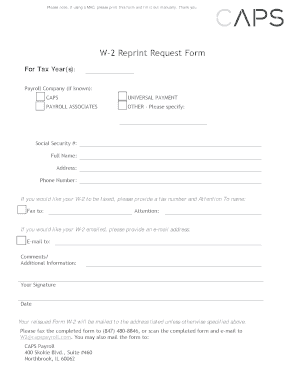

Caps Payroll Forms

What are caps payroll forms?

Caps payroll forms are essential documents used by businesses to manage payroll processes efficiently. These forms typically include information about employee wages, tax withholdings, and other deductions necessary for accurate payroll calculations. By utilizing caps payroll forms, employers can ensure compliance with federal and state regulations while streamlining their payroll operations.

How to use the caps payroll forms

Using caps payroll forms involves several key steps to ensure accurate completion and compliance. First, gather all necessary employee information, including Social Security numbers, tax filing statuses, and wage rates. Next, fill out the forms with precise details, ensuring that all required fields are completed. After filling out the forms, review them for accuracy before submitting them to the appropriate payroll system or department. Utilizing digital tools can enhance this process by allowing for easy editing and secure storage.

Steps to complete the caps payroll forms

Completing caps payroll forms involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary employee data, including identification and wage information.

- Access the caps payroll forms through your payroll system or download them as needed.

- Fill in all required fields, ensuring accuracy in names, addresses, and financial details.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically or print them for physical submission, depending on your business practices.

Legal use of the caps payroll forms

The legal use of caps payroll forms is crucial for ensuring compliance with employment laws and tax regulations. These forms must be filled out accurately and retained for record-keeping purposes. Employers should be aware of the specific legal requirements related to payroll documentation, including deadlines for submission and retention policies. Compliance with federal and state laws helps protect businesses from potential penalties and legal issues.

Key elements of the caps payroll forms

Caps payroll forms contain several key elements that are essential for accurate payroll processing. These include:

- Employee Information: Name, Social Security number, and address.

- Wage Information: Hourly rates or salary, overtime rates, and pay frequency.

- Tax Withholdings: Federal and state tax withholding allowances.

- Deductions: Information on benefits, retirement contributions, and other deductions.

Form submission methods

Caps payroll forms can be submitted through various methods, depending on the preferences of the employer and the requirements of the payroll system. Common submission methods include:

- Online Submission: Many payroll systems allow for direct electronic submission of completed forms.

- Mail: Forms can be printed and mailed to the appropriate payroll department or agency.

- In-Person Submission: Some businesses may require forms to be submitted in person for verification purposes.

Quick guide on how to complete caps payroll forms

Effortlessly Prepare Caps Payroll Forms on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Caps Payroll Forms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Easiest Way to Modify and eSign Caps Payroll Forms with Ease

- Find Caps Payroll Forms and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the woes of lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Caps Payroll Forms and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the caps payroll forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are caps payroll forms and how can airSlate SignNow help?

Caps payroll forms are essential documents used for processing employee payroll efficiently. airSlate SignNow provides a seamless platform to create, send, and electronically sign these forms, ensuring that your payroll process is both streamlined and compliant with regulations.

-

Is there a cost associated with using airSlate SignNow for caps payroll forms?

Yes, airSlate SignNow offers competitive pricing plans tailored to various business needs. You can choose from several subscription options based on how many caps payroll forms you need to manage, making it a cost-effective solution for your payroll processing.

-

What features does airSlate SignNow offer for caps payroll forms?

airSlate SignNow includes features such as customizable templates for caps payroll forms, automatic reminders for sign-offs, and secure storage options. These features enhance efficiency and help ensure that all necessary documents are completed and maintained in an organized manner.

-

Can I use airSlate SignNow to integrate caps payroll forms with other software?

Absolutely! airSlate SignNow supports integration with various HR and payroll software, allowing you to create a cohesive system for managing caps payroll forms. This integration helps save time and reduces errors by syncing data across your platforms.

-

How secure are the caps payroll forms processed through airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform utilizes advanced encryption technologies and complies with industry standards to ensure that your caps payroll forms are stored safely and that sensitive employee information is protected.

-

What benefits can I expect from using airSlate SignNow for my caps payroll forms?

By using airSlate SignNow for caps payroll forms, you can expect increased efficiency, reduced turnaround times, and improved accuracy in your payroll processes. Additionally, the user-friendly interface minimizes the learning curve for your team, enabling them to focus more on core business activities.

-

Can I track the status of caps payroll forms sent through airSlate SignNow?

Yes, airSlate SignNow provides an intuitive tracking feature that allows you to monitor the status of your caps payroll forms in real time. You will receive notifications when forms are viewed and signed, ensuring that you stay updated throughout the payroll processing cycle.

Get more for Caps Payroll Forms

- Fillable online form rew 3 mainegov fax email print

- Get the free maine revenue services corporate income tax form

- Pdf affidavit of no florida estate tax due form

- Topic no 753 form w 4employees withholding certificate2021 new w 4 formno allowances plus computational bridgehow to fill out a

- Form rew 5 download fillable pdf or fill online request

- Form w 3me maine revenue services reconciliation of maine

- Form l941p me pass through entity return of income tax

- Individual income tax 1040memaine revenue services form

Find out other Caps Payroll Forms

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF