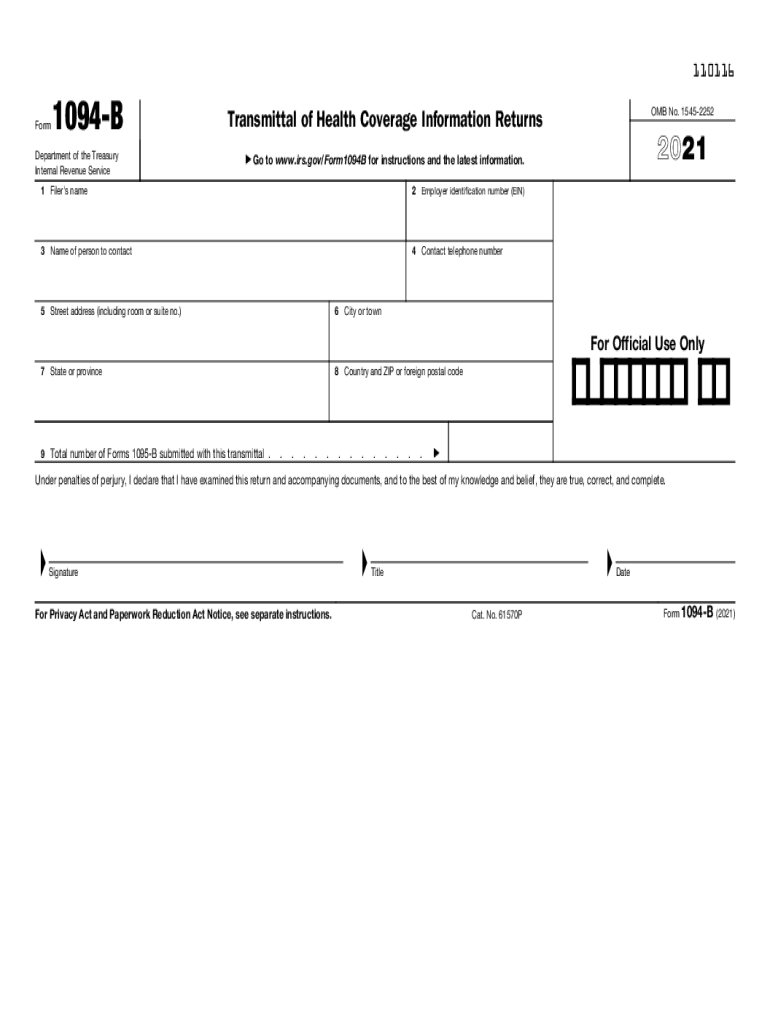

PAYERS Name, Street Address, City or IRS Tax Forms 2021

Understanding the Payer's Information on Form 1094 B

The payer's name, street address, city, and state are crucial components of the IRS Form 1094 B. This information identifies the entity responsible for providing health coverage to individuals. Accurate details are essential for the IRS to process the form correctly and ensure compliance with health coverage reporting requirements.

When filling out the form, ensure that the payer's name matches the legal name registered with the IRS. The address should include the street number, street name, city, and state, formatted in accordance with postal standards. This information helps the IRS to establish the connection between the payer and the health coverage provided.

Steps to Complete the Payer's Information on Form 1094 B

To accurately complete the payer's information on Form 1094 B, follow these steps:

- Locate the section designated for the payer's information on the form.

- Enter the full legal name of the payer as registered with the IRS.

- Provide the street address, ensuring to include any suite or apartment numbers if applicable.

- Fill in the city and state, using the correct postal abbreviations.

- Double-check the information for accuracy before submission.

Completing these steps carefully will help avoid delays or issues with processing your form.

Legal Use of the Payer's Information on Form 1094 B

The payer's information on Form 1094 B serves a legal purpose in reporting health coverage to the IRS. This information must be accurate and complete to comply with federal regulations regarding health insurance reporting. Misrepresentation or errors can lead to penalties and complications during audits.

It is essential to maintain records that support the information provided on the form, as the IRS may request this documentation during compliance checks. Properly documenting the payer's details helps ensure that the form is legally valid and recognized by the IRS.

IRS Guidelines for Completing Form 1094 B

The IRS provides specific guidelines for completing Form 1094 B, which include instructions on how to accurately fill out the payer's information. Familiarizing yourself with these guidelines will help ensure compliance and reduce the risk of errors.

