Form 8606 Internal Revenue Service Irs

What is the Form 8606 Internal Revenue Service IRS

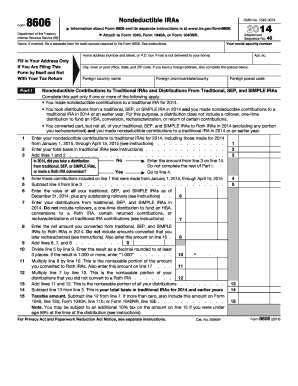

The Form 8606 is a tax form used by the Internal Revenue Service (IRS) to report non-deductible contributions to traditional Individual Retirement Accounts (IRAs) and distributions from Roth IRAs. This form is essential for taxpayers who have made contributions to these accounts but do not qualify for a tax deduction. It helps track the basis in traditional IRAs, ensuring that taxpayers do not pay taxes on the same money twice. Understanding the purpose of Form 8606 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8606 Internal Revenue Service IRS

Using Form 8606 involves several key steps to ensure that all necessary information is accurately reported. Taxpayers should first determine if they need to file the form based on their IRA contributions and distributions. If non-deductible contributions have been made, the form must be completed to report these amounts. The form requires details such as the amount of contributions, distributions, and any conversions from traditional IRAs to Roth IRAs. It is important to fill out the form carefully and retain a copy for personal records, as it may be needed for future tax filings.

Steps to complete the Form 8606 Internal Revenue Service IRS

Completing Form 8606 involves a series of methodical steps:

- Gather necessary information: Collect details about your IRA contributions, distributions, and any conversions.

- Fill out the form: Start with Part I to report non-deductible contributions and continue to Part II if applicable for distributions.

- Calculate your basis: Ensure that you accurately calculate the total basis in your traditional IRAs to avoid double taxation.

- Review: Double-check all entries for accuracy before submission.

- File with your tax return: Attach Form 8606 to your federal tax return for the year in which the contributions or distributions occurred.

Legal use of the Form 8606 Internal Revenue Service IRS

The legal use of Form 8606 is essential for compliance with IRS regulations. This form is necessary for taxpayers who have made non-deductible contributions to their traditional IRAs or have taken distributions from their Roth IRAs. Filing the form accurately ensures that taxpayers do not face penalties for underreporting income or failing to report taxable distributions. It is a legal requirement to report these contributions and distributions, and maintaining accurate records is crucial for future tax filings.

Filing Deadlines / Important Dates

Filing deadlines for Form 8606 align with the annual tax return deadlines. Typically, individual taxpayers must file their federal tax returns by April 15 of the following year. If you are unable to meet this deadline, you may file for an extension, but Form 8606 must still be submitted by the extended deadline. It is important to keep track of these dates to avoid late filing penalties and ensure compliance with IRS requirements.

Penalties for Non-Compliance

Failing to file Form 8606 when required can lead to significant penalties. The IRS may impose a penalty of $50 for each failure to file the form, which can accumulate if not addressed. Additionally, taxpayers may face issues with double taxation on their non-deductible contributions if the form is not filed correctly. Understanding the importance of compliance with Form 8606 is vital to avoid these financial repercussions.

Quick guide on how to complete form 8606 internal revenue service irs

Complete Form 8606 Internal Revenue Service Irs effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 8606 Internal Revenue Service Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 8606 Internal Revenue Service Irs with ease

- Find Form 8606 Internal Revenue Service Irs and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to deliver your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8606 Internal Revenue Service Irs to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8606 internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8606 and why is it important for taxes?

Form 8606 is an essential IRS document used to report nondeductible contributions to traditional IRAs and conversions to Roth IRAs. It helps taxpayers track their basis in IRAs, which is crucial for accurately calculating taxable distributions. Understanding and completing Form 8606 Internal Revenue Service Irs correctly ensures compliance and minimizes potential tax liabilities.

-

How can airSlate SignNow assist with the submission of Form 8606 to the IRS?

airSlate SignNow provides a seamless electronic signature process that allows users to sign and submit Form 8606 Internal Revenue Service Irs documents securely. With our user-friendly interface, you can easily manage and send your completed forms directly to the IRS. This streamlines your tax filing process, ensuring that your submissions are timely and compliant.

-

What features does airSlate SignNow offer for managing IRS forms like Form 8606?

airSlate SignNow offers numerous features tailored for managing IRS forms such as Form 8606 Internal Revenue Service Irs, including customizable templates, electronic signatures, and document tracking. Our platform allows users to create, edit, and store essential tax documents in a secure cloud environment. Additionally, reminders and notifications help ensure that no deadlines are missed.

-

Is airSlate SignNow suitable for small businesses managing Form 8606?

Yes, airSlate SignNow is an excellent solution for small businesses dealing with Form 8606 Internal Revenue Service Irs. Our cost-effective pricing plans cater to varying needs, making it accessible for businesses of all sizes. With streamlined processes, small business owners can focus on their operations while effectively managing their IRS filings.

-

Can I integrate airSlate SignNow with other accounting software for Form 8606 preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to help facilitate the preparation of Form 8606 Internal Revenue Service Irs. Whether you use QuickBooks, Xero, or other systems, our integrations enhance your workflow, allowing for efficient document management and streamlined tax preparation.

-

What are the benefits of using airSlate SignNow for eSigning Form 8606?

Using airSlate SignNow to eSign Form 8606 Internal Revenue Service Irs provides numerous benefits, including enhanced security, convenience, and reduced turnaround time. Our advanced encryption protects your sensitive tax information, ensuring your documents are secure. Moreover, the ease of sending and signing documents electronically simplifies the overall tax process.

-

How does airSlate SignNow ensure compliance with IRS regulations for Form 8606?

airSlate SignNow adheres to strict compliance standards to ensure that all processes related to Form 8606 Internal Revenue Service Irs meet IRS regulations. Our platform employs secure technologies for document storage and transmission, giving you peace of mind that your forms are handled according to legal requirements. Regular updates ensure our compliance practices align with the latest laws.

Get more for Form 8606 Internal Revenue Service Irs

Find out other Form 8606 Internal Revenue Service Irs

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template