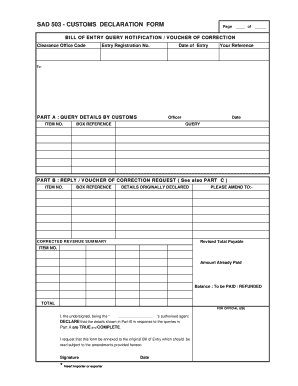

Sad 503 Form

What is the Sad 503 Form

The Sad 503 Form is a specific document utilized primarily for tax purposes in the United States. It is often required for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. Understanding the purpose of the Sad 503 Form can help taxpayers navigate their obligations effectively.

How to use the Sad 503 Form

Using the Sad 503 Form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with precise information, ensuring that all entries are clear and legible. After completing the form, review it for accuracy before submission. It is important to follow the specific guidelines provided by the IRS to avoid any potential issues.

Steps to complete the Sad 503 Form

Completing the Sad 503 Form requires attention to detail. Begin by entering your personal information, such as your name, address, and Social Security number. Next, accurately report your income and any deductions you are claiming. Ensure that you double-check all calculations to prevent errors. Once the form is filled out, sign and date it before submitting it to the appropriate IRS office. Keeping a copy for your records is also advisable.

Legal use of the Sad 503 Form

The Sad 503 Form is legally binding when completed correctly and submitted within the required timeframe. Compliance with IRS regulations is crucial for the form to be accepted. This includes adhering to guidelines regarding electronic signatures and document submission methods. Utilizing a reliable eSignature platform can enhance the legitimacy of your submission, ensuring that all legal requirements are met.

Key elements of the Sad 503 Form

Several key elements must be included in the Sad 503 Form for it to be valid. These include accurate personal identification information, a detailed account of income, and any applicable deductions. Additionally, the form must be signed by the taxpayer, affirming the accuracy of the information provided. Understanding these elements is vital for ensuring that your form meets all necessary criteria.

Form Submission Methods

The Sad 503 Form can be submitted through various methods, including online, by mail, or in-person. Each method has its own set of guidelines and deadlines. For online submissions, ensure you use a secure platform that complies with IRS regulations. If choosing to mail the form, be aware of the appropriate address and any required postage. In-person submissions may require an appointment at a local IRS office.

Filing Deadlines / Important Dates

Filing deadlines for the Sad 503 Form are critical to avoid penalties. Generally, the form must be submitted by the annual tax deadline, which is typically April fifteenth for most taxpayers. However, specific circumstances may alter this date, so it is essential to verify the current year's deadlines. Keeping track of these dates can help ensure timely compliance with tax obligations.

Quick guide on how to complete sad 503 form

Complete Sad 503 Form effortlessly on any device

Online document management has gained increased popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Sad 503 Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

How to modify and eSign Sad 503 Form with ease

- Obtain Sad 503 Form and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, text (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Sad 503 Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sad 503 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Sad 503 Form?

A Sad 503 Form is a document used to formalize agreements in a simplified manner. It streamlines the process of obtaining necessary signatures for various administrative tasks. Utilizing airSlate SignNow can help automate the eSigning of Sad 503 Forms, making the process quicker and more efficient.

-

How much does it cost to use airSlate SignNow for Sad 503 Forms?

airSlate SignNow offers competitive pricing plans tailored to different business needs. You can choose from monthly or annual subscriptions, and the plans provide the flexibility to send and eSign multiple Sad 503 Forms without breaking the bank. Cost-effective solutions make it easier for businesses to stay compliant.

-

What features does airSlate SignNow offer for handling Sad 503 Forms?

airSlate SignNow provides a range of features specifically designed for managing Sad 503 Forms. These include customizable templates, automated reminders, and secure storage for signed documents. With a user-friendly interface, users can easily create and dispatch Sad 503 Forms for eSigning.

-

What are the benefits of using airSlate SignNow for Sad 503 Forms?

Using airSlate SignNow for Sad 503 Forms offers numerous benefits, such as reducing turnaround time and increasing operational efficiency. The platform ensures that your documents are secure and legally binding, providing peace of mind. Additionally, it enhances collaboration and communication among involved parties.

-

Can I integrate airSlate SignNow with other applications for processing Sad 503 Forms?

Yes, airSlate SignNow offers robust integration options with various applications and platforms. These integrations help streamline workflows associated with Sad 503 Forms, allowing users to connect with tools they already use. Popular integrations include CRM systems, cloud storage services, and project management tools.

-

Is it easy to eSign a Sad 503 Form with airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for Sad 503 Forms. Users can easily send documents to signers via email, and recipients can sign on their devices without the need for complicated software or downloads.

-

What types of businesses can benefit from using airSlate SignNow for Sad 503 Forms?

Businesses of all sizes can benefit from using airSlate SignNow to manage Sad 503 Forms. From small startups to large corporations, the platform's features cater to diverse needs, enhancing the efficiency of document signing and management in any industry.

Get more for Sad 503 Form

- Sapropterin for bh4 deficiency initial and continuing pbs authority application form

- Reference form 2017 18 rosthern junior college rosthernjuniorcollege

- Referral form the camelot difference

- Au state administrative tribunal form

- Verification of experience form for certified employees

- Form 9465sp rev december 2003 installment agreement request spanish

- Ap 193 form

- Revised 403 certificate of correctiondoc form

Find out other Sad 503 Form

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now