Refer to the IRS instructions for Form 1094 B, which detail the requirements for each section of the form. These guidelines can help clarify any uncertainties regarding the information needed and how to present it correctly.

Filing Deadlines for Form 1094 B

Filing deadlines for Form 1094 B are critical for compliance with IRS regulations. Generally, the form must be submitted by the last day of February for paper filings or by March thirty-first for electronic submissions. It is essential to keep track of these dates to avoid penalties.

Failure to file on time can result in significant fines, so maintaining a calendar of important tax dates can be beneficial for businesses and organizations required to submit this form.

Penalties for Non-Compliance with Form 1094 B

Non-compliance with the requirements for Form 1094 B can lead to penalties imposed by the IRS. These penalties can vary based on the nature of the violation, such as late filing, failure to file, or providing incorrect information.

Understanding the potential risks associated with non-compliance can motivate timely and accurate submissions. Businesses should take the necessary steps to ensure that they meet all requirements to avoid these penalties.

Quick guide on how to complete payers name street address city or irs tax forms

Complete PAYERS Name, Street Address, City Or IRS Tax Forms effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage PAYERS Name, Street Address, City Or IRS Tax Forms on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign PAYERS Name, Street Address, City Or IRS Tax Forms with ease

- Find PAYERS Name, Street Address, City Or IRS Tax Forms and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow fulfills your needs in document management in just a few clicks from your preferred device. Edit and eSign PAYERS Name, Street Address, City Or IRS Tax Forms and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payers name street address city or irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the payers name street address city or irs tax forms

The way to generate an electronic signature for a PDF document online

The way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is a 1094 b form and why is it important?

The 1094 b form is essential for businesses to report health coverage information to the IRS. It serves as a transmittal form for 1095 forms and is crucial for compliance with the Affordable Care Act. Understanding your responsibilities regarding the 1094 b can help your business avoid penalties.

-

How can airSlate SignNow assist with the 1094 b filing process?

airSlate SignNow simplifies the 1094 b filing process by allowing you to eSign and send necessary documents quickly. With our easy-to-use platform, you can ensure all forms are correctly filled and submitted on time. This streamlining not only saves time but also helps maintain compliance effortlessly.

-

What features does airSlate SignNow offer for managing 1094 b forms?

airSlate SignNow offers features such as document templates, secure eSigning, and tracking for 1094 b forms. You can create, customize, and store your 1094 b documents all in one place, making it easier to manage your filing requirements. Our platform ensures that every detail is attended to for accurate submissions.

-

Is there a trial period available for airSlate SignNow when dealing with 1094 b forms?

Yes, airSlate SignNow offers a free trial period to explore our features for managing 1094 b forms and other documents. This allows users to experience the ease of use and efficiency of our platform before committing to a subscription. It's a great way to see if our solution meets your needs.

-

What pricing options are available for businesses needing to file 1094 b forms?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes when it comes to managing 1094 b forms. Our plans include various features such as unlimited eSigning and document storage based on your needs. You can select a plan that fits your budget while ensuring compliance with 1094 b requirements.

-

Can airSlate SignNow integrate with other software for processing 1094 b?

Yes, airSlate SignNow seamlessly integrates with many popular software solutions, enhancing your capabilities for processing 1094 b forms. These integrations help streamline data transfer and improve overall efficiency in your document management workflow. By using airSlate SignNow, you can connect your tools and simplify compliance efforts.

-

What are the benefits of using airSlate SignNow for 1094 b filing?

Using airSlate SignNow for 1094 b filing provides several benefits, including speed, security, and compliance. Our platform ensures that your documents are securely eSigned, stored, and easily accessible, reducing the manual effort involved. This means you can focus more on your business while ensuring 1094 b forms are filed on time.

Get more for PAYERS Name, Street Address, City Or IRS Tax Forms

- Bankruptcy chapter information

- Bill of sale with warranty by individual seller georgia form

- Bill of sale with warranty for corporate seller georgia form

- Bill of sale without warranty by individual seller georgia form

- Bill of sale without warranty by corporate seller georgia form

- Verification of creditors matrix georgia form

- Georgia creditors form

- Verification of creditors matrix georgia 497303899 form

Find out other PAYERS Name, Street Address, City Or IRS Tax Forms

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online