Wage and Income Transcript Example Form

What is the Wage and Income Transcript Example

The wage and income transcript is a document provided by the IRS that summarizes an individual’s income information for a specific tax year. This transcript includes details from various forms, such as W-2s, 1099s, and other income-related documents. It serves as an official record of earnings and is often required when applying for loans, financial aid, or other situations where proof of income is necessary. Understanding what a wage and income transcript looks like is crucial for taxpayers who need to verify their income for various purposes.

How to Obtain the Wage and Income Transcript Example

To obtain a wage and income transcript, individuals can request it directly from the IRS. There are several methods to do this:

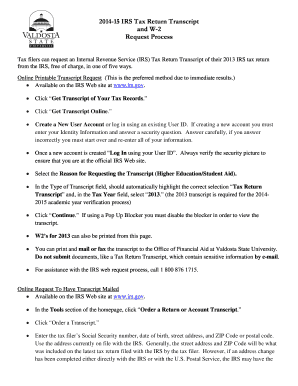

- Online: Use the IRS website to access the "Get Transcript" tool. This option requires creating an account and verifying your identity.

- By Mail: Complete Form 4506-T, Request for Transcript of Tax Return, and send it to the IRS. This method may take longer than the online option.

- By Phone: Call the IRS at and follow the prompts to request your transcript.

It is advisable to have your personal information ready, including your Social Security number, date of birth, and address, to facilitate the process.

Key Elements of the Wage and Income Transcript Example

A wage and income transcript contains several key elements that provide a comprehensive overview of an individual's income for the year:

- Tax Year: Indicates the specific year for which the income is reported.

- Employer Information: Lists the names and Employer Identification Numbers (EINs) of employers who reported wages.

- Income Details: Shows total wages, tips, and other compensation received, as well as any additional income reported on 1099 forms.

- Filing Status: Indicates the taxpayer's filing status for the year, such as single or married filing jointly.

These elements are essential for verifying income and ensuring accuracy when filing taxes or applying for financial assistance.

Legal Use of the Wage and Income Transcript Example

The wage and income transcript is a legally recognized document that can be used in various situations. It is often required for:

- Loan Applications: Lenders may request this transcript to verify income before approving loans or mortgages.

- Financial Aid: Colleges and universities often require this document to assess eligibility for financial aid programs.

- Tax Preparation: Tax preparers may use the transcript to ensure that all income is accurately reported on tax returns.

Using this transcript helps maintain compliance with IRS regulations and provides a reliable source of income verification.

Steps to Complete the Wage and Income Transcript Example

Completing a wage and income transcript involves several steps to ensure that the information is accurate and properly formatted:

- Gather Documents: Collect all relevant income documents, including W-2s and 1099s.

- Access the Transcript: Use the IRS methods to obtain your wage and income transcript.

- Review Information: Carefully check the transcript for any discrepancies or missing information.

- Use as Needed: Provide the transcript as required for loans, financial aid, or tax preparation.

Following these steps helps ensure that the wage and income transcript is complete and accurate, facilitating its use in various applications.

Quick guide on how to complete wage and income transcript example

Effortlessly manage Wage And Income Transcript Example on any device

Web-based document administration has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to design, modify, and electronically sign your documents promptly without any holdups. Manage Wage And Income Transcript Example on any system with the airSlate SignNow applications for Android or iOS, and simplify any document-oriented procedure today.

How to modify and electronically sign Wage And Income Transcript Example with ease

- Obtain Wage And Income Transcript Example and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Finish button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Wage And Income Transcript Example to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage and income transcript example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax transcript example?

A tax transcript example is a record provided by the IRS that summarizes your tax return information. It can help clarify your financial history when applying for loans or verifying income. Understanding a tax transcript example is essential for accurately filling out financial documentation.

-

How can airSlate SignNow assist with obtaining a tax transcript example?

With airSlate SignNow, you can easily sign and send requests for your tax transcript through a secure digital platform. Our user-friendly interface simplifies the process, ensuring you receive your tax transcript example quickly and efficiently. This saves time and enhances productivity, making it an ideal choice for businesses.

-

Are there any costs associated with obtaining a tax transcript example through airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, which may include services related to obtaining your tax transcript example. While the IRS typically does not charge for transcripts, using our service will help streamline your document handling processes for minimal cost. Check our pricing page for detailed information on the best plan for you.

-

What features does airSlate SignNow provide for document signing related to a tax transcript example?

airSlate SignNow offers a suite of features including customizable templates, secure eSigning, and document tracking, all of which enhance the process of obtaining a tax transcript example. These features ensure that your documents are executed quickly and securely, allowing you to focus on your business operations without delays.

-

Is it easy to integrate airSlate SignNow with other tools for tax document management?

Yes, airSlate SignNow integrates seamlessly with various applications that assist in tax document management. These integrations enhance workflow efficiency and allow users to manage their tax transcript example requests and other documents in one place. You can connect with platforms like Google Drive, Dropbox, and more for a streamlined experience.

-

What are the benefits of using airSlate SignNow for managing tax-related documents?

Using airSlate SignNow for managing tax-related documents offers signNow benefits like increased efficiency, reduced paperwork, and enhanced security. It's designed to simplify processes like obtaining a tax transcript example, allowing you to save time and avoid errors in documentation. Plus, our platform ensures your sensitive information is protected.

-

Can I customize a tax transcript example request template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for a tax transcript example request, enabling you to tailor the document to your specific needs. This customization helps ensure all necessary details are included, making the submission process smoother and less error-prone.

Get more for Wage And Income Transcript Example

Find out other Wage And Income Transcript Example

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now