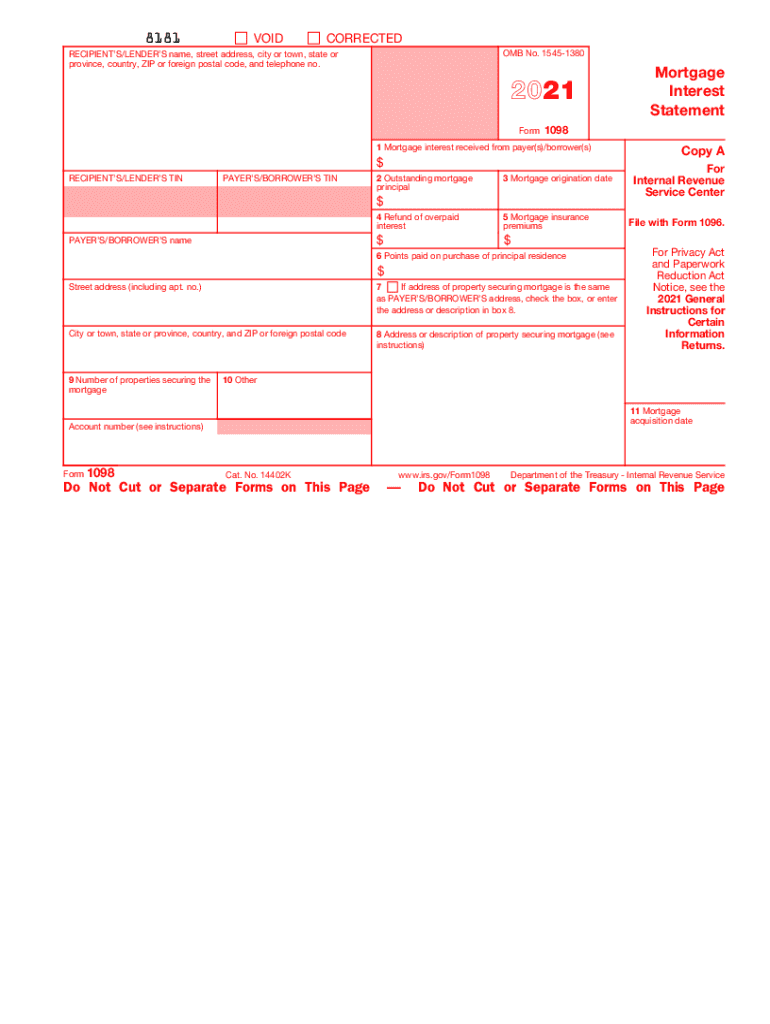

Form 1098 Mortgage Interest Statement 2021

What is the Form 1098 Mortgage Interest Statement

The Form 1098 Mortgage Interest Statement is an essential document used by homeowners in the United States to report mortgage interest payments made during the tax year. This form is issued by lenders to borrowers and serves as a record of the amount of interest paid on a mortgage, which can be deducted from taxable income. The IRS requires this form to ensure accurate reporting of mortgage interest for tax purposes, making it a critical component for those looking to benefit from the mortgage interest deduction.

How to use the Form 1098 Mortgage Interest Statement

To effectively use the Form 1098 Mortgage Interest Statement, taxpayers should first verify that the information provided by the lender is accurate. This includes checking the total interest paid, any points paid on the mortgage, and the outstanding mortgage balance. Taxpayers should then report this information on their annual tax return, typically on Schedule A, where they can claim the mortgage interest deduction. Proper use of this form can significantly reduce taxable income, potentially leading to substantial tax savings.

Steps to complete the Form 1098 Mortgage Interest Statement

Completing the Form 1098 Mortgage Interest Statement involves several key steps. First, ensure that all personal and mortgage details are correctly entered, including the borrower’s name, address, and Social Security number. Next, accurately report the total mortgage interest paid during the year, as well as any points that may be deductible. Finally, submit the completed form to the IRS along with your tax return, ensuring that all information matches the records provided by your lender to avoid discrepancies.

Legal use of the Form 1098 Mortgage Interest Statement

The legal use of the Form 1098 Mortgage Interest Statement is governed by IRS regulations, which stipulate that the information reported must be truthful and accurate. Taxpayers are legally required to report all mortgage interest payments received from their lenders. Failure to do so can result in penalties, including fines or audits by the IRS. It is essential for homeowners to retain this form for their records, as it serves as proof of interest payments made, which may be needed for future tax filings or audits.

