Get PDF FS Form 1522 TreasuryDirect US Legal Forms 2022-2026

Understanding the FS Form 5444

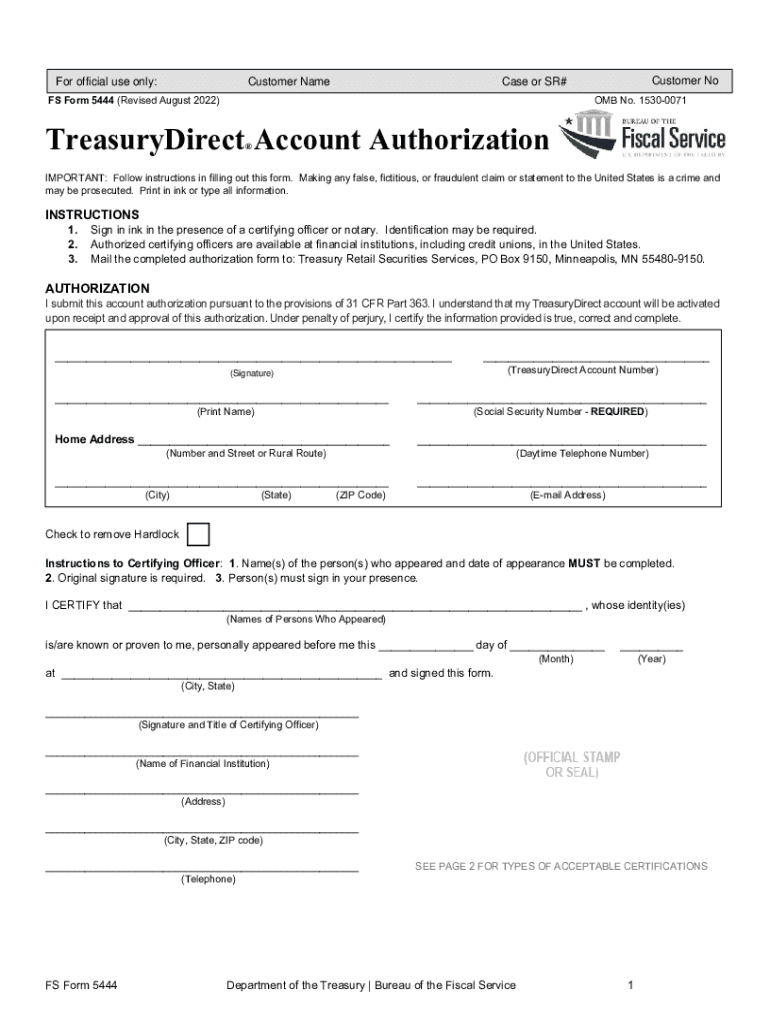

The FS Form 5444, also known as the TreasuryDirect account authorization form, is essential for individuals looking to manage their TreasuryDirect accounts effectively. This form allows account holders to authorize transactions, such as purchases or redemptions of savings bonds and securities. Understanding its purpose and functionality is crucial for anyone engaged with U.S. Treasury securities.

Steps to Complete the FS Form 5444

Completing the FS Form 5444 involves several straightforward steps:

- Begin by downloading the FS Form 5444 PDF from the official TreasuryDirect website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the TreasuryDirect account you wish to authorize.

- Sign and date the form to validate your authorization.

- Submit the completed form as instructed, either online or via mail.

Legal Use of the FS Form 5444

The FS Form 5444 holds legal significance as it serves as a binding agreement between the account holder and the U.S. Department of the Treasury. By submitting this form, you authorize specific transactions on your TreasuryDirect account, making it essential to complete it accurately. Compliance with all instructions ensures that your authorizations are legally recognized.

Required Documents for FS Form 5444 Submission

When submitting the FS Form 5444, certain documents may be required to verify your identity and account details. These can include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of address, such as a utility bill or bank statement.

- Your Social Security card or a document containing your Social Security number.

Form Submission Methods for FS Form 5444

The FS Form 5444 can be submitted through various methods, providing flexibility for account holders:

- Online Submission: If you have an existing TreasuryDirect account, you can log in and submit the form electronically.

- Mail Submission: You can print the completed form and mail it to the designated address provided on the form.

- In-Person Submission: While less common, some individuals may choose to submit the form in person at a local financial institution that handles Treasury securities.

Eligibility Criteria for FS Form 5444

To complete and submit the FS Form 5444, you must meet specific eligibility criteria. These include:

- You must be a U.S. citizen or resident alien.

- You must have an active TreasuryDirect account.

- You must be at least eighteen years old to authorize transactions independently.

Quick guide on how to complete get pdf fs form 1522 treasurydirect us legal forms

Prepare Get PDF FS Form 1522 TreasuryDirect US Legal Forms seamlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Get PDF FS Form 1522 TreasuryDirect US Legal Forms on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

The simplest way to modify and eSign Get PDF FS Form 1522 TreasuryDirect US Legal Forms effortlessly

- Find Get PDF FS Form 1522 TreasuryDirect US Legal Forms and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Get PDF FS Form 1522 TreasuryDirect US Legal Forms while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get pdf fs form 1522 treasurydirect us legal forms

Create this form in 5 minutes!

How to create an eSignature for the get pdf fs form 1522 treasurydirect us legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TreasuryDirect account authorization?

A TreasuryDirect account authorization allows individuals to manage their investments in U.S. Treasury securities online. This authorization grants access to your account for activities such as purchasing, redeeming, and transferring securities, ensuring a seamless experience with your TreasuryDirect account.

-

How can I obtain a TreasuryDirect account authorization?

To obtain a TreasuryDirect account authorization, you must first set up a TreasuryDirect account by providing your personal information and banking details. Once your account is established, you can manage authorization settings to allow access for specific transactions or activities related to your investments.

-

What are the benefits of using TreasuryDirect account authorization?

The main benefits of TreasuryDirect account authorization include simplified management of your treasury investments, secure online access to your account, and the ability to perform transactions efficiently. This ensures you have full control over your investments while accessing essential services at your convenience.

-

Is there a cost associated with TreasuryDirect account authorization?

No, there are no fees associated with establishing a TreasuryDirect account authorization. The service is free, allowing you to manage your treasury securities without incurring any additional costs.

-

Can I integrate TreasuryDirect account authorization with other financial tools?

Yes, you can integrate your TreasuryDirect account authorization with various financial management tools to enhance your investment tracking. This allows you to monitor your treasury securities alongside your other financial assets efficiently.

-

How does TreasuryDirect account authorization work with airSlate SignNow?

With airSlate SignNow, you can streamline the process of managing your TreasuryDirect account authorization by sending and eSigning necessary documents electronically. This integration simplifies your interaction with TreasuryDirect, making it easier to fulfill authorization requirements securely.

-

What features should I look for in a TreasuryDirect account authorization tool?

When choosing a tool for TreasuryDirect account authorization, look for features like user-friendly interfaces, security protocols, document management capabilities, and efficient eSigning solutions. These features enhance your experience and ensure that your account is managed effectively.

Get more for Get PDF FS Form 1522 TreasuryDirect US Legal Forms

- Certification candidates must submit the entire certification application package including the test form

- How to get in transit vehicle permits temporary registrations form

- Request for interim extension license form

- Wwwdmvvirginiagovwebdocpdfdrivers license and identification card application virginia form

- Illinoistemporary visitor drivers license tvdl quick guide chinese form

- Self service storage facility form

- Si tiene una queja en contra de su abogado state bar of form

- Jis code pem form

Find out other Get PDF FS Form 1522 TreasuryDirect US Legal Forms

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document