MAIL to Washington State Department of Revenue JanDec 2021

Understanding the MAIL TO Washington State Department Of Revenue

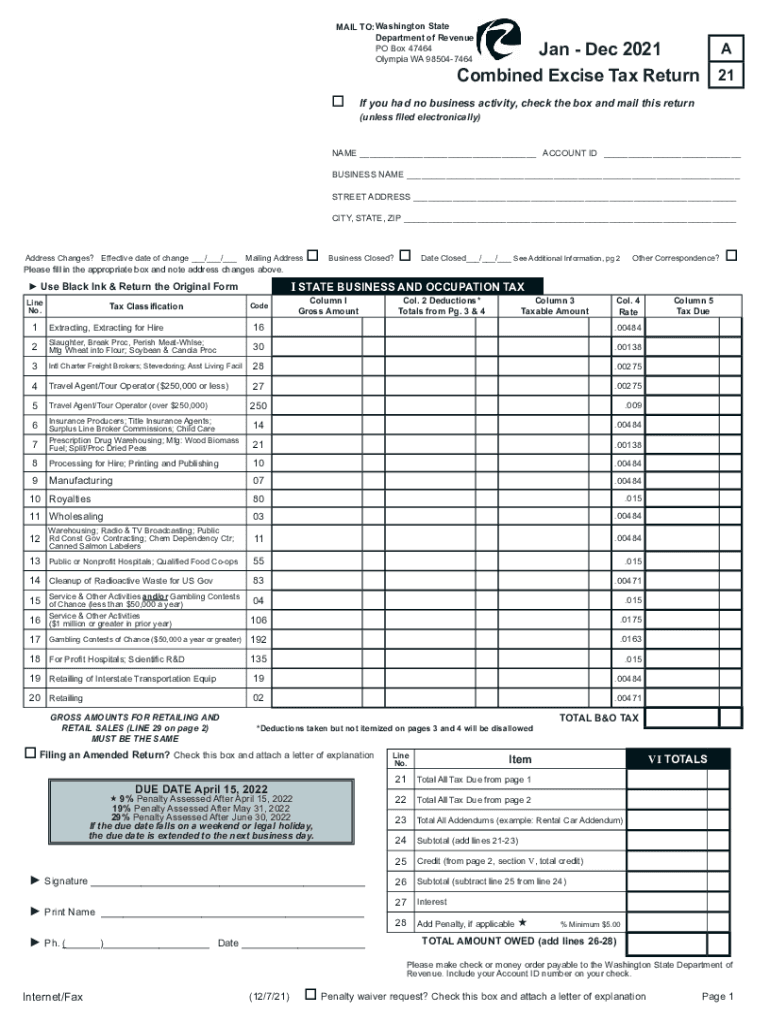

The MAIL TO Washington State Department Of Revenue is a crucial component for individuals and businesses required to file their excise tax returns. This form serves as a formal submission to the state, ensuring compliance with local tax regulations. It is essential to understand the specific requirements and procedures associated with this form to avoid any potential issues.

Steps to Complete the MAIL TO Washington State Department Of Revenue

Completing the MAIL TO Washington State Department Of Revenue involves several important steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Fill out the form accurately, ensuring all fields are completed as required.

- Double-check for any errors or omissions that could delay processing.

- Sign the form digitally or physically, depending on your submission method.

- Submit the form via the chosen method: online, by mail, or in-person.

Legal Use of the MAIL TO Washington State Department Of Revenue

The legal use of the MAIL TO Washington State Department Of Revenue requires adherence to specific guidelines set forth by the state. This includes ensuring that all information provided is truthful and accurate. Failure to comply with these regulations can result in penalties, including fines or legal action.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines associated with the MAIL TO Washington State Department Of Revenue. Typically, these deadlines align with the end of the fiscal year or specific quarterly periods. Missing these deadlines can lead to late fees and complications with your tax status.

Form Submission Methods

There are multiple methods for submitting the MAIL TO Washington State Department Of Revenue. These include:

- Online submission through the state’s tax portal.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices.

Each method has its own advantages and may be preferred based on individual circumstances.

Required Documents

To successfully complete the MAIL TO Washington State Department Of Revenue, several documents are typically required. These may include:

- Income statements for the reporting period.

- Previous tax returns for reference.

- Any supporting documentation relevant to deductions or credits claimed.

Having these documents ready can streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Non-compliance with the requirements of the MAIL TO Washington State Department Of Revenue can result in various penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes.

- Potential legal action for severe infractions.

Understanding these penalties can motivate timely and accurate submissions.

Quick guide on how to complete mail to washington state department of revenue jandec

Complete MAIL TO Washington State Department Of Revenue JanDec seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Manage MAIL TO Washington State Department Of Revenue JanDec on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign MAIL TO Washington State Department Of Revenue JanDec without effort

- Obtain MAIL TO Washington State Department Of Revenue JanDec and click on Get Form to begin.

- Employ the tools we offer to fill in your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that function.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign MAIL TO Washington State Department Of Revenue JanDec and guarantee exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mail to washington state department of revenue jandec

Create this form in 5 minutes!

How to create an eSignature for the mail to washington state department of revenue jandec

The way to generate an electronic signature for a PDF file in the online mode

The way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an e-signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is wador and how does airSlate SignNow incorporate it?

Wador is an innovative digital document solution designed to streamline the signing process. airSlate SignNow incorporates wador's technology, allowing businesses to easily send and eSign documents without the complexities typically associated with electronic signing.

-

How does wador improve the document signing experience?

Wador enhances the document signing experience by providing a user-friendly interface and seamless integration with various platforms. With airSlate SignNow's implementation of wador, users can expect reduced turnaround times and increased efficiency, ensuring that their signing process is both quick and secure.

-

Is there a cost associated with using wador through airSlate SignNow?

Yes, there is a cost associated with using wador features through airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. You'll find various pricing plans that cater to different needs, ensuring that you can access wador’s capabilities without straining your budget.

-

What are the key features of wador within airSlate SignNow?

Key features of wador within airSlate SignNow include customizable templates, real-time tracking of document status, and multi-party signing capabilities. These features empower users to enhance their workflow efficiency while ensuring compliance and security in document management.

-

How can wador be integrated with other software?

Wador can easily integrate with a variety of business software through airSlate SignNow's open API and pre-built integrations. This flexibility allows businesses to connect wador with tools they already use, simplifying the workflow and improving overall productivity.

-

What benefits will my business gain from using wador with airSlate SignNow?

By using wador with airSlate SignNow, your business will benefit from enhanced efficiency, reduced paperwork, and improved customer satisfaction. The combination of wador's smart features and airSlate SignNow’s reliable service ensures a smoother and more engaging signing experience for all parties involved.

-

Is wador secure for sensitive documents?

Absolutely! Wador, as implemented in airSlate SignNow, prioritizes security, utilizing encryption and authentication measures to protect sensitive documents. Users can rest assured that their information remains confidential and secure throughout the entire signing process.

Get more for MAIL TO Washington State Department Of Revenue JanDec

Find out other MAIL TO Washington State Department Of Revenue JanDec

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer