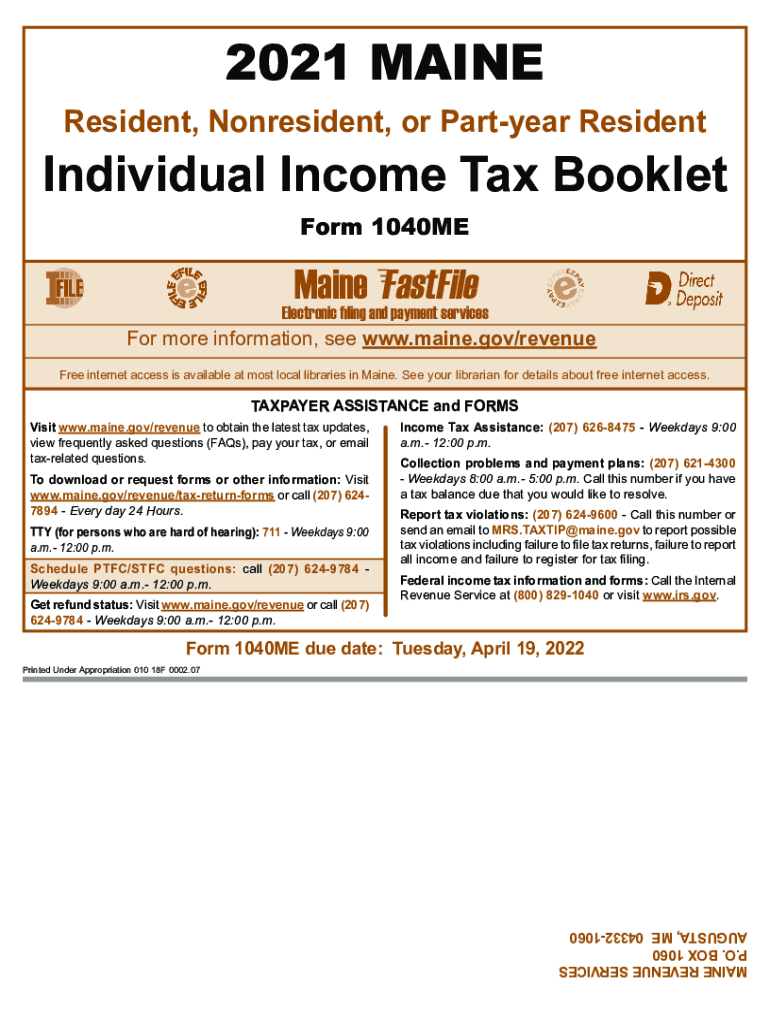

Individual Income Tax 1040MEMaine Revenue Services 2021

Understanding the Maine Income Tax Form

The Maine income tax form, known as the 1040ME, is essential for residents to report their income and calculate their tax liability. This form is designed for individuals and is used to determine the amount of state income tax owed to the Maine Revenue Services. It is important to understand the specific requirements and sections of this form to ensure accurate filing and compliance with state tax laws.

Steps to Complete the Maine Income Tax Form

Completing the Maine 1040ME involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any other taxable income.

- Calculate deductions and credits applicable to your situation, which may reduce your taxable income.

- Determine your total tax liability using the tax tables provided in the Maine income tax booklet.

- Sign and date the form before submission to validate your filing.

Required Documents for Filing

When preparing to file the Maine income tax, you will need to collect specific documents:

- W-2 forms from employers, which report annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income sources, such as rental income or investment earnings.

- Receipts for deductible expenses, including medical costs and property taxes.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Maine income tax to avoid penalties:

- The standard filing deadline for the 1040ME is typically April 15 of each year.

- If you require an extension, you must file Form 4868 to request additional time, but any taxes owed must still be paid by the original deadline.

Legal Use of the Maine Income Tax Form

The Maine 1040ME is legally binding once completed and submitted according to state regulations. To ensure its validity:

- All information provided must be accurate and truthful.

- Signatures must be included to confirm the authenticity of the submission.

- Filing electronically through secure platforms can enhance the legal standing of the document.

Digital vs. Paper Version of the Maine Income Tax Form

Taxpayers can choose between filing the Maine income tax form digitally or on paper. Each method has its advantages:

- Digital filing is often faster, allowing for quicker processing and refunds.

- Paper filing may be preferred by those who are more comfortable with traditional methods or have limited access to technology.

Quick guide on how to complete individual income tax 1040memaine revenue services

Complete Individual Income Tax 1040MEMaine Revenue Services effortlessly on any device

Web-based document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Handle Individual Income Tax 1040MEMaine Revenue Services on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to adjust and eSign Individual Income Tax 1040MEMaine Revenue Services without hassle

- Locate Individual Income Tax 1040MEMaine Revenue Services and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Individual Income Tax 1040MEMaine Revenue Services and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual income tax 1040memaine revenue services

Create this form in 5 minutes!

How to create an eSignature for the individual income tax 1040memaine revenue services

The best way to create an electronic signature for a PDF file online

The best way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

What is the significance of understanding maine income tax when using airSlate SignNow?

Understanding maine income tax is crucial for businesses to ensure compliance during document signing and management. airSlate SignNow allows users to easily incorporate necessary tax considerations in their workflow. With our platform, you can streamline the signing of important tax documents relevant to maine income tax.

-

How can airSlate SignNow help in managing maine income tax documents?

airSlate SignNow provides features like customizable templates and secure eSignatures that help manage maine income tax documents efficiently. This allows businesses to ensure accuracy and compliance by having all necessary paperwork organized and easily accessible. With our solution, you can simplify the process of sending and signing these important documents.

-

Is airSlate SignNow cost-effective for managing maine income tax-related agreements?

Yes, airSlate SignNow offers competitive pricing plans that are cost-effective for managing maine income tax-related agreements. Our solution saves both time and resources, allowing you to focus on your business instead of paperwork. The efficiency gained can ultimately lead to better financial management regarding tax obligations.

-

What features does airSlate SignNow offer to support maine income tax compliance?

To support maine income tax compliance, airSlate SignNow includes features such as audit trails, secure storage, and team collaboration tools. These features ensure that your documents are legally binding and easy to retrieve when needed. Compliance with maine income tax regulations becomes seamless with our digital solutions.

-

Can airSlate SignNow integrate with accounting software for maine income tax management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage maine income tax documents. This integration helps streamline the process of tracking expenses and filing taxes, enhancing overall workflow. You'll have a holistic view of your financial obligations at your fingertips.

-

How does airSlate SignNow enhance the eSigning process for maine income tax documents?

airSlate SignNow enhances the eSigning process for maine income tax documents by offering a user-friendly interface and multiple signing options. Users can sign documents from anywhere, reducing delays in the tax filing process. This ease of use is essential for staying organized and compliant when it comes to maine income tax.

-

What are the benefits of using airSlate SignNow for small businesses regarding maine income tax?

For small businesses, using airSlate SignNow can signNowly alleviate the burden of managing maine income tax documentation. Our platform simplifies the eSigning process, reduces paper usage, and ensures compliance, thus allowing you to focus on growing your business. The time saved can lead to a better understanding of your tax responsibilities.

Get more for Individual Income Tax 1040MEMaine Revenue Services

- Nj name change 497319562 form

- Nj minor name change form

- New jersey unsecured installment payment promissory note for fixed rate new jersey form

- New jersey note form

- New jersey note 497319566 form

- New jersey note 497319567 form

- Notice of option for recording new jersey form

- Interrogatories compensation form

Find out other Individual Income Tax 1040MEMaine Revenue Services

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online