Key elements of the Form 1098 Mortgage Interest Statement

Key elements of the Form 1098 Mortgage Interest Statement include the borrower's name, address, and Social Security number, as well as the lender's information. The form details the total amount of mortgage interest paid during the year, any points paid, and the outstanding mortgage balance. Additionally, the form may include information about the property securing the mortgage, which is crucial for accurately reporting tax deductions. Understanding these elements is vital for ensuring accurate tax reporting and compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1098 Mortgage Interest Statement typically align with the annual tax filing deadline. For most taxpayers, this means that the form must be submitted by April 15 of the following year. Lenders are required to provide the Form 1098 to borrowers by January 31, allowing ample time for homeowners to prepare their tax returns. It is important for taxpayers to be aware of these dates to ensure timely and accurate filing, thus avoiding potential penalties.

Who Issues the Form

The Form 1098 Mortgage Interest Statement is issued by mortgage lenders, including banks, credit unions, and other financial institutions that provide home loans. These lenders are responsible for compiling the necessary information regarding the borrower’s mortgage interest payments and providing the form to the borrower by the end of January each year. Homeowners should ensure they receive this form from their lender, as it is crucial for accurately reporting mortgage interest on their tax returns.

Quick guide on how to complete 2021 form 1098 mortgage interest statement

Complete Form 1098 Mortgage Interest Statement effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1098 Mortgage Interest Statement on any gadget with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign Form 1098 Mortgage Interest Statement with ease

- Locate Form 1098 Mortgage Interest Statement and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to store your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require additional printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Form 1098 Mortgage Interest Statement and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 1098 mortgage interest statement

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 1098 mortgage interest statement

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

How can airSlate SignNow help with mortgage document signing?

airSlate SignNow streamlines the mortgage document signing process by allowing users to eSign vital documents quickly and securely. This reduces the time it takes to complete mortgage transactions and ensures that all parties can access necessary documents from anywhere, enhancing efficiency.

-

What are the pricing plans available for airSlate SignNow for mortgage-related services?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with mortgages. Each plan includes unique features and capabilities, ensuring you can choose one that matches your requirements and budget effectively, thus streamlining your mortgage operations.

-

What features does airSlate SignNow provide for managing mortgage agreements?

With airSlate SignNow, you gain access to features such as customizable document templates, automated workflows, and real-time tracking for all mortgage agreements. These tools simplify the management of documents and enhance collaboration among all stakeholders involved in the mortgage process.

-

Are there any integration options with other mortgage software?

Yes, airSlate SignNow integrates seamlessly with various mortgage software and applications like CRM systems, allowing for a cohesive workflow. This ensures that all your mortgage-related tasks can be handled in one place, signNowly improving operational efficiency.

-

How does airSlate SignNow ensure the security of mortgage documents?

airSlate SignNow employs advanced security measures, such as encryption and secure storage, to protect your mortgage documents. Compliance with industry standards further ensures that sensitive information remains confidential and safeguarded during the entire signing process.

-

Can I use airSlate SignNow on mobile devices for mortgage signing?

Absolutely! airSlate SignNow is designed for mobile compatibility, allowing users to sign mortgage documents on smartphones and tablets easily. This flexibility ensures that signing can occur anytime and anywhere, enhancing convenience for all parties involved in a mortgage transaction.

-

How quickly can I get started with airSlate SignNow for my mortgage needs?

Getting started with airSlate SignNow for your mortgage processes is quick and easy. You can sign up and create an account within minutes, enabling you to begin sending and eSigning mortgage documents immediately without any lengthy setup.

Get more for Form 1098 Mortgage Interest Statement

- Warranty deed from two individuals to husband and wife arkansas form

- Arkansas transfer death deed form

- Quitclaim deed from form

- Quitclaim deed form 497296358

- Llc limited liability form

- Notice of labor or materials provided individual arkansas form

- Quitclaim deed by two individuals to llc arkansas form

- Warranty deed from two individuals to llc arkansas form

Find out other Form 1098 Mortgage Interest Statement

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy