant Deed Form

The Kern County Grant Deed Form can be obtained through various means. It is available at the Kern County Recorder's Office, where individuals can request a physical copy. Additionally, many online resources provide downloadable versions of the form. It is advisable to ensure that the form is the most current version to comply with local regulations. Always verify the source to avoid using outdated or incorrect forms.

Quick guide on how to complete kern county grant deed form

Complete Kern County Grant Deed Form easily on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Kern County Grant Deed Form on any device with airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The simplest way to edit and eSign Kern County Grant Deed Form without effort

- Locate Kern County Grant Deed Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important parts of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Kern County Grant Deed Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the kern county grant deed form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a grant deed in Kern County?

A grant deed in Kern County is a legal document that transfers ownership of real estate from one party to another. It guarantees that the property is free of any encumbrances unless stated otherwise. Understanding how a grant deed works is essential for anyone involved in real estate transactions in Kern County.

-

How can airSlate SignNow assist with grant deeds in Kern County?

AirSlate SignNow streamlines the process of preparing and signing grant deeds in Kern County. With our eSignature solution, you can securely send documents to multiple parties and track their progress. This ensures that your grant deed is executed quickly and efficiently, saving you time and hassle.

-

What are the costs associated with using airSlate SignNow for grant deeds in Kern County?

AirSlate SignNow offers affordable pricing plans tailored to meet your needs, making it cost-effective for managing grant deeds in Kern County. You can choose from several subscription options, allowing you to select the plan that best fits your budget. Plus, the time saved in administration costs can lead to overall savings.

-

Is there a free trial available for airSlate SignNow for grant deeds in Kern County?

Yes, airSlate SignNow offers a free trial that you can use to explore its features for handling grant deeds in Kern County. This trial provides access to all the core functionality needed for eSigning, allowing you to experience its user-friendly interface without any initial investment. It's a great way to see if it's the right fit for your needs.

-

Can I integrate airSlate SignNow with other applications for grant deeds in Kern County?

Absolutely! AirSlate SignNow supports integrations with numerous applications, enabling seamless workflows for grant deeds in Kern County. Whether you use CRM software or document management systems, our platform connects effortlessly, enhancing productivity and simplifying your processes.

-

What features does airSlate SignNow offer for creating grant deeds in Kern County?

AirSlate SignNow provides powerful features for creating grant deeds in Kern County, such as customizable templates, bulk sending, and real-time tracking. You can also use our electronic signature capability to ensure that all parties can sign the document securely from anywhere. This makes it easier to complete the process quickly and efficiently.

-

How secure is airSlate SignNow for handling grant deeds in Kern County?

Security is a top priority at airSlate SignNow, particularly when managing sensitive documents like grant deeds in Kern County. Our platform employs advanced encryption and security measures, including compliance with industry standards, to protect your data. You can trust that your documents will remain confidential and secure throughout the signing process.

Get more for Kern County Grant Deed Form

Find out other Kern County Grant Deed Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors