FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION of MAINE 2022-2026

What is the Form W-3ME?

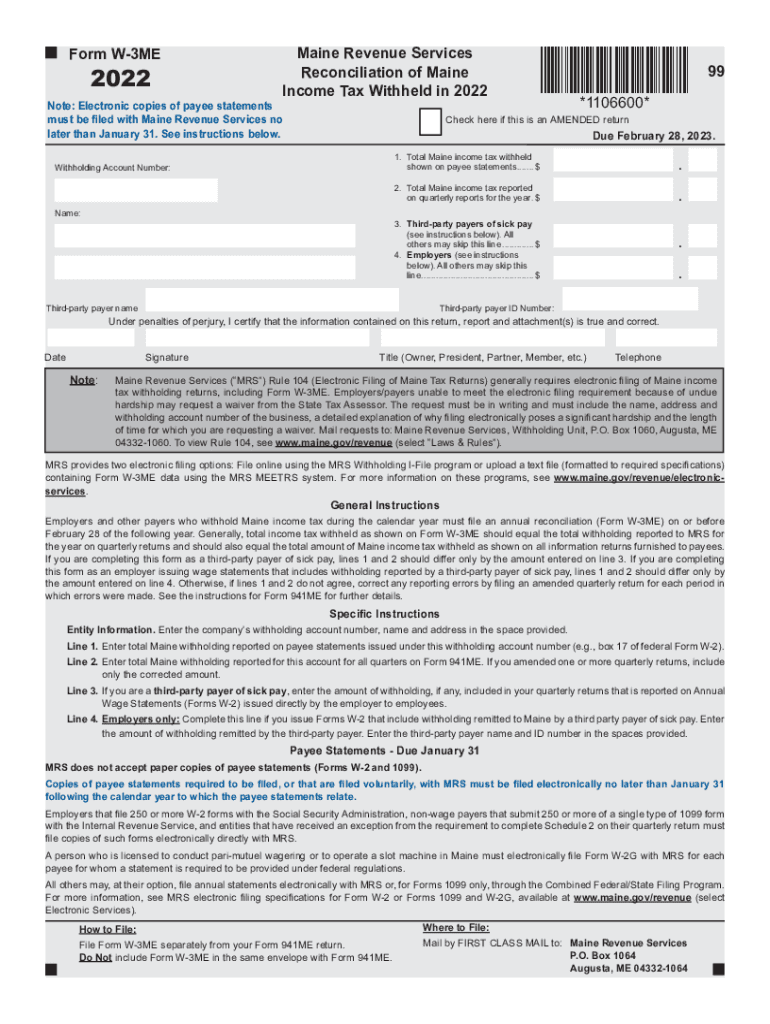

The Form W-3ME is a reconciliation form used by Maine Revenue Services to summarize and report income tax withheld from employee wages. This form is essential for employers who need to reconcile their payroll tax with the state of Maine. It provides a comprehensive overview of the total amount of income tax withheld, ensuring that the amounts reported match the individual W-2 forms submitted for each employee. The W-3ME is crucial for maintaining compliance with state tax regulations and for accurate reporting of tax obligations.

How to Use the Form W-3ME

Using the Form W-3ME involves several steps that ensure accurate reporting of withheld income tax. Employers must first gather all W-2 forms issued to employees, as these will provide the necessary data for completing the W-3ME. Next, employers should accurately fill out the form by entering the total amount of Maine income tax withheld from all employees. It is important to double-check all figures to prevent discrepancies. Once completed, the form must be submitted to Maine Revenue Services along with the W-2 forms by the designated deadlines.

Steps to Complete the Form W-3ME

Completing the Form W-3ME requires careful attention to detail. Follow these steps:

- Gather all W-2 forms for your employees.

- Calculate the total Maine income tax withheld from all employees.

- Fill out the W-3ME form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the W-3ME along with the W-2 forms to Maine Revenue Services by the deadline.

Legal Use of the Form W-3ME

The Form W-3ME is legally required for employers in Maine who withhold state income tax from employee wages. Failure to submit this form can result in penalties and interest on unpaid taxes. The form serves as an official record that helps the state verify the accuracy of tax withholdings reported by employers. It is important for employers to understand their legal obligations regarding this form to avoid compliance issues.

Filing Deadlines for the Form W-3ME

Employers must adhere to specific deadlines for filing the Form W-3ME. Typically, the form is due by the last day of January following the end of the tax year. This means that for the 2021 tax year, the form must be submitted by January 31, 2022. It is crucial for employers to mark this date on their calendars to ensure timely submission and avoid potential penalties.

Examples of Using the Form W-3ME

Employers in various sectors utilize the Form W-3ME to report income tax withholdings. For instance, a small business owner with multiple employees will compile the total tax withheld from each employee's wages and report that amount on the W-3ME. Similarly, a larger corporation will aggregate data from numerous W-2 forms to ensure that all tax withholdings are accurately reported. These examples highlight the form's importance in maintaining compliance with state tax regulations.

Quick guide on how to complete form w 3me maine revenue services reconciliation of maine

Easily Prepare FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE on Any Device

Digital document management has gained immense traction among organizations and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Handle FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE across any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

The Easiest Way to Edit and Electronically Sign FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE Effortlessly

- Obtain FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE and select Get Form to begin.

- Utilize the features we offer to submit your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about misplaced or lost documents, tedious form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 3me maine revenue services reconciliation of maine

Create this form in 5 minutes!

How to create an eSignature for the form w 3me maine revenue services reconciliation of maine

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

How to generate an e-signature for a PDF on Android

People also ask

-

What is the form w 3me and how is it used?

The form w 3me is a tax form used by employers to transmit information about the earnings of their employees to the IRS. It summarizes the wages paid and taxes withheld, ensuring accurate reporting for tax purposes. Utilizing airSlate SignNow, you can easily eSign and send the form w 3me securely, streamlining your payroll reporting.

-

How can airSlate SignNow help with the form w 3me process?

airSlate SignNow simplifies the form w 3me process by providing an intuitive platform to eSign and share documents. You can instantly prepare your form, add signatures, and send it to the relevant parties without cumbersome paperwork. This efficiency helps businesses meet their deadlines and stay organized.

-

Is there a cost associated with using airSlate SignNow for the form w 3me?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of different sizes and needs. Each plan provides features that ensure a seamless eSigning experience for documents like the form w 3me. Choosing the most suitable plan will help you manage your signing needs without exceeding your budget.

-

What features does airSlate SignNow offer for managing the form w 3me?

Key features of airSlate SignNow for managing the form w 3me include customizable templates, automated workflows, and secure cloud storage. These features make it easy to prepare, eSign, and store your documents efficiently. Additionally, the platform allows for real-time tracking of document status.

-

Can airSlate SignNow integrate with other software solutions for handling the form w 3me?

Absolutely! airSlate SignNow integrates with various popular software solutions such as CRM systems and accounting platforms to facilitate a smoother workflow. This means you can incorporate the form w 3me into your existing processes without disruptions. Seamless integration enhances productivity and keeps your data synchronized.

-

What are the benefits of using airSlate SignNow for the form w 3me?

Using airSlate SignNow for your form w 3me offers numerous benefits, including time savings, improved accuracy, and enhanced security. eSigning your documents electronically reduces the need for physical paperwork, minimizes errors, and provides a secure way to handle sensitive tax information. This streamlining can benefit businesses of all sizes.

-

How secure is my information when using airSlate SignNow for the form w 3me?

airSlate SignNow prioritizes the security of your information by implementing advanced encryption protocols and compliance measures. When you eSign the form w 3me through our platform, your data remains protected at all times. Additionally, the platform ensures that only authorized users have access to your documents.

Get more for FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE

Find out other FORM W 3ME MAINE REVENUE SERVICES RECONCILIATION OF MAINE

